The preliminary numbers for the US economic profile in February are flashing a warning sign, according to Markit’s sentiment data for the manufacturing and services sectors. It’s premature to assume the worst just yet, in part because the nearly complete set of numbers for January still point to growth. Ditto for the Chicago Fed’s January reading of the trend. By contrast, there’s only a handful of data points available at the moment for February. But the early signals for this month suggest that forward momentum will continue to suffer. We’ll know more in the days ahead as new data arrives. Meanwhile, the macro trend appears headed for more deterioration. While we’re waiting for fresh figures, let’s get up to speed on where we stand at the moment for February.

The latest data point is the flash Services PMI, which dipped into contractionary territory this month—below the neutral 50 mark–for the first time since Oct. 2013. Chris Williamson, Markit’s chief economist, bluntly noted in the accompanying press release that “the PMI survey data show a significant risk of the US economy falling into contraction in the first quarter. The flash PMI for February shows business activity stagnating as growth slowed for a third successive month. Slumping business confidence and an increased downturn in order book backlogs suggest there’s worse to come.”

Markit’s Manufacturing PMI delivered a stronger reading for February, printing at 51.0. But the trend is weakening for this sector and the latest update reflects the weakest reading since Oct. 2012. “Every indicator from the flash PMI survey, from output, order books and exports to employment, inventories and prices, is flashing a warning light about the health of the manufacturing economy,” Williamson noted earlier this week.

Initial jobless claims are the main antidote to the gloomy PMI numbers for February at the moment. Last week’s update revealed that new filings for unemployment benefits dipped to a three-month low, suggesting that recession risk for the US is minimal. The Philly Fed’s ADS Index, a high-frequency measure of the US macro trend, is also trending positive, based on economic data published through Feb. 13. And the Atlanta Fed’s latest GDPNow estimate sees a solid rebound for first-quarter growth, based on the bank’s Feb. 17 projection.

But in the wake of this week’s worrisome PMI numbers for February, there’s a lot riding on today’s weekly update for new claims, which is due out later this morning. Although the consensus forecast via Econoday.com sees a modest rise in claims to 270,000, that’s still an encouraging number for expecting that the labor market will continue to expand and keep the economy bubbling. But let’s be clear: a substantially higher-than-expected jump today would be problematic for the still-evolving profile for US macro in February after the latest PMI releases.

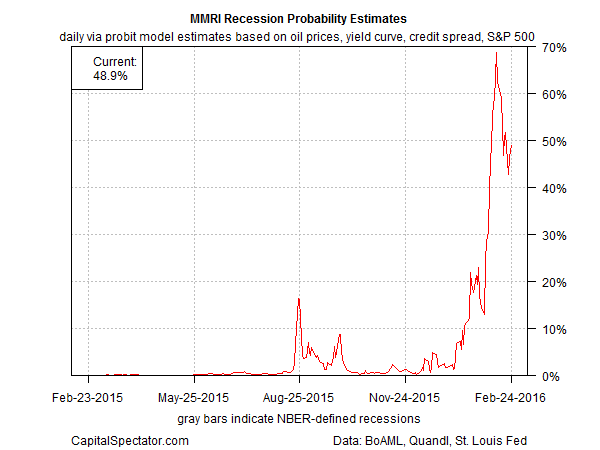

Given the mixed messages at the moment, it’s no surprise to find that a markets-based reading of the US macro trend is sitting on the fence as of yesterday (Feb. 24). The implied probability that a new US recession has started is effectively 50%, based on a probit-model reading of the Macro-Markets Risk Index, which aggregates data from stocks, oil, the Treasury yield curve and the junk bond spread to estimate the macro trend (see here for design details). This admittedly noisy measure of the crowd’s macro outlook has pulled back from an explicit recession forecast but has yet to issue an all-clear signal. Like everyone else, Mr. Market is on pins and needles in anticipation of the next round of data releases.

The bottom line: the US economic outlook is looking wobbly, again. Deciding if it’s noise or a genuine signal requires more data, starting with today’s update on jobless claims. Meantime, we’re in a gray zone. But clarity is coming, for good or ill, which leaves us at a familiar if frustrating juncture: the next several days of data releases could be critical in the dark art/science of evaluating the near-term economic trend.