* Global manufacturing sentiment improves in January

* Bumper earnings from big tech firms cheer markets in early Friday trading

* IMF predicts housing demand in China to drop 50% over next decade

* US jobless claims, although still low, increase to 11-week high

* Job cuts in US jump to 10-month high in January

* Construction spending in US beats expectations by wide margin

* ISM Manufacturing Index rises to 15-month high in January:

Major Asset Classes | January 2024 | Performance Review

Global markets were mixed in January following a strong finish in 2023 that lifted nearly all corners. Commodities bounced back last month, leading the major asset classes, while property shares led the losers, based on a set of ETFs.

Macro Briefing: 1 February 2024

* Fed leaves interest rates unchanged and downplays odds for a cut in March

* House passes $80 billion tax deal that now heads to Senate

* New warning for regional banks flashing via NY Community Bancorp downgrade

* China’s factory activity expanded for third-straight month in January

* Birthrates are still falling, raising challenges around the world

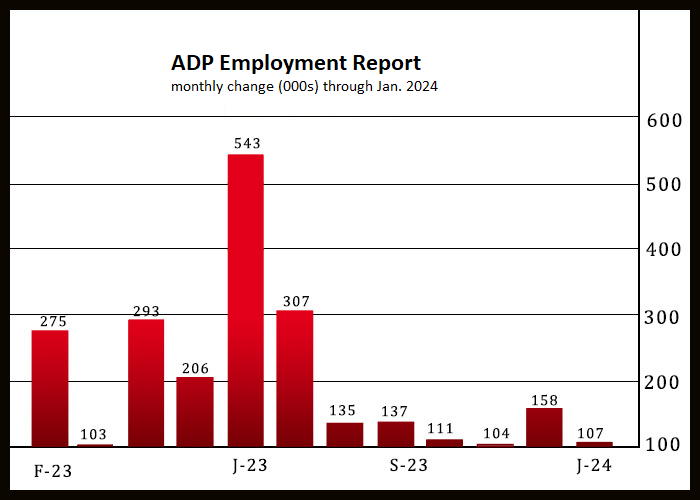

* US companies hire fewer workers than expected in January:

Initial Median Q1 GDP Nowcast For US Indicates Softer Growth

Will last week’s news of substantially stronger-than-expected growth for US economic output in 2023’s fourth quarter extend into this year’s Q1? It’s too soon to make high-confidence estimates, but CapitalSpectator.com’s initial median nowcast (based on several independent estimates) for this year’s first quarter suggests the expansion will continue to slow relative to the previous high point in last year’s red-hot Q3.

Macro Briefing: 31 January 2024

* Federal Reserve expected to leave rates unchanged today

* IMF upgrades global economic outlook, citing US strength, China stimulus

* China’s factory activity contracts for fourth straight month in January

* China auto exports closing in on Japan, which is still leading car exporter

* Home prices in US reach new high in November

* US job openings unexpectedly increase in December

* US Consumer Confidence Index rises to two-year high in January:

Despite Geopolitical Threats, Markets Still Lean Into Risk-On

There’s no shortage of troubling developments around the world, but markets are still inclined to embrace a risk-on bias. There are exceptions, of course, but from several big-picture angles the trends continue to skew positive, based on a set of ETF pairs that serve as risk proxies through Monday’s close (Jan. 29).

Macro Briefing: 30 January 2024

* US considers how to respond to Sunday’s deadly Iranian-backed militia attack

* Democratic lawmakers pressure Fed Chairman Powell to cut rates, but…

* Is the economy too strong to warrant rate cuts?

* Eurozone growth stagnates

* Elon Musk says Neuralink implanted brain chip in a human

* Regulatory hurdles kill Amazon’s plan to buy Roomba, maker of iRobot

* US 10-year Treasury yield trades below 4.1% ahead of tomorrow’s Fed meeting:

Losses Prevail For Major Asset Classes In January

Red ink dominates 2024’s opening month for most of the major asset classes. The upside exceptions for the performance profile so far: US stocks, commodities and junk bonds. Otherwise, year-to-date losses prevail, based on a set of ETFs through Friday’s close (Jan. 26).

Macro Briefing: 29 January 2024

* Biden vows to retaliate after deadly attack on US forces in Jordan

* Iran distances itself from attack that killed 3 US soldiers in Jordan

* This week’s Fed policy decision may drop clues re: a March rate cut

* Rising real interest rates amid falling inflation is new challenge for Fed

* Falling inflation, solid growth give US economy edge over rest of world

* US borrowing by companies and consumers is picking up

* Evergrande, China’s giant property developer, is ordered to liquidate

* China approves over 40 AI models for public use over past 6 months

* US consumer spending accelerated in December:

Book Bits: 27 January 2024

● Busting the Bankers’ Club: Finance for the Rest of Us

● Busting the Bankers’ Club: Finance for the Rest of Us

Gerald Epstein

Review via Kirkus Reviews

An economics professor catalogs the countless ways in which the financial system fails ordinary consumers while favoring the wealthy.

“Finance,” writes Epstein, “is an essential and highly productive part of our economic system; but the financial system can also be a source of stagnation, instability, inequality, and crisis.” The essential inequities in the system have been laid bare at several points, but especially in the financial crisis of 2007-2008, when many corporations and financial institutions walked away unscathed at a cost to taxpayers of $50,000 to $120,000 per household—and not the mega-wealthy households, you can be sure.