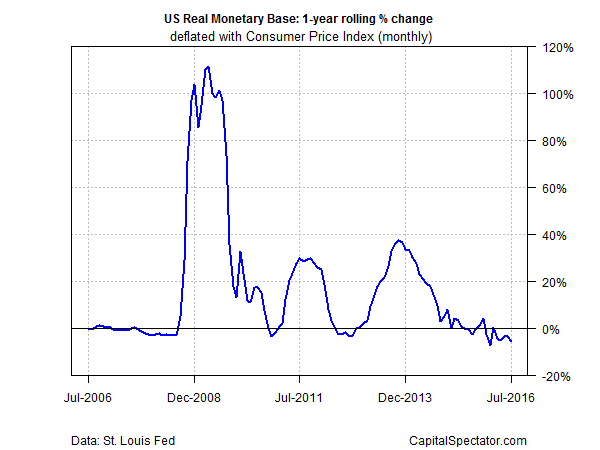

Fed fund futures continue to imply a low probability of a rate hike at next month’s FOMC meeting, but the annual trend in real (inflation-adjusted) base money supply points to a slightly firmer bias for anticipating another round of monetary policy tightening in the near-term future.

The 5.9% slump in real M0 in July vs. the year-earlier level marks the fifth straight month of negative annual comparisons. That’s the longest stretch of back-to-back monthly decreases in four years.

Is this a sign that the central bank is laying the groundwork for rate hike in September? The Fed fund futures market is skeptical. CME data estimates a 15% probability of a rate hike at the Sep. 21 policy meeting, based on prices for Aug. 22.

The effective Fed funds (EFF) rate at the moment doesn’t conflict with that forecast. But note that EFF has edged higher in the summer and the 30-day average is currently 0.39%, which is close to the highest in nearly eight years.

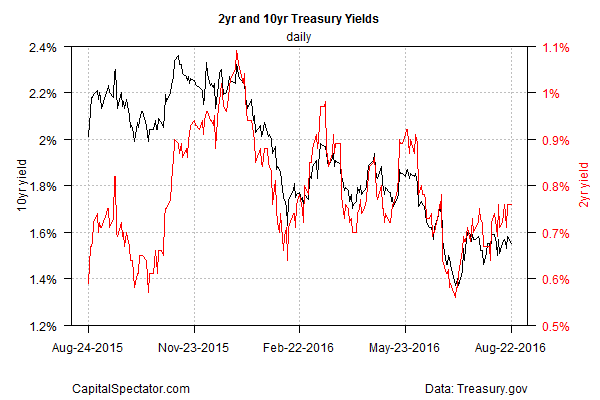

Meantime, Treasury yields remain subdued vs. recent history. The 2-year yield, which is said to be the most sensitive for rate expectations, is close to the lowest levels in a year. Although the 2-year yield has inched up to 0.76% (as of Aug. 22), that’s still well below the 1.0%-plus rate that prevailed at the start of 2016, based on daily data via Treasury.gov.

The main event for this week that could change expectations one way or the other: Federal Reserve Chair Janet Yellen’s speech on Friday at the central bank’s symposium in Jackson Hole, Wyoming.

“We’ll have to wait for Yellen’s comments for some clarity,” advises Chris Green, the director of economics and strategy at First NZ Capital Group. “Despite some signs of improvements in the US economy, particularly in the labor market, a rate hike is probably a 2017 story.”

Perhaps, although some economists expect that data will trump chatter as the pivotal event on what to expect for next month’s monetary announcement. Payrolls in particular will be closely watched ahead of the Sep. 21 FOMC meeting. After two solid reports of job growth in June and July, some analysts think that three in a row will be a tipping point for the Fed.

“If the August employment report, scheduled for release on Sep. 2, is solid, then we expect the Fed to raise rates at its September meeting,” says Michael Gapen, chief US economist at Barclays.