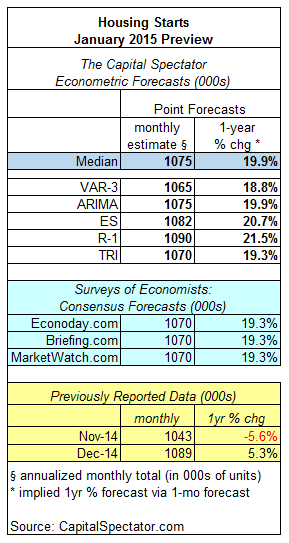

Housing starts are expected to decrease to an annual pace of 1.075 million in tomorrow’s update for January, according to The Capital Spectator’s median point forecast for several econometric estimates. The projection represents a slightly lower level of residential construction vs. December’s 1.089 million units.

Three estimates based on recent surveys of economists point to a slightly deeper slide for housing starts in January relative to The Capital Spectator’s median projection.

Translating The Capital Spectator’s median monthly forecast into an annual comparison implies that starts will increase in tomorrow’s update at a substantial rate vs. the year-earlier level.

Here’s a closer look at the numbers, followed by brief definitions of the methodologies behind The Capital Spectator’s forecasts that are used to calculate the median estimate:

VAR-3: A vector autoregression model that analyzes three economic series to project housing starts: new home sales, newly issued permits for residential construction, and the monthly supply of homes for sale. VAR analyzes the interdependent relationships of these series with housing starts through history. The forecasts are run in R using the “vars” package.

ARIMA: An autoregressive integrated moving average model that analyzes the historical record of housing starts in R via the “forecast” package.

ES: An exponential smoothing model that analyzes the historical record of housing starts in R via the “forecast” package.

R-1: A linear regression model that analyzes the NAHB Housing Market Index in context with housing starts. The historical relationship between the data sets is applied to the more recently updated NAHB Housing Market Index to project housing starts. The computations are run in R.

TRI: A model that’s based on combining point forecasts, along with the upper and lower prediction intervals (at the 95% confidence level), via a technique known as triangular distributions. The basic procedure: 1) run a Monte Carlo simulation on the combined forecasts and generate 1 million data points on each forecast series to estimate a triangular distribution; 2) take random samples from each of the simulated data sets and use the expected value with the highest frequency as the prediction. The forecast combinations are drawn from the following projections: Econoday.com’s consensus forecast data and the predictions generated by the models above (VAR-3, ARIMA, ES and R-1). The forecasts are run in R with the “triangle” package.