Tomorrow’s revised GDP data for the third quarter is expected to hold at a 1.9% increase, according to the consensus point forecast via Econoday.com. That’s a moderate gain but it’s may be a bridge too far based on estimates for Q4 via a set of nowcasts compiled by The Capital Spectator.

Macro Briefing | 26 November 2019

Yet another hint of progress in US-China trade-deal talks: Bloomberg

Fed Chairman Powell: strong labor market still has room to run: NY Times

2% inflation remains Fed’s target, says Powell: CNBC

Americans expect to raise their Christmas spending at a strong pace: Gallup

Financial advisers worry they’ll get squeezed in Schwab-TD Ameritrade deal: WSJ

Dallas Fed Mfg Index reflect modest contraction in November: DFed

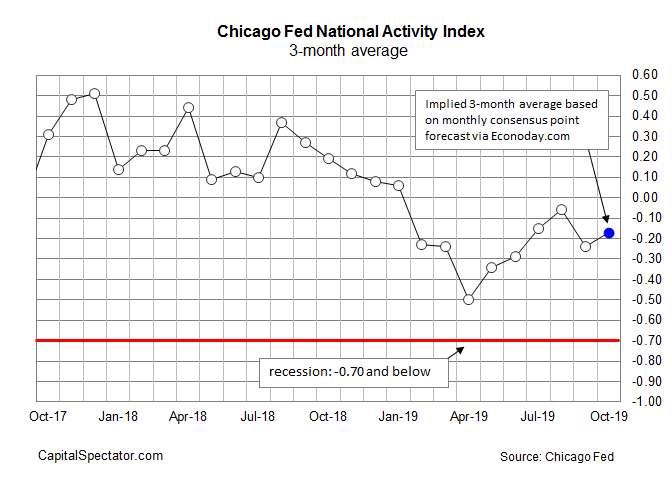

US economic activity continued to slow in October: Chicago Fed

US Bonds, Foreign REITs Were Haven From Selling Last Week

Most of the major asset classes lost ground last week, according to a set of exchange-traded funds. Bucking the downside trend: US investment grade bonds and foreign real estate shares. Otherwise, red ink prevailed in global markets over the five days of trading through November 22.

Macro Briefing | 25 November 2019

US Navy Secretary forced to resign over controversial SEAL case: Reuters

Pro-democracy candidates win big in Hong Kong election: Reuters

German business sentiment improved slightly in November: Bloomberg

Capital spending by S&P 500 companies slows, creating economic headwind: WSJ

Security forum focuses on rising stress weighing on West’s democracies: Politico

US consumers remain upbeat in November: CNBC

KC Fed Manufacturing Index falls again in November: Mstar

US economic growth picked up in November but remains slow: IHS Markit

Slightly firmer slow-growth sign expected in today’s CFNAI (3mo avg) data for Oct:

Book Bits | 23 November 2019

● The Deals of Warren Buffett Volume 2: The Making of a Billionaire

By Glen Arnold

Summary via publisher (Harriman House)

In this second volume of The Deals of Warren Buffett, the story continues as we trace Warren Buffett’s journey to his first $1bn. When we left Buffett at the end of Volume 1, he had reached a fortune of $100m. In this enthralling next instalment, we follow Buffett’s investment deals over two more decades as he became a billionaire. This is the most exhilarating period of Buffett’s career, where he found gem after gem in both the stock market and among tightly-run family firms with excellent economic franchises. In this period, Berkshire Hathaway shares jumped 29-fold from $89 to $2,600.

Continue reading

Research Review | 22 November 2019 | Factor Investing Strategies

ETF Momentum

Frank Weikai Li (Singapore Management University), et al.

October 12, 2019

We document economically large momentum profits when sorting ETFs on returns over the past two to four years. A value-weighted, long-short strategy based on ETF momentum delivers Carhart (1997) four-factor alphas of up to 1.20% per month. Neither cross-sectional stock momentum nor co-variation with macroeconomic and liquidity risks can explain ETF momentum. Instead, the post-holding period returns are most consonant with the behavioral story of delayed overreaction. While ETF momentum survives multiple adjustments for transaction costs, it may be difficult to arbitrage as the profits are volatile and concentrated in ETFs with high idiosyncratic volatility or that hold low-analyst-coverage stocks.

Continue reading

Macro Briefing | 22 November 2019

Bridgewater, world’s largest hedge fund, bets big on market drop: WSJ

Eurozone economy virtually stagnant for third month in Nov: IHS Markit

UK economy contracting at deepest rate in three years in Nov: IHS Markit

Japan’s economic activity is essentially flat in Nov: IHS Markit

Negotiations on NAFTA successor roll on; vote possible in weeks ahead: NY Times

US Leading Economic Index fell for the third month in October: CB

Existing home sales in US rose 1.9% in October: WSJ

Philly Fed’s regional mfg index posted stronger growth in November: Philly Fed

US jobless claims held steady at five-month high last week: CNBC

US business cycle index (ADS) rebounds after falling close to recession signal:

US Small-Cap Stocks Continue To Trail Large Caps In 2019

Advocates of small-cap equities keep talking about the possibility of a revival for these shares, but year-to-date results suggest otherwise, based on a set of exchange-traded funds.

Macro Briefing | 21 November 2019

Sondland says Trump directed Ukraine pressure campaign: Politico

US-China trade deal may be at risk if Trump signs Hong Kong bill: CNBC

China invites Americans for new trade talks: WSJ

Fed minutes show more rate cuts are unlikely: MW

Charles Schwab reportedly in talks to acquire TD Ameritrade: CNBC

OECD: Europe’s QE monetary policy deepens pain of negative rates: Bloomberg

German exports to US rose in Q3: Reuters

Israel fails to form a government; new elections (again) are likely: NPR

Share of Americans moving falls below 10% — lowest since 1947: NY Times

US commercial lending 1yr growth rate fell to +4.7% in Oct, lowest in 1-1/2 years:

US Business Cycle Risk Report | 20 November 2019

US economic growth has slowed but signs that the macro trend is stabilizing suggest that the recent downshift won’t lead to a recession in the immediate future. Nonetheless, the expansion appears to be increasingly vulnerable. Another round of shocks, expected or otherwise, could push the economy over the edge. For the moment, however, the numbers show that slow growth prevails.