The recent rally in global markets thinned out last week as commodities and foreign stocks rose while US assets retreated, based on a set of ETF proxies.

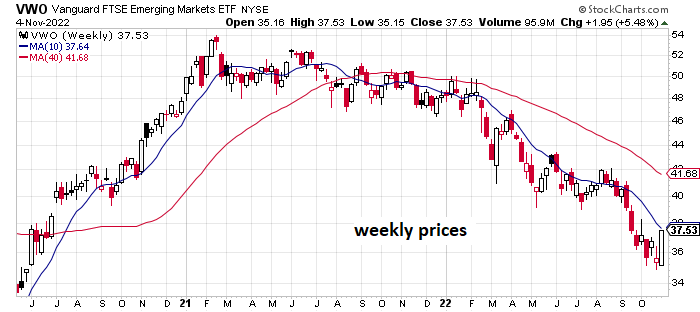

Stocks in emerging markets posted the leading performance for the major asset classes in the trading week through Friday’s close (Nov. 4). The 5.5% surge in Vanguard Emerging Markets (VWO) is impressive, but the ETF continues to reflect a bearish trend and so the latest pop doesn’t the change the fund’s negative outlook.

A key headwind for VWO and other emerging-markets funds: China, which continues to suffer economically from its zero-Covid policy. For example, the country reported monthly declines in exports and imports for October. “The weak export growth likely reflects both poor external demand as well as the supply disruptions due to COVID outbreaks,” says Zhiwei Zhang, chief economist at Pinpoint Asset Management.

China is VWO’s top country allocation with a roughly 33% weight in the country. That’s been a significant headache as China’s stock market has substantially underperformed global equities this year. The iShares MSCI China ETF (MCHI) is down 34.6% year to date, well below the 21.1% haircut for global stocks (VT) this year.

But some analysts predict that China may soon ease its lockdown policies. Goldman Sachs economists advise in a research note: “We estimate that a full reopening could drive 20% upside for Chinese stocks based on empirical, top-down, and historical sensitivity analyses.” The possibility that a policy change may be near appears to be a factor in the latest pop in China stocks.

US shares posted the deepest loss for the major asset classes last week. Vanguard Total US Stock Market (VTI) slumped 3.3%, the fund’s first weekly loss in the past three. The downturn reaffirms the bearish trend that continues to weigh on the ETF this year.

Last week’s mixed results for markets delivered a loss for the Global Market Index (GMI.F), an unmanaged benchmark, maintained by CapitalSpectator.com. This index holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies overall. GMI.F shed 1.5% last week, the benchmark’s first weekly loss in the past three (red line in chart below).

For the one-year change, commodities (GCC) remain the only winner for the major asset classes. Otherwise, losses prevail over the past 12 months through Friday’s close.

GMI.F’s one-year change: just shy of a 21% loss.

Reviewing the major asset classes through a drawdown lens continues to show steep declines from previous peaks. The softest drawdown at the end of last week: inflation-indexed US Treasuries (TIP) with a 14% peak-to-trough decline. The deepest drawdown is in foreign real estate shares (VNQI) with a roughly 33% slide.

GMI.F’s drawdown: -21.3% (green line in chart below).

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno