● Money for Nothing: The Scientists, Fraudsters, and Corrupt Politicians Who Reinvented Money, Panicked a Nation, and Made the World Rich

Thomas Levenson

Summary via publisher (Penguin Random House)

Money for Nothing chronicles the moment when the needs of war, discoveries of natural philosophy, and ambitions of investors collided. It’s about how the Scientific Revolution intertwined with finance to set England—and the world—off in an entirely new direction… Unlike science, though, with its tightly controlled experiments, the financial revolution was subject to trial and error on a grand scale, with dramatic, sometimes devastating, consequences for people’s lives. With England at war and in need of funds and “stock-jobbers” looking for any opportunity to get in on the action, this new world of finance had the potential to save the nation—but only if it didn’t bankrupt it first.

Conflicting Treasury Market Signals Keep Investors Guessing

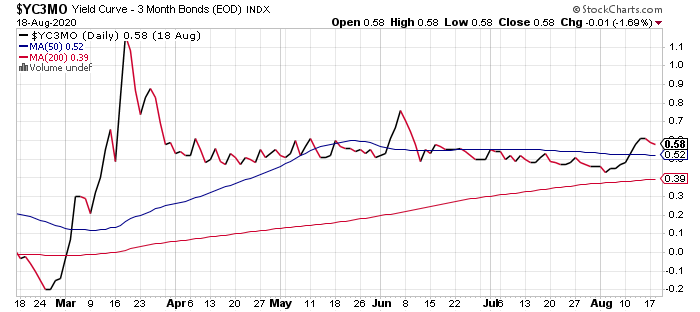

Depending on the slice of the Treasury market, inflation expectations are rebounding — or the outlook for economic growth is weakening. One of these implied forecasts is probably wrong, or least less useful for estimating future macro risks. Higher inflation and softer economic growth isn’t impossible (think “stagflation” in the 1970s). But it’s not yet obvious that the conditions that produced that malaise are recurring and so the odds still favor one scenario at the expense of the other.

Macro Briefing | 21 August 2020

Biden accepts Democratic nomination, pledges to lead US out of darkness: WSJ

Allies reject US bid to reimpose sanctions on Iran: CNN

EU’s chief negotiator: Brexit deal looks unlikely for now: BBG

UK retail sales continued to grow in July, rising past pre-Covid-19 peak: Reuters

Eurozone’s economic rebound loses momentum in Aug via PMI data: IHS Markit

Japan’s steep downturn continues in Aug, according to PMI survey data: IHS Markit

Philly Fed Mfg Index: sector growth in bank’s region slows in August: Mstar

US jobless claims increased more than expected last week: CNBC

Deep-Value ETF Report: 20 August 2020

The coronavirus blowback and the crowd’s ongoing preference for high-flying growth investments aren’t doing any favors for value investing strategies. Perhaps the chaos of 2020 is laying the groundwork for a performance revival in assets (and asset classes) that have suffered the most. The lagging results of value generally in recent years suggest otherwise, at least by some accounts. But if there’s opportunity in beaten-down assets, at least we know where to look.

Macro Briefing | 20 August 2020

China’s commerce ministry: US and China will hold trade talks: CNBC

Fed minutes: Fed staff lowers economic growth outlook for rest of 2020: MW

Earnings surge for big retailers, including Target and Walmart: NYT

Are stocks increasingly vulnerable to currency risk? BBG

Apples becomes first company to reach $2 trillion market cap: CNET

10yr-3mo Treasury yield curve remains in a tight range, settling at 0.58% on Wed:

US Equity Sector Results Vary Widely With S&P 500 At Record High

The US stock market wiped out the last of its coronavirus losses on Tuesday (Aug. 18), delivering a rapid rebound from a devastating drawdown. As Reuters notes, this year’s slide is the shortest bear market on record. But from the perspective of the market’s sectors, there’s a wide array of pain and gain to consider.

Macro Briefing | 19 August 2020

Democrats nominate Biden as presidential candidate to run against Trump: AP

Democratic and Republican leaders look for opening on stimulus talks: BBG

Trump: “I cancelled [trade] talks with China”: SCMP

US stock market (S&P 500) closed at record high on Tuesday: NYT

The S&P 500 recovers from the shortest bear market on record: Reuters

BoA survey: fund managers think a new bull market has started: II

Despite coronavirus, UK inflation jumps to the highest since March: Reuters

Japan’s exports drop sharply due to coronavirus: BC

US housing construction roared higher in July, extending rebound: BBG

Partial Recovery Expected For US Q3 GDP

The unprecedented decline in in US economic output in the second quarter is currently on track to recover less than half the loss in Q3, according to several GDP nowcasts compiled by CapitalSpectator.com. The estimates are vulnerable to the high uncertainty related to the path of the coronavirus in the remaining weeks of Q3, but for the moment the prospects appear to favor a partial rebound.

Macro Briefing | 18 August 2020

California suffers first rolling blackouts in nearly two decades: Politico

China says US damaging global trade with Huawei sanctions: BC

Gold rebounds above $2000/oz. on renewed US-China tensions: BBG

Norway’s sovereign wealth fund — world’s largest — suffers huge 1H loss: CNBC

The recession is just starting to hit US cities: NYT

Latest Covid-19 retail victim: Marks & Spencer to cut 7,000 jobs: MW

NY Fed Mfg Index: sector growth slowed sharply in August: Mstar

US homebuilder sentiment in August rises to match record high: CNBC

Foreign Stocks, Non-US Property Shares Topped Gains Last Week

Equities in developed markets ex-US topped returns for the major asset classes during the trading week through Aug. 14, based on a set of exchange traded funds. In second place: real estate shares listed outside the US.

Continue reading