China set to retaliate against new US tariffs: Bloomberg

Trump suggests ‘personal meeting’ with China’s Xi over Hong Kong crisis: CNBC

Warning signs suggest global economic slowdown is accelerating: WSJ

Chinese paramilitary exercise near Hong Kong — a ‘clear warning’: Reuters

US moves to block release of Iranian oil tanker in Gibraltar: CNN

Business inflation expectations steady at 2.0% in August: Atlanta Fed

US import prices rose in July but trend remains weak: Reuters

10yr-2yr Treasury yield curve inverts, issuing a new recession warning: BBG

It’s An Expansion, If You Can Keep It

President Trump’s decisions on the US-China trade war reflect a method to the madness, his supporters insist. To everyone else, it just appears to be madness. Regardless, Trump’s abrupt announcement on Tuesday that new tariffs on Chinese goods would be delayed inadvertently provided some clarity on the US economy.

Macro Briefing | 14 August 2019

Trump delays Chinese tariffs, igniting stock market rally: WSJ

China refuses port visits in Hong Kong for US warships: Bloomberg

Calm returns to Hong Kong airport after protests: CNN

Five of world’s major economies at risk of recession: CNN

German economy contracted in second quarter: BBC

China’s industrial production in July posts slowest growth since 2002: Reuters

US small business optimism ticked up in July, close to post-recession high: NFIB

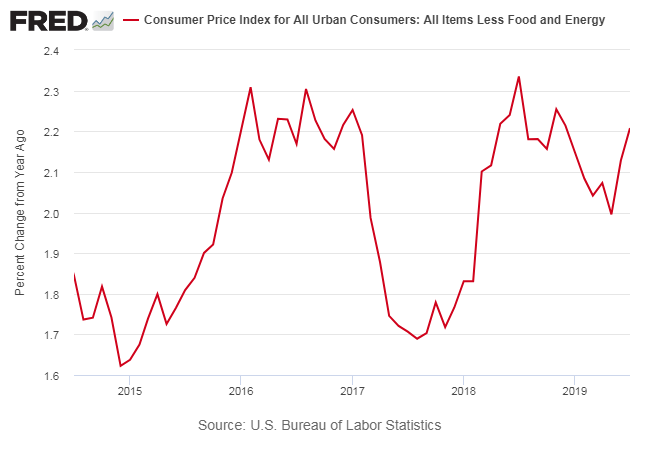

US core consumer inflation edged higher in July to +2.2% annual pace:

Bond Market Smells Recession. Will The Real Economy Follow?

Asset pricing is often mysterious as a source of figuring out exactly what Mr. Market is discounting, but in the case of bonds these days there’s no ambiguity about the crowd’s outlook. Recession is effectively a forgone conclusion, the yield curve is predicting. But while the real economy has slowed, growth remains strong enough to dispute the market’s forecast, at least for now. The question is when or if the hard data will align with market’s dark expectations?

Macro Briefing | 13 August 2019

Hong Kong leader: protests have unleashed ‘chaos and panic’: Reuters

Fears of Argentina’s default trigger widespread selling: Bloomberg

Will Trump’s crackdown on immigration damage California’s economy? LA Times

China’s central bank weakens yuan/$ midpoint reference rate for 4th day: CNBC

German economic survey indicates ‘significant deterioration’ in outlook: ZEW

60% of S&P 500 stocks offer dividend yield above 10-year Treasury yield: WSJ

Bond market’s recession signal set to strength if 10yr-2yr gap inverts: CNBC

10yr Treasury yield sinks to 1.65% as risk-off sentiment strengthens:

US Real Estate Investment Trusts Led Markets For Second Week

Real estate shares are on a roll. For a second week, real estate investment trusts (REITs) posted the strongest weekly gain for the major asset classes, based on performances via a set of exchange-traded funds. The leading gain is no mean feat when you consider that risk-off sentiment has returned lately and bond prices have surged.

Macro Briefing | 12 August 2019

Hong Kong cancels all flights due to protests: CNBC

Goldman Sachs economists see rising US recession risk due to trade war: Reuters

Argentina’s president loses primary, casting doubts on his re-election: Reuters

US government debt yields are sharply lower today: CNBC

Here’s a list of key events for next several weeks that could rock stocks: MW

Could it happen here? Sliding US yields raise concerns about negative rates: WSJ

US wholesale inflation in July remained subdued at 1.7% annual pace: MW

Book Bits | 10 August 2019

● The Skyscraper Curse: And How Austrian Economists Predicted Every Major Economic Crisis of the Last Century

By Mark Thornton

Summary via publisher (Ludwig von Mises Institute)

In the wake of the financial crisis of 2008, the economics profession suffered a blow to what reputation it had. But unlike most of his colleagues, Mark Thornton was vindicated by 2008. Mark has been a voice of sanity at times when the wild interventions of the Federal Reserve have caused otherwise sensible people to lose their minds. This collection serves the valuable purpose of defending the market economy against the conventional view that freedom has failed us and we need still more controls. We had plenty of rules and bureaucrats on the eve of the financial crisis. A lot of good that did us. Pretty much none of them saw any problems on the horizon. Maybe we should consider a real free market, with sound money and market interest rates, and abolish the giant bubble machine once and for all.

Continue reading

Trump’s Trade War Is A High-Stakes Gamble

There are several extraordinary aspects to the US-China trade war, but perhaps the most unusual (and risky) is President Donald Trump’s reliance on “his own intuition and analysis and not the advice of aides,” as The Washington Post reports, for waging economic conflict.

Macro Briefing | 9 August 2019

US-China trade war is pinching global oil demand: WSJ

Is US oil in the crosshairs for China as trade conflict escalates? CNBC

Majority of economists say US-China trade war raising US recession risk: Reuters

UK economy contracted in Q2, first quarterly decline since 2012: BBC

German exports fell sharply in June, the most in three years: Bloomberg

China’s Huawei unveils phone operating system to replace Google’s Android: AP

China’s food prices surge 9% annually due to swine fever outbreak: CNBC

US jobless claims fell last week, continue to signal strong labor market: Reuters

Philly Fed’s US business cycle index (ADS Index) still reflects low recession risk: