It’s hardly the first time that the sharp rise in interest rates over the previous two years has prompted warnings about the business cycle outlook from an economist. Yet the forecast still resonates when it comes from a Nobel laureate, even in the wake of the latest upbeat US economic news.

Macro Briefing: 8 February 2024

* Fed officials offer cautious outlook on expectations for rate cuts

* China deflation deepens in January–prices fall at fastest rate in 15 years

* US trade deficit narrowed in 2023 by the most since 2009

* CBO projects US federal budget deficit at 6.1% of GDP for 2025 vs 2024’s 5.6%

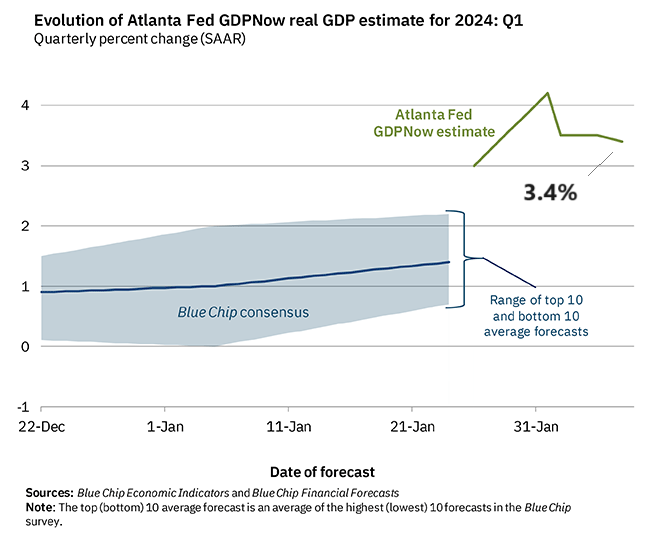

* US GDP Q1 nowcast via Atlanta Fed’s GDPNow model in line with Q4’s increase:

US Stocks Remain Upside Outlier For Major Asset Classes In 2024

It’s lonely at the top. American shares are posting strong year-to-date results in 2024. Granted, it’s only early February. But the striking distance between the gain in US stocks vs. the rest of the major asset classes is still striking, based on ETF proxies through Tuesday’s close (Feb. 6).

Macro Briefing: 7 February 2024

* US bills on border security, Ukraine and Israel aid falters amid GOP dysfunction

* S&P 500 Q4 earnings reported to date (about 2/3 of firms) beat expectations

* Credit card debt in US rises to new high in Q4 as delinquencies surge

* BP reports 2nd highest profit in decade, joining strong results for oil majors

* World’s largest chipmaker will build a second factory in Japan

* NY Community Bancorp downgraded to junk, sparking fears for regional banks:

US Treasury Market Misjudges Timing On First Rate Cut… Again

We’ve been here before. In the spring of 2023, the bond market rallied sharply, effectively forecasting a rate cut by the Federal Reserve. But the punt turned to tears as the Federal Reserve continued raising interest rates, causing bond prices to sink and yields to spike.

Macro Briefing: 6 February 2024

* Fed can delay rate cuts due to strong economy: Minneapolis Fed President

* Global growth edges up to 7-month high in January via PMI survey data

* Are China’s efforts to curb stock market rout too little too late?

* US Treasury officials head to China to discuss policy

* US bond yield looks unattractive relative to stock market’s earning yield

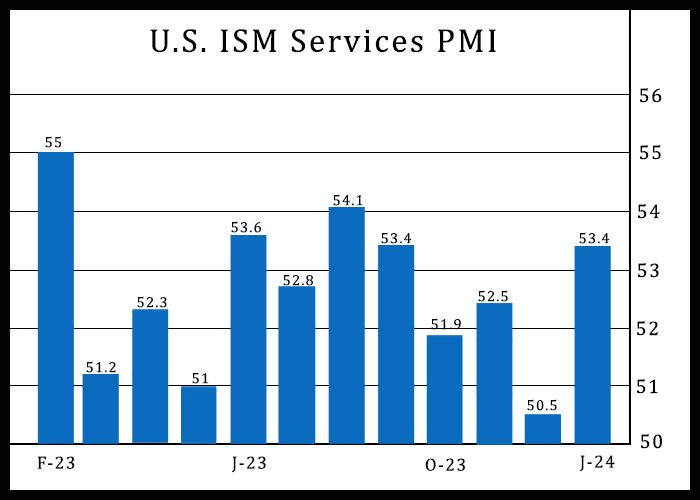

* ISM Services Index rebounds more than expected in January:

American Stocks Continue To Lead Global Equities ex-US In 2024

Betting on the demise of the long-running leadership of US shares over foreign markets has been a losing proposition for some time and the early going in 2024 suggests the trend persists. It’s only February and so the new year is still ripe with opportunity, risk and surprise. But judging by year-to-date results, old history is repeating, again, in terms of relative performance for US stocks, based on a set of ETFs through Friday’s close (Feb. 2).

Macro Briefing: 5 February 2024

* Fed’s Powell reaffirms outlook for rate cuts this year, but…

* Powell insists Fed will proceed “carefully” on timing

* Lower US inflation lays groundwork for rate cuts, OECD advises

* Corporate earnings for key S&P 500 firms are in focus this week

* Deflation pressures expected to continue in China for 2024

* Tech layoffs continue despite booming US economy

* US hiring accelerated in January, rising at strongest pace in a year:

Book Bits: 3 February 2024

● The War Below: Lithium, Copper, and the Global Battle to Power Our Lives

● The War Below: Lithium, Copper, and the Global Battle to Power Our Lives

Ernest Scheyder

Review via Sierra

Transitioning away from fossil fuels is going to take a lot of metals. Global production of lithium and graphite—essential components of EV batteries—will have to ramp up by 4,000 percent by 2040 to meet the Paris Agreement climate goals. Renewable technologies such as wind turbines and solar panels could not exist without heavy doses of metals we know, like copper, and metals we may have never heard of, like neodymium, promethium, samarium, and europium.

To get those metals, we have to mine them. And there’s the rub. “The mines opposed by the environmental lobby in the near term are, paradoxically, necessary to battle climate change in the long term,” Ernest Scheyder writes in The War Below: Lithium, Copper, and the Global Battle to Power Our Lives (One Signal/Atria, 2024). “Recycling alone cannot provide the materials needed to fuel the global green energy transition.”

Total Return Forecasts: Major Asset Classes | 2 February 2024

The long-term return forecast for the Global Market Index (GMI) continued to ease in January, dipping to an annualized 6.6% total return, based on the average for three models (defined below). GMI is a market-value-weighted portfolio that holds all the major asset classes (except cash) via a set of ETF proxies. Today’s revised performance estimate marks another fractionally lower forecast vs. the previous month’s outlook.