● Wealth, Poverty and Politics: An International Perspective

By Thomas Sowell

Review via The Washington Post

Sowell’s central message is that the reason some people are poor — in any country, at any period in history — is not discrimination or exploitation or malicious actions on the part of the rich. Rather, people are poor because they don’t or won’t produce. For him, the only mystery is why.

Geography may have something to do with it. Civilizations that shut themselves off from the rest of the world, Sowell writes, are those that lag behind.

Continue reading

A New Research Service For Monitoring Recession Risk

Starting today, The Capital Spectator is offering a subscriber-only research service for monitoring US business cycle risk—The Business Cycle Risk Report. Regular readers are already familiar with the monthly updates of this data—see the August review, for instance. The monthly reports will continue to appear on CapitalSpectator.com, but now there’s a higher level of service that will keep you informed in real time. For details, including subscription options and a sample issue that’s hot off the press today, click on the “Premium Research” tab above or follow this link.

Continue reading

The Trend Turns Negative For The Real Monetary Base

High-powered voices are calling on the Federal Reserve to delay raising interest rates beyond its policy meeting next week, but it’s not obvious that a stay of execution for squeezing liquidity is a done deal. One reason for thinking that the central bank is still considering the case for pushing rates higher this month: inflation-adjusted money supply continued to contract in year-over-year terms for the third month in a row through August. The slide marks the first run of red ink for base money (M0) in real terms in three years. Meanwhile, the effective Fed funds rate continues to inch higher. These aren’t definitive signs that a rate hike is fate, but on the margins the data supports a hawkish outcome next week.

Continue reading

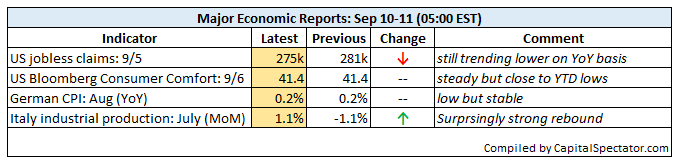

Initial Guidance | 11 September 2015

US Jobless Claims Continued Falling In Early September

The number of new filings for unemployment benefits in the US fell last week, delivering another encouraging round of numbers for the economy, according to this morning’s release from the US Labor Dept. The news follows upbeat data for the labor market overall in August. Considering all the numbers to date reaffirms the view that business cycle risk remains low.

Continue reading

Calls To Delay Fed Rate Hike As 2-Year Yield Rises

The World Bank and two influential economists–Larry Summers and Paul Krugman–have joined the do-not-raise-rates club of doves. The Treasury market, however, is still expecting that the Federal Reserve will tighten monetary policy at next week’s meeting, according to the rate-sensitive 2-year maturity, which ticked up to a seven-week high of 0.75% yesterday (Sep. 9) via daily data from Treasury.gov.

Continue reading

Initial Guidance | 10 September 2015

US Recession Risk Is Still Low Based On August Labor Market Data

The pace of growth for US private payrolls stumbled in August, but last month’s deceleration doesn’t translate into a warning sign for the business cycle. That’s the message in yesterday’s monthly update of the Federal Reserve’s Labor Market Index (LMCI), a multi-factor benchmark that’s designed as a comprehensive measure of the broad trend for job-market indicators. Expectations for low recession risk also finds support in initial jobless claims numbers and a markets-based proxy for estimating business cycle conditions.

Continue reading

Initial Guidance | 9 September 2015

Skewed By Randomness: Testing Arbitrary Rebalancing Dates

How much influence do investors have over their portfolios? Perhaps it’s less than commonly assumed. The notion that randomness plays a role in money management has been widely studied in finance–Nassim Taleb’s popular treatment in Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets is one example. The concept is a staple in the money game, although it’s easily overlooked, even ignored in some cases. Consider a simple rebalancing strategy. Does it matter which dates you choose to return a portfolio mix back to the target weights? Maybe, but the details matter quite a lot in terms of the answer. For instance, crunching the numbers on an 11-fund portfolio with a Dec. 31, 2003 start date shows that randomly choosing rebalancing dates tends to perform as well if not better than a consistent year-end remix and a buy-and-hold strategy (based on daily data).

Continue reading