● Fed’s Williams sees rate hike this year… maybe | MarketWatch

● US bond market gives green light for rate hike | Bloomberg

● China commodity imports slump on weak demand | Reuters

Labor Market Conditions Index: August 2015 Preview

The Federal Reserve’s Labor Market Conditions Index is expected to tick lower to 1.0 in tomorrow’s update for August vs. the previous month, based on The Capital Spectator’s average point forecast for several econometric estimates. The prediction suggests that labor market conditions weakened slightly in August vs. July.

Continue reading

Book Bits | 5 September 2015

● Playing the Long Game: How to Save the West from Short-Termism

By Laurie Fitzjohn-Sykes

Summary via publisher (Imprint Academic)

We obsess about what our politicians are doing, but ignore that our companies are no longer investing, instead they are focusing on next quarter’s profits in order to justify ever higher executive compensation. This is in turn accelerating the West’s economic decline versus the East. While the short-term focus of business is becoming widely acknowledged, we are not doing enough to reverse this. Looking at the less known history of companies shows us the choices we can no longer afford to ignore. Some current reforms need to go further and some areas that need reform are currently being ignored. Encouraging our businesses to invest again is one of the most important issues of our time.

Continue reading

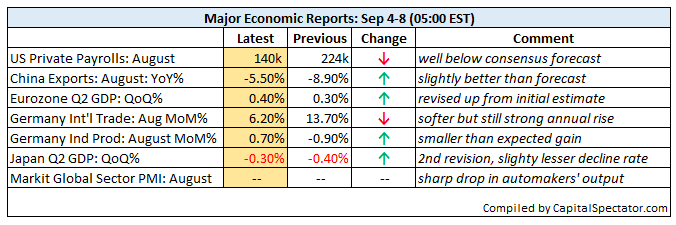

US Job Growth Stumbles In August

Private payrolls in the US grew at a surprisingly slow pace in August, according to this morning’s monthly employment update from the US Labor Dept. Companies created 140,000 new jobs last month—well below expectations for 200,000-plus. The disappointing news raises new questions about the strength of economic growth–and the timing of the Federal Reserve’s interest-rate hike.

Continue reading

A Popular Tactical Model Goes To 100% Cash. Now What?

The tactical asset allocation model that’s outlined in Meb Faber’s widely read paper–the most downloaded paper on SSRN.com, in fact—went to cash at the end of last month, Bloomberg reported earlier this week. The risk-off move has attracted a fair amount of attention, which isn’t surprising, given the fame and influence of the 2006 paper (and its revisions)– “A Quantitative Approach to Tactical Asset Allocation.”

Continue reading

Initial Guidance | 4 September 2015

● US jobless claims rise, but remain near historically low level

● ISM: a slower but still solid pace of growth for US services sector in August

● PMI: growth in US services rises to 3-month high in August

● US job cuts fall sharply in August

● US consumer comfort index slipped last week

● PMI: Eurozone retail sales growth eases in August

● European Central Bank lowers growth forecast

US Nonfarm Private Payrolls: August 2015 Preview

Private nonfarm payrolls in the US are projected to increase by 201,000 (seasonally adjusted) in tomorrow’s August report from the Labor Department, based on The Capital Spectator’s average point forecast for several econometric estimates. The prediction reflects a modest decrease in the rate of growth vs. July’s 210,000 gain.

Continue reading

Growth In US Services Sector Remains Solid In August

Economic activity in the US services sector posted robust gains in August, throwing more cold water on the idea that the US macro trend is fatally wounded. The headline figure for the ISM Non-Manufacturing Index retreated last month, but only moderately so—and after touching an all-time high in July (based on data that begins in 2008). Meanwhile, Markit’s US Services Purchasing Managers’ Index (PMI) for August was revised up from the previously released flash estimate. As a result, this benchmark rose to its highest level in three months in August, signaling a healthy pace of growth.

Continue reading

Jobless Claims Up In August’s Final Week, But Still Near 40-Yr Lows

Weekly filings for unemployment benefits rose 12,000 last week to a seasonally adjusted 282,000, the US Labor Department reports. The jump is well above Econoday.com’s consensus forecast that anticipated a small rise to 273,000. But when you step back and consider the trend, the news is still upbeat. Indeed, the four-week average for jobless claims is still close to the lowest level since the early 1970s. Meanwhile, the weekly tally for this leading indicator continues to fall in year-over-year terms, suggesting that the labor market’s expansion will roll on in the near future. Today’s numbers also provide support for thinking that tomorrow’s August employment report from Washington will offer a fresh round of encouraging news for the economic outlook generally.

Continue reading

Is The Treasury Market Still Expecting Moderate US Growth?

The roller-coaster ride in global markets in recent weeks has raised new doubts about economic growth in general and the case for a Fed rate hike this month in particular. But the resilience of key Treasury yields in recent days suggests that the bond market may be rethinking the case for the worst-case scenario that seemed inevitable over a few days last week. It could all reverse course in a heartbeat–especially if tomorrow’s employment report for August falls short of expectations for solid growth. Meantime, the rebound in US yields this week suggests that reports of optimism’s death may have been exaggerated.

Continue reading