* Polls predict Trump will effectively be GOP nominee after today’s NH primary

* Goldman’s head of trading still expects four Fed rate cuts for 2024

* China considers stock-market rescue package to address slumping prices

* Japan’s Nikkei stock market index rose to 34-year peak on Monday

* India’s stock market cap is now world’s fourth largest, overtaking Hong Kong

* US Leading Economic Index still signals recession despite growing economy:

US Stock Market At Record While Drawdowns Prevail Elsewhere

Wall Street celebrated on Friday when the S&P 500 Index, the most popular benchmark of US shares, closed at a record high for the first time in more than two years. The celebration, however, was an outlier as the rest of the major asset classes continue to trade below previous peaks in varying degrees, based on a set of ETFs through the close of trading on Jan. 19.

Macro Briefing: 22 January 2024

* Global supply-chain risk is rising again

* Russia was China’s biggest oil supplier in 2023

* Mortgage rates expected to fall below 6% by year’s end: Fannie Mae

* US home sales fell in 2023 to lowest level in nearly 30 years

* US to invest $325 million into EV charger to boost reliability and reduce costs

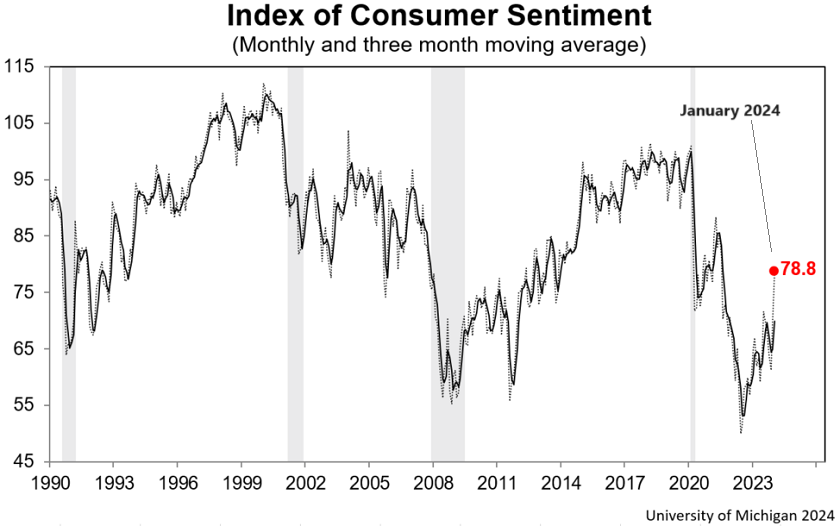

* US Consumer Sentiment Index rises sharply in January to 2-1/2 year high:

Book Bits: 20 January 2024

● Limitarianism: The Case Against Extreme Wealth

● Limitarianism: The Case Against Extreme Wealth

Ingrid Robeyns

Review via The Times

Why should we tax the rich? Because that’s where the money is.

A new book putting the ‘limitarian’ case for imposing a ceiling on personal wealth begs an interesting debate about society’s future.

Nobody deserves to be a multimillionaire and no one, ideally, should be allowed to amass a personal fortune of more than £1 million. So says the Dutch philosopher and economist Ingrid Robeyns in a provocative new book, Limitarianism: The Case Against Extreme Wealth, out this month.

Limitarians believe that there should be a ceiling on personal wealth. Just as governments nowadays routinely set minimum legal wage levels, so they also should set maximum nest-egg sizes.

Much wealth is undeserved, amassed through criminality or market abuse of some kind and undermines democracy. Worse, the very process by which it is piled up has the effect of keeping the poor poor. That’s the limitarian view, anyway.

Moderate Growth Is Still The Estimate For US Q4 GDP

Next week’s official release of US GDP data for the fourth quarter remains on track to post a moderate increase, based on a the median estimate for a set of nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 19 January 2024

* Congress approves short-term funding to avert government shutdown

* What are the factors behind China’s slowing economic growth?

* Bitcoin ETFs are second only to gold funds re: investor popularity

* Trump rules out a US central bank digital currency if he’s elected

* Jobless claims fell last week to lowest level since Sep. 2022

* Philly Fed Manufacturing Index continued to slide in January

* US housing starts fell in December, reversing some of November’s surge:

Healthcare Sector Is Off To A Strong, Market-Leading Start In 2024

After a modest loss in 2023, shares in the healthcare sector are enjoying a market-leading rebound so far in the new year. No one knows if it will last, but the early results certainly look encouraging after this slice of the market has pulled ahead of the rest of the field year to date, based on a set of sector ETFs through yesterday’s close (Jan. 17).

Macro Briefing: 18 January 2024

* Pakistan launches retaliatory airstrikes on militants in Iran

* Commercial real estate market braces for record amount of maturing loans

* US homebuilder sentiment rises for second month in January

* Fed Beige book reports mixed US economic activity in recent weeks

* Business inflation expectations fell “significantly” to 2.2% in January: Atlanta Fed

* Industrial output in US ticks up slightly in December

* US retail sales rise more than forecast in December:

Does NY Fed Manufacturing Index’s Plunge Signal US Recession?

The sharp drop in the New York Federal Reserve’s Empire State business-conditions index in January triggered a wave of warnings. Soon after this monthly survey data was released yesterday (Jan. 16), social media and beyond lit up, warning that this was a smoking gun for the US economy’s imminent descent into recession, assuming output hadn’t already turned negative. But like most single-indicator releases, the crowd rushed to judgment and allowed the headlines du jour to overwhelm more thoughtful analysis.

Macro Briefing: 17 January 2024

* US spending bill clears first hurdle in Senate to avoid government shutdown

* Fed’s Waller expects rate cuts this year

* China Q4 GDP growth annual growth ticks up to 5.2%–slower than expected

* Population in China fell for second straight year in 2023

* Fund managers are bullish on small cap stocks: BofA managers survey

* NY Fed Manufacturing Index plunges in January to lowest level since 2020: