As rebounds go, the current revival in the fortunes of stocks in emerging markets surely ranks as one of the more impressive feats in recent history. The caveat: The turnaround is primarily due to surging share prices in China. Exclude China and broadly defined EM stocks are posting substantially softer results, based on a set of ETFs through Friday’s close (Oct. 4).

Macro Briefing: 7 October 2024

Florida braces for a direct hit from Hurricane Milton, which is expected to make landfall on Wednesday in the Tampa Bay area. The storm, with maximum sustained winds of 100 mph, is projected to move across central Florida.

US payrolls rose more than expected in September, according to Labor Department data. The 254,000 increase beat expectations by a wide margin. The unemployment rate ticked down to 4.1%, marking the second month of lower joblessness. The government’s report also revised up previous estimates for new job creation in August and July.

Book Bits: 5 October 2024

● Overshoot: How the World Surrendered to Climate Breakdown

● Overshoot: How the World Surrendered to Climate Breakdown

Andreas Malm and Wim Carton

Interview with co-author (Malm) via NYTimes.com

Q: It’s hard for me to think of a realm outside of climate where mainstream publications would be engaging with someone, like you, who advocates political violence. (Just to be explicit about this: Malm does not endorse or advocate any political violence that targets people. His aim is violence against property.) Why are people open to this conversation?

A: If you know something about the climate crisis, this means that you are aware of the desperation that people feel. It is quite likely that you feel it yourself. With this desperation comes an openness to the idea that what we’ve done so far isn’t enough. But the logic of the situation fundamentally drives this conversation: All attempts to rein in this problem have failed miserably. Which means that, virtually by definition, we have to try something more than we’ve tried…. Political history is replete with movements that have conducted sabotage without taking the next step. But the risk is there. One driver of that risk is that the climate crisis itself is exacerbating all the time. It’s hard-wired to get worse. So people might well get more desperate.

The Yield Curve’s “Infallible” Recession Signal Failed This Time

There are no absolutes in economic forecasting. Thinking otherwise eventually leads to trouble. Case in point: the recession warning triggered nearly two years ago by an inverted Treasury yield curve almost certainly amounts to a false signal.

