Why Are High Exposures to Factor Betas Unlikely to Deliver Anticipated Returns?

Chris Brightman (Research Affiliates) et al.

January 11, 2021

By choosing investment strategies that intentionally create exposure to factor betas, investors may be obtaining uncompensated risks. We show across a wide variety of factors and geographical markets that factors constructed from fundamental characteristics have earned high returns, whereas those constructed from statistical betas have earned returns close to zero. When designing factor-based investment strategies, investors should seek exposure to the fundamental characteristics that define a factor and use statistical measures of factor betas to manage factor risks. Conversely, seeking to gain exposure to factor betas is a misguided means of obtaining the returns available from factor investing.

Monthly Archives: February 2021

Macro Briefing: 12 February 2021

* House committee approves Biden’s $1.9 trillion relief program

* Biden says US has new deals to secure 200 million more vaccine doses

* Vaccine rollouts are improving across the US

* Trump’s legal team’s defense begins today in Senate impeach trial

* Fed’s Daly expects central bank bond buying to continue through 2021

* Eurozone headed for political battle over sharply higher debt levels

* Pondering how tech innovations will unleash a surge in productivity\

* UK GDP fell a record 9.9% in 2020 but rebounded in December

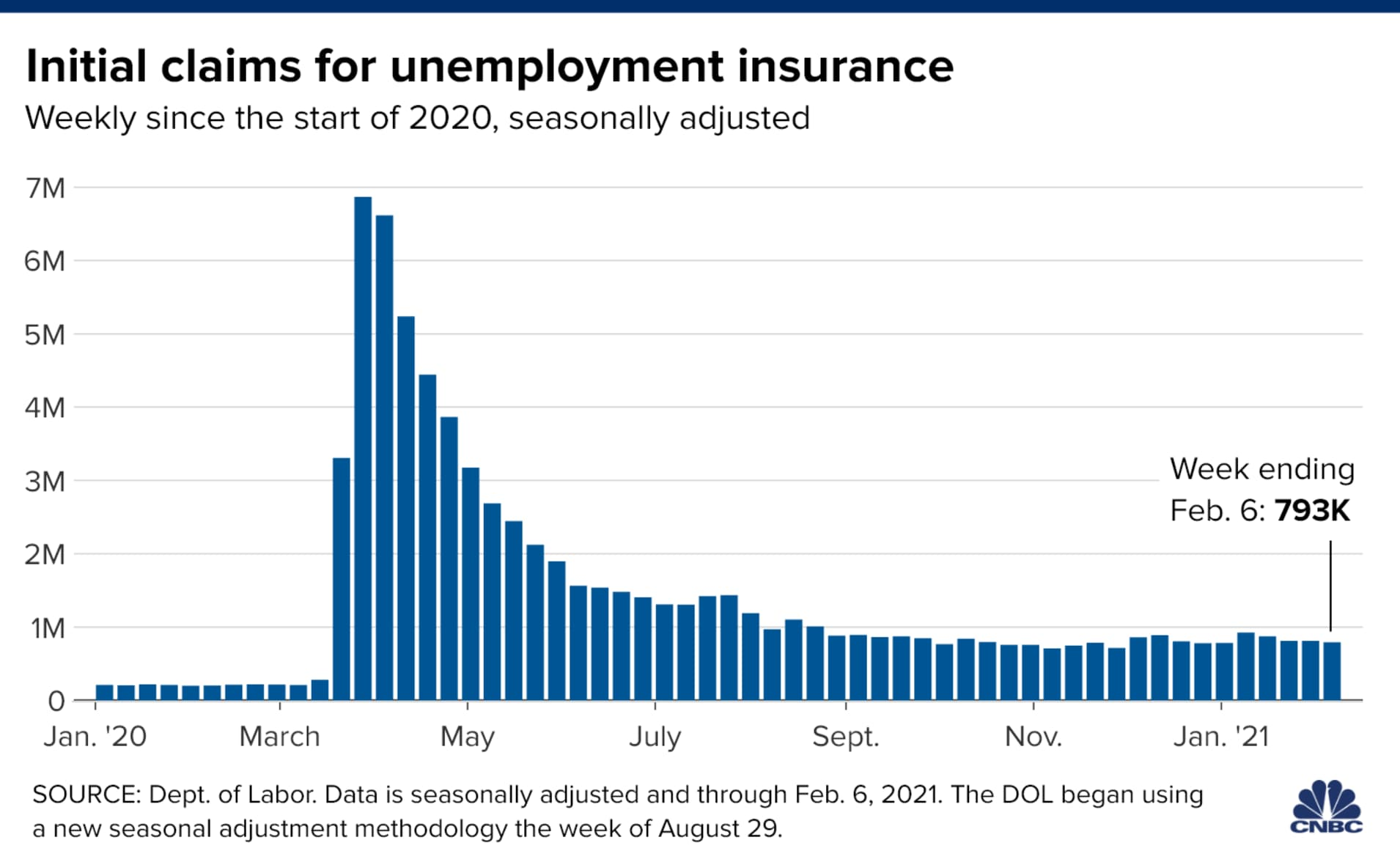

* US jobless claims signal stronger pandemic-related headwinds:

Small-Cap Risk Leads US Equity Factor Returns Year To Date

Small-capitalization shares are having a good year. It’s only mid-February, but year-to-date results continue to show a strong performance edge in favor of smaller stocks in the US equity space, based on a set of exchange traded funds through yesterday’s close (Feb. 10).

Macro Briefing: 11 February 2021

* President Biden discussed ‘fundamental concerns’ with China’s President Xi

* Dems press charges against Trump in second day of Senate impeachment trial

* Biden approves US sanctions on Myanamar’s military leaders after coup

* Biden team: US may not reach herd immunity until Thanksgiving at earliest

