Amid signs that 2019’s slowdown in the US economy may be stabilizing, the US Treasury market appears to be flirting with firmer inflation expectations. It’s too early to know if the latest dance with reflation is noise or a preliminary signal, but the recent U-turns in the market’s implied inflation estimates deserve close monitoring in the weeks ahead.

Macro Briefing | 17 December 2019

Boeing will halt 737 Max production in January: CNBC

China and Russia seek to ease UN sanctions on N. Korea: Reuters

US budget proposal rises to $1.4 trillion: The Hill

Will slow job growth in Midwest threaten Trump’s re-election? NY Times

Is the US stock market poised for a ‘melt-up’ rally? MW

US homebuilder confidence jumps to 20-year high in December: CNBC

NY Fed Mfg Index continues to reflect soft growth in December: MW

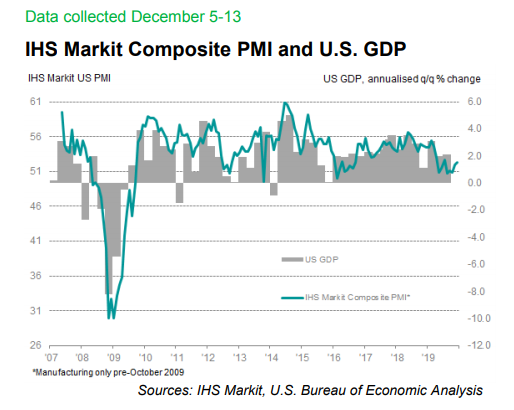

US economy shows signs of strengthening in December: IHS Markit

Emerging Markets Stocks Continued To Rebound Last Week

The recent bounce in emerging markets shares accelerated last week, delivering the strongest gain for the major asset classes over the five trading days through Dec. 13, based on a set of US-listed exchange-traded funds.

Macro Briefing | 16 December 2019

Key details remain unclear on US-China trade deal: CNBC

Violent protests spread across India over new citizenship law: CNN

Why did economists misread the past decade? WSJ

Eurozone economy continues to stagnate in December: IHS Markit

No sign of recovery for Germany’s factory recession: Bloomberg

UK economy contracted again in December, PMI survey data shows: IHS Markit

US business inventories rose in Oct, boosting outlook for Q4 growth: Reuters

Oil lifted US import-price inflation in November: MW

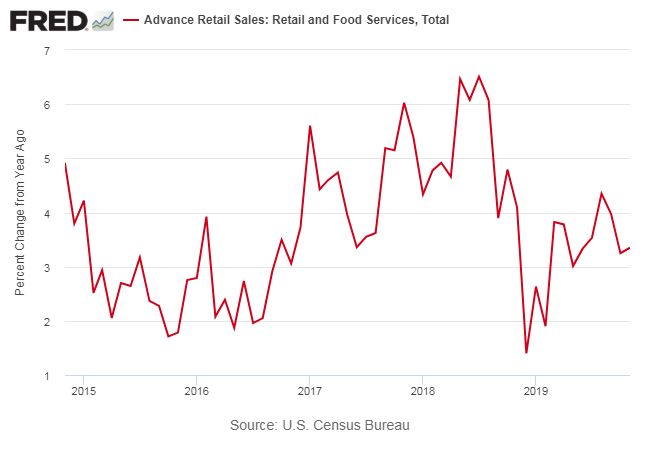

US retail spending growth slowed in Nov but 1-year trend ticked up:

Book Bits | 14 December 2019

● Advances in Active Portfolio Management: New Developments in Quantitative Investing

By Richard C. Grinold and Ronald N. Kahn

Summary via publisher (McGraw-Hill Education)

From the leading authorities in their field—the newest, most effective tools for avoiding common pitfalls while maximizing profits through active portfolio management. Whether you’re a portfolio managers, financial adviser, or student of investing, this follow-up to the authors’ classic work on the subject delivers everything you need to master the concepts and practices of active portfolio management. Advances in Active Portfolio Management brings you up to date on the issues, trends, and challenges in the world of active management and shows how advances in the authors’ approach can solve current problems.

Continue reading

Lessons Learned From The Recent Recession Scare

Earlier this year a number of economic analysts were convinced that a US recession was imminent. So far, however, the economy has continued to expand, albeit at a slowing pace as the year unfolded. The breathless warnings have, once again, come to naught — par for the course in recent years. The culprit, as usual: misguided business-cycle analytics.

Macro Briefing | 13 December 2019

Trump OKs partial trade deal with China: WSJ

China’s foreign ministry backs trade deal… sort of: SCMP

Vote on impeachment articles abruptly postponed: The Hill

UK’s Johnson wins big majority, lifting odds for Brexit: BBC

Will the Fed starting cutting rates again in 2020? CNN

Today’s US retail sales report for Nov expected to show slightly firmer 1-year trend

Soft US wholesale inflation in Nov points to weak pricing pressure: CNBC

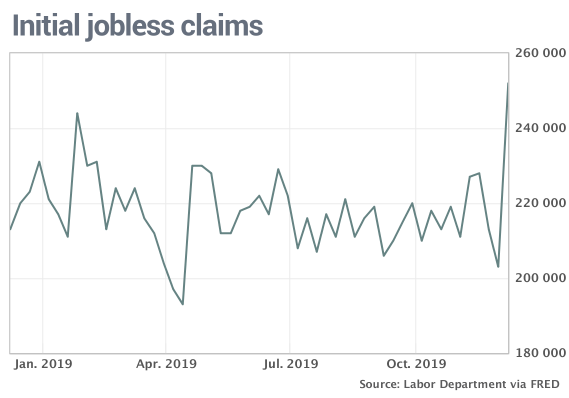

US jobless claims spiked last week to a 2-year high: MW

Will The US Economy Accelerate In 2020?

The recent economic slowdown has fanned worries that the US is headed for a rough year in 2020. But some analysts are practicing the art of seeing the glass half full and are now calling for improved odds that economic activity will pick up in the new year. All the usual caveats apply, of course, when mere mortals attempt to divine the future. But let’s run this idea through a mild stress test using hard data and a set of combination forecasts to see if the case for optimism holds up. As a preview, the results below imply that while it’s premature to rule out the possibility for firmer growth next year, The Capital Spectator’s view is that growth appears more likely stabilize at a relatively modest pace for the near term.

Continue reading

Macro Briefing | 12 December 2019

House prepares for impeachment vote on Trump: Reuters

Here’s the outlook for today’s new ECB head’s first policy meeting: MW

UK goes to polls today in third general election in less than 5 years: BBC

Wharton study: Warren’s wealth tax will raise $1 trillion less than expected: CNBC

Fed leaves interest rates unchanged at policy meeting: NY Times

Fed economic projections continue to anticipate slow/slowing growth: Fed

So-called black-swan index flashes warning for stocks: Reuters

Eurozone industrial production continued to fall in October: Reuters

No sign of US recession on the horizon, predicts BCA: MW

Atlanta Fed business inflation expectation steady at +1.9% for Dec: AF

US headline consumer inflation (1-year change) jumps to 12-month high: MW

Tech Stocks Leading US Sectors By Wide Margin In 2019

As horse races go, this one isn’t close. Shares of technology stocks are far ahead of the rest of the equity sector field this year, based on a set of exchange traded funds. Barring a dramatic reversal in the final weeks of December, it appears that tech will close out 2019 with an outsized gain.