Macro Briefing: 4 October 2024

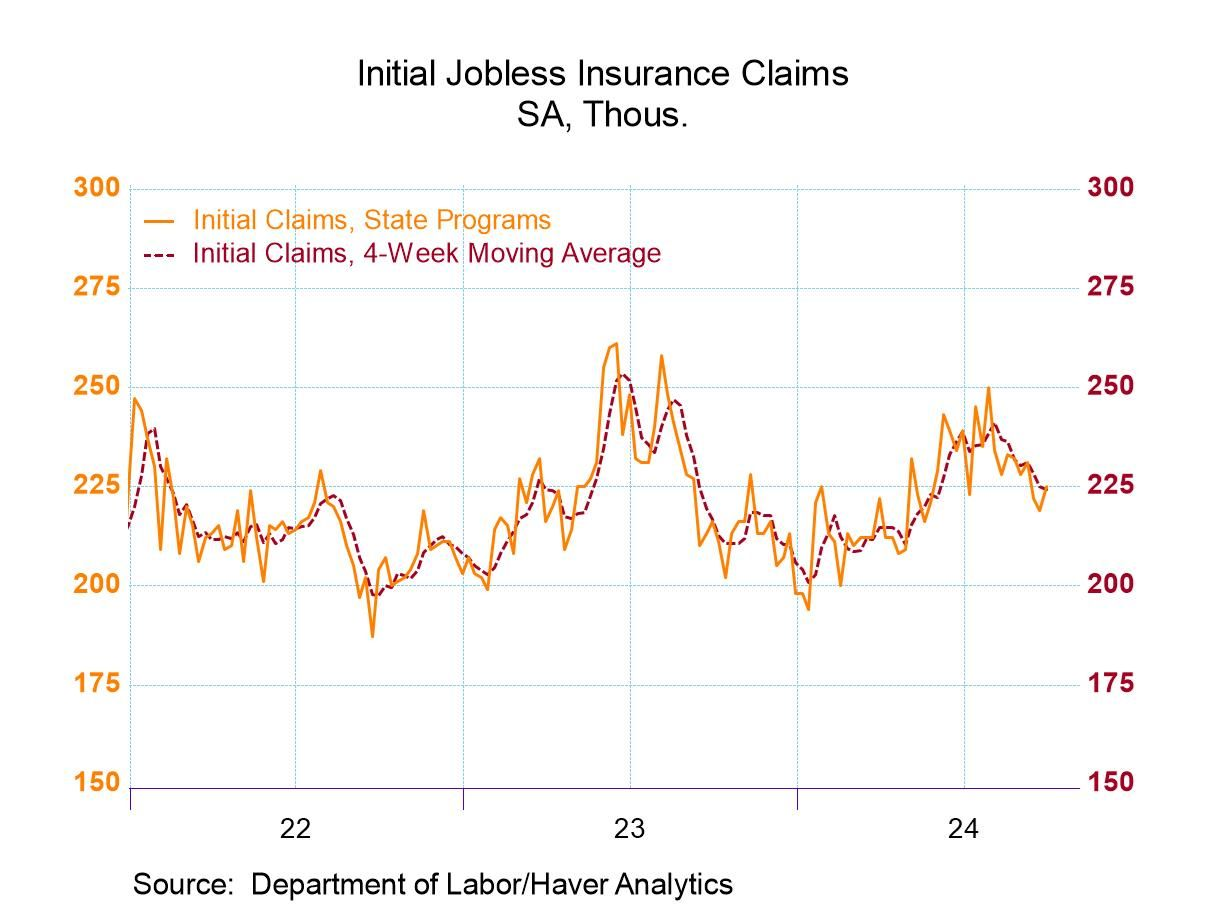

US jobless claims rose last week, but the number of new filings for unemployment benefits remains low relative to history. The 4-week average, which reduces some of the week-to-week noise, continues to trend lower. “For the moment, the labor market looks steady as a rock and the economy appears to have missed falling headlong over the cliff into the depths of recession,” says Christopher Rupkey, chief economist at FWDBONDS.

Momentum, Large-Cap Growth Factors Still Leading This Year

Betting against momentum and large-cap growth continues to be a losing proposition, at least in relative terms, for positioning US equity portfolios in 2024, based on a set of factor ETFs. These risk premia have dominated for much of the year and it’s not obvious that the trend is set to change, based on trading through Oct. 2.

Macro Briefing: 3 October 2024

Hiring at US companies rebounded in September, according to the ADP Employment Report. “Job creation showed a widespread rebound after a five-month slowdown,” notes ADP Research. “Only one sector, information, lost jobs. Manufacturing added jobs for the first time since April.”

Total Return Forecasts: Major Asset Classes | 02 October 2024

The long-term performance forecast for the Global Market Index (GMI) continued to edge lower in September. Today’s revised estimate marks the third straight month of decline for GMI, an unmanaged benchmark that holds all the major asset classes (except cash) according to market weights via a set of ETF proxies.

Macro Briefing: 2 October 2024

Israel plans a “significant retaliation” to Tuesday’s massive missile attack from Iran that threatens to shift the Middle East to a regionwide war. “A full-scale war, or even a more limited one, could be devastating for Lebanon, Israel, and the region,” says Jonathan Panikoff, the director of the Scowcroft Middle East Security Initiative at the Atlantic Council.

Major Asset Classes | September 2024 | Performance Review

Emerging-markets stocks surged in September, delivering the lead performance for the major asset classes, based on a set of ETFs. Real estate shares were also strong performers last month, extending recent strength for these stocks. Commodities, once again, were the downside outlier.