Investor sentiment on the outlook for another rate cut has been volatile lately, but comments from Federal Reserve officials in recent days has turned the tide back in favor of the doves.

New York Fed President John Williams last week said the central bank can lower its key interest rate to address labor market weakness. Inflation, by contrast, is a lesser threat at the moment, he suggested. “I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral, thereby maintaining the balance between the achievement of our two goals.”

Fed Governor Christopher Waller on Monday supported the case for another rate cut next month. Since the last Fed meeting, “most of the private sector and anecdotal data that we’ve gotten is that nothing has really changed. The labor market is soft. It’s continuing to weaken,” with inflation expected to ease, Waller said.

The commentary has revived expectations via Fed funds futures that the central bank will ease its target rate for a third time at the upcoming Dec. 10 policy meeting. After recently pricing in a coin flip for the next rate decision, futures are now pricing in an 80% probability for a cut.

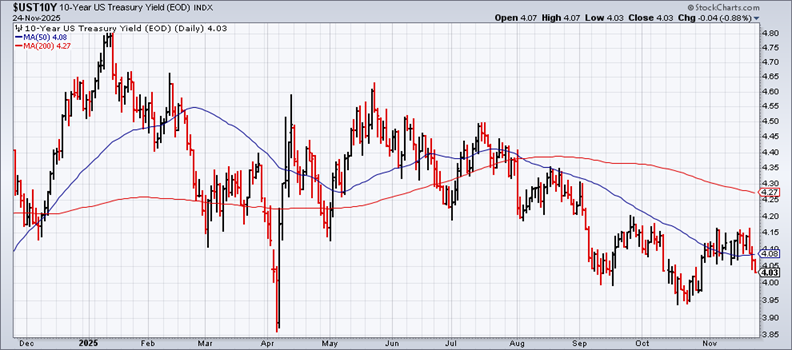

The dovish commentary has fueled a bond market rally in recent days, pushing up prices and driving down yields. The US 10-year Treasury yield fell to 4.03% on Monday, the lowest this month.

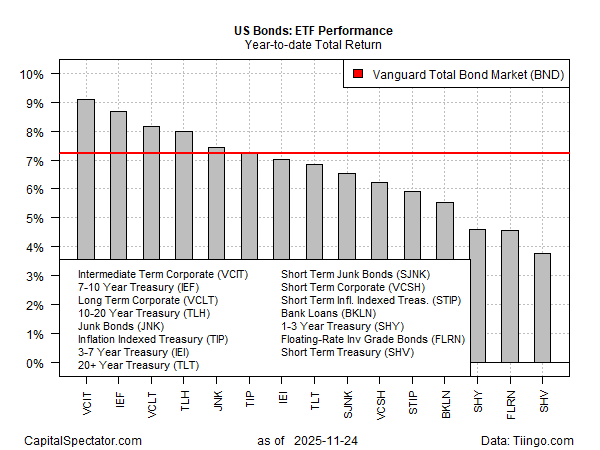

The Vanguard Total Bond Market ETF (BND), a benchmark of US investment-grade credits and government securities, is approaching its previous high. The fund is up 7.2% this year and looks set to score its third straight calendar-year increase. The current year-to-date rally ranks as BND’s best calendar-year performance since 2020.

Federal Reserve Bank of Boston President Susan Collins on Saturday said she was “hesitant” to cut rates next month. “My own view is that policy is currently in the kind of mildly restrictive range after the 50-basis-point easing that we did in September and October, and that’s appropriate” given the current state of the economy, she told reporters.

Given the latest sentiment shift, Collins and fellow hawks seem to be in the minority again. But with two weeks to go before the next Fed meeting, it’s not too late for a new round of attitude adjustment, especially in the current climate, highlighted by missing government data and a deeply divided Fed that some observers think could lead to an unprecedented tie vote on Dec. 10.

“There is no precedent here” for a tie, said Robert Eisenbeis, a former director of research at the Atlanta Fed. Earlier this year, he told Fortune: “I would presume there would be the option for a revote [in the case of a tie], but if not, then no change in the funds rate. If there is no change in the rate, then the next meeting is where another review and vote would take place.”