The Federal Reserve removed the word “patient” from its new policy statement yesterday, signaling that the central bank is inching closer to raising interest rates. But in an attempt to walk a thin line with managing expectations, Fed Chairwoman Yellen advised that “just because we removed the word ‘patient’ from the statement doesn’t mean we are going to be impatient.” The comment certainly resonates when considered with the Fed’s updated economic forecasts, which trimmed the 2015 projection for growth to a 2.3%-to-2.7% range for real GDP vs. the 2.6%-to-3.0% range cited for the December meeting.

As for expectations for the current quarter, the Atlanta Fed’s GDPNow forecast for Q1 GDP continues to slide, dipping to a meager 0.3% rate in the March 17 estimate. That’s well below the recent the Blue Chip consensus forecast via economists that’s just below 2.5%. (The first round of the government’s official Q1 GDP data is scheduled for release next week, on Mar. 27.) It’s still early for deciding where the first-quarter numbers are headed in the final print, which won’t be known for months. But if the Atlanta Fed’s estimate holds it would mark the weakest pace since last year’s Q1 contraction.

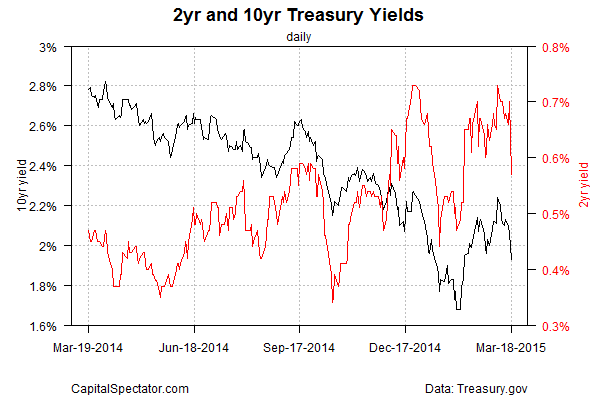

As for Mr. Market’s reaction to yesterday’s Fed news, Treasury yields dropped sharply. The benchmark 10-year yield slipped below 2.0% for the first time in over a month, settling at 1.93% yesterday (Mar. 18). The 2-year yield—widely seen as the most sensitive spot on the yield curve for rate expectations—tumbled to 0.57% yesterday, the lowest since Feb. 5.

The key question now is whether the downgraded expectations for economic growth are more than a temporary dip due to a harsh winter. Recession risk is still low, according to yesterday’s update of the US Economic Profile, but that doesn’t preclude a substantial slowdown in growth relative to recent history.

The next batch of clues may turn out to be critical, starting with today’s releases: initial jobless claims and the Conference Board’s Leading Economic Index. On Monday, we’ll see fresh numbers on existing home sales and the big-picture analysis via the Chicago Fed’s National Activity Index. The following day (Mar. 24) dispenses an early clue on how the March profile is shaping up via the flash estimate of Markit Economic’s business survey data for the manufacturing sector.

The key stress test for judging the economy, of course, will be the next employment report. A hint of things to come arrives on April 1 with the ADP Employment Report, a prelude for the official payrolls report that will be published on April. 3.

Meantime, the guessing game is in high gear… again. For the moment, risk-on is on, with stocks rallying in Europe and throughout much of Asia at the moment in the wake of yesterday’s Fed news. The crowd’s enthused with the idea that the first rate hike may be delayed after all. The question, of course, is whether the fundamental catalyst behind this revised outlook turns out to be a wolf in sheep’s clothing?

Pingback: Federal Reserve Statement Impacts Treasury Yields