* Fed’s Powell reaffirms central bank’s commitment to ultra-low interest rates

* How a value shop used behavioral bias analytics to survive the value drought

* Rise of green energy will be painful for oil-producing nations, report advises

* Signaling end of era, Shell says its oil output will fall in years ahead

* Inflation isn’t a near-term issue, analyst predicts

* One-year trend in US consumer inflation remains modest in January:

The ETF Portfolio Strategist: 10 Feb 2021

In this issue:

- iShares MSCI Turkey (TUR) takes flight

- US Natural Gas (UNG) – the downside exception to the commodities rally

- Invesco Solar (TAN) continues to run hot

Programming note: Here begins a periodic update of ETFs that caught your editor’s eye on the trending front. In contrast to our broad-based portfolio strategy edition (see here, for instance), Trend Watch will go granular and tactical. In this space we’ll selectively highlight funds that, for one reason or another, stand out vis-à-vis a wide-ranging list of 146 ETFs that run the gamut, from various measures of US stocks and bonds to commodities, REITs, forex, foreign fixed income, country funds and narrowly defined industry groups. For a complete list of the funds we’re monitoring, see the list below.

Herd Immunity Is The Solution For Covid-19. But When?

The end of the pandemic’s acute phase, or something genuinely close to it, will arrive when so-called herd immunity is reached. This will mark a meaningful turning point for public health and the economy, which are inextricably linked in the age of Covid-19. That leaves the critical question: When will herd immunity arrive?

Macro Briefing: 10 February 2021

* US Covid-19 surge weakens but unclear if this is a turning point

* Senate votes to to allow Trump impeachment trial to continue

* Senate Democrats working on plan to raise federal minimum wage

* Critics charge that Fed policies are fueling speculative bubbles

* Core consumer inflation in China falls for first time in a decade

* Buy emerging mkts via large-cap value stocks only during crises, study advises

* US small business sentiment slipped to 8-month low in January

* US job openings rise modestly in Dec, but remain well below pre-pandemic peak:

The