* Winter weather continues to wreak havoc in Texas

* Fed officials last month discussed outlook for higher inflation

* US interest rates will continue to rise, analysts predict

* US economy could lose $1 trillion if Biden pursues sharp separation from China

* Life expectancy in US fell in first half of 2020 due to pandemic

* US jobless claims expected to ease in today’s report but remain high

* US producer prices increased the most in January since 2009

* Homebuilder sentiment in US remains firmly bullish in February

* Industrial output in US increased more than expected in January

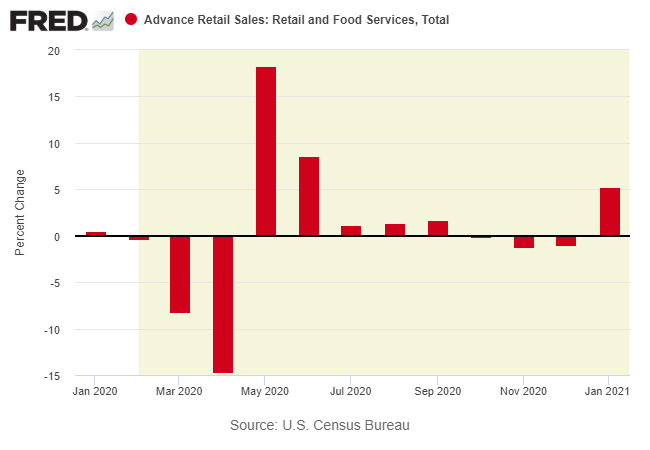

* US retail sales surged in January, rising for first time in 4 months:

Monthly Archives: February 2021

The ETF Portfolio Strategist: 17 Feb 2021

In this issue:

- Gold slides to 3-month low

- Energy stocks continue to rally as Goldman turns bullish on the sector

- Another record high for ishares MSCI China ETF (MCHI)

Rising Interest Rates Create Headwinds For Bonds In 2021

Only when the tide goes out do you discover who’s been swimming naked, Warren Buffett famously quipped. A real-time financial example is unfolding in the bond this year, especially after yesterday’s jump in Treasury yields.

Macro Briefing: 17 February 2021

* Biden administration will extend ban on home foreclosures

* Huge protests in Mynamar continue in reaction to military coup

* US retail sales expected to rebound in today’s January udpate

* Electricity prices surge in Texas as deep freeze roils state

* China topped US in 2020 as Europe’s biggest trading partner

* Bitcoin reaches $51,000, a new record

* Widespread business disruption across US in wake of winter storm

* Does extreme weather provide opportunity for infrastructure upgrade?

* Manufacturing activity in New York state expanded in February at a quicker pace

* 10-year Treasury yield rises to 1.30%, near one-year high:

US GDP Estimates Point To Ongoing Economic Expansion in Q1

Early projections for US economic output in the first quarter point to extension of the rebound that started in last year’s Q3. A set of nowcasts point to GDP growth that’s currently on track to speed up modestly from the pace of growth reported for 2020’s final quarter.

Macro Briefing: 16 February 2021

* Pelosi announces plan for commission to investigate Capitol riot

* US debt ceiling issue unresolved in Biden’s $1.9 trillion relief program

* China considers restricting rare earths exports to US defense industry

* Severe winter weather triggers emergency declarations in at least seven states

* Winter weather lifts US crude oil benchmark above $60 a barrel

* Daily change in new US Covid-19 deaths falls to three-month low

* Biden and Fed don’t see inflation risk as a challenge

* Bitcoin rally raises price to record $50,000

* 30-year Treasury yield rises above 2%–highest in a year:

Emerging Markets Stocks Continue To Lead Major Asset Classes

Shares in emerging markets were again the top weekly performer for the major asset classes, based on a set of exchange traded funds. Commodities and foreign stocks in developed markets were close second- and third-place winners in last week’s trading through Friday, Feb. 12.

Macro Briefing: 15 February 2021

* Arctic freeze in Texas unleashes power blackouts

* US coronavirus infection rate falls to lowest since October

* Support grows for Capitol riot inquiry after Trump acquittal

* Myanmar protests continue after Feb. 1 military coup

* Investor demand for corporate debt driving a Wall Street lending boom

* Afghanistan is near tipping point as Taliban’s control of country advances

* Japan’s economy continues expanding in Q4, signaling resiliency

* Japan’s Nikkei 225 stock index rebounds to new high (30 years later)

* Eurozone industrial production fell more than expected in December

* US consumer sentiment falls to 6-month low in Feb as inflation outlooks rises:

Book Bits: 13 February 2021

● This Is How They Tell Me the World Ends:

● This Is How They Tell Me the World Ends:

The Cyberweapons Arms Race

Nicole Perlroth

Review via The Washington Post

The U.S. government is paying hackers for vulnerabilities it finds in software and hardware used by corporations and governments. Once they’ve bought those vulnerabilities, they’re turning them into cyberweapons employed in attacking or spying on adversaries.

That’s the moral, political and economic dilemma explored by “This Is How They Tell Me The World Ends: The Cyberweapons Arms Race,” a new book out today by New York Times cybersecurity reporter Nicole Perlroth.

The ETF Portfolio Strategist: 12 Feb 2021

In this issue:

- Stocks rise as Treasury yields tick higher

- Is the tide finally turning in favor of global asset allocation?

Programming note: Starting with this issue, ETF-PS will separate reporting on our portfolio strategy benchmarks from the proprietary strategies, which will be updated in an upcoming issue.

Equities rally as the reflation trade starts to pinch bonds: US equities rose for a second week, based on Vanguard Total US Stock Market (VTI). The fund gained 1.7% at Friday’s close (Feb. 12), marking the first back-to-back weekly gain this year and propelling VTI to a new record high.