The Federal Reserve on Wednesday provided the bond bulls with a fresh round of news to keep this year’s fixed-income rally running. As expected, the central bank left interest rates unchanged. As an added bonus for fixed-income markets, the Fed also advised that rate hikes may remain on hold for the rest of the year. And if that wasn’t enough, the bank trimmed its outlook for economic growth in yesterday’s revision of quarterly forecasts and projected that inflation will remain subdued.

Continue reading

Macro Briefing: 21 March 2019

No sign of imminent US-China trade deal, according to Trump: Bloomberg

Midwestern farmers facing widespread devastation after record floods: Reuters

Federal judge blocks oil and gas drilling in Wyoming, citing climate change: NBC

Fed keeps rates unchanged and signals no hikes for rest of year: WSJ

Federal Reserve trims outlook for US growth in 2019: CBS

UK’s May in Brussels to ask EU for 3-month extension for Brexit deadline: BBC

CEO optimism on global economic outlook falls to lowest level since Q1:2017: BR

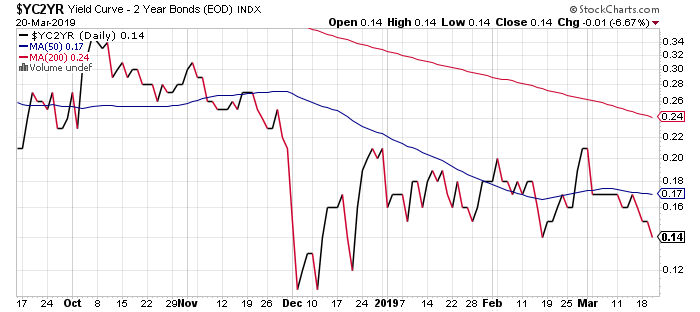

10yr-2yr Treasury yield spread falls to 5-week low after Fed decision:

China Continues To Lead Global Rebound In Stocks This Year

Bullish sentiment has lifted equity prices in every major region of the global market so far in 2019 and China’s shares continue to lead the rally by a wide margin, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 20 March 2019

New round of negotiations scheduled for US-China trade talks: WSJ

Federal Reserve expected to keep interest rates steady today: Reuters

Fed may forecast another rate hike in today’s policy update: Bloomberg

Defaults on Chinese corporate bonds surged in 2019: CNBC

FedEx says global economy is still slowing: CNBC

Supreme Court rules certain immigrants can be detained indefinitely: The Hill

Large swaths of Midwest battle flooding: USA Today

UK’s May won’t ask for long day in Brexit deadline: Bloomberg

Japan’s gov’t downgrades economic outlook due to US-China trade war: Reuters

US factory orders barely rose in Jan but 1-year trend turned up: Reuters

US Q1 GDP Growth On Track To Slow Again As Fed Meeting Begins

The recent slowdown in US economic growth is expected to continue in the first quarter, according to the latest nowcasts for GDP. The estimates will likely be a factor in the Federal Reserve’s policy meeting that begins today and concludes tomorrow with an announcement on interest rates, a new set of quarterly forecasts and a press conference.

Continue reading

Macro Briefing: 19 March 2019

Trump’s financial ties with Deutsche Bank under review in Congress: NY Times

Sen. Warren calls for eliminating electoral college: Reuters

House of Commons Speaker derails govt’s plans for 3rd Brexit vote: Bloomberg

White House outlines case against social progressive programs: CNBC

Venezuela’s opposition takes control of diplomatic offices in US: CBS

Fed struggles with interpretation over its ‘dot plot’ interest-rate projections: WSJ

US Housing Market Index holds steady in March, suggests sector is stabilizing BB

Across-The-Board Rallies Lifted All Markets Last Week

Bullish sentiment boosted prices across all the major asset classes last week, based on a set of exchange-traded funds. The clean sweep of gains marks the first time in six calendar weeks that every corner of global markets rallied, as of trading through Friday, March 15.

Continue reading

Macro Briefing: 18 March 2019

Midwest rivers rise to record levels, forcing evacuations: USA Today

Fed likely to extend pause on rate hikes in Wed announcement: WSJ

Russia says it will comply with Opec’s production cut: CNBC

Consumer Sentiment Index for US rises for second month in March: MW

US business leaders worried about the next recession, consultancy reports: MW

US job openings rose to a new high of 7.6 million in January: CNBC

NY Fed Mfg Index indicates slow growth for bank’s region in March: MW

US industrial production’s 1-year trend eases to softest rise in 8 months in Feb:

Book Bits | 16 March 2019

● The Billionaire Boondoggle: How Our Politicians Let Corporations and Bigwigs Steal Our Money and Jobs

By Pat Garofalo

Summary via publisher (Thomas Dunne Books)

The first comprehensive look at how politicians let the entertainment industry bilk taxpayers, hijack public policy and hurt economic investment, starting and ending with Trump. From stadiums and movie productions to casinos and mega-malls to convention centers and hotels, cities and states have paid out billions of dollars in tax breaks, subsidies, and grants to the world’s corporate titans. They hope to boost their economies, create new and better jobs, and lure well-known events such as the Super Bowl–not to mention give their officials the chance to meet celebrities. That Big Entertainment drives bigger economies is a myth, however. Overwhelming evidence shows catering public policy to its promises results in a raw deal for the taxpaying public.

Continue reading

Research Review | 15 March 2019 | Nowcasting

Factor Timing Revisited: Alternative Risk Premia Allocation Based on Nowcasting and Valuation Signals

Olivier Blin (Unigestion), et al.

10 September 2018

Alternative risk premia are encountering growing interest from investors. The vast majority of the academic literature has been focusing on describing the alternative risk premia (typically, momentum, carry and value strategies) individually. In this article, we investigate the question of allocation across a diversified range of cross-asset alternative risk premia over the period 1990-2018. For this, we design an active (macro risk-based) allocation framework that notably aims to exploit alternative risk premia’s varying behavior in different macro regimes and their valuations over time. We perform backtests of the allocation strategy in an out-of-sample setting, shedding light on the significance of both sources of information.

Continue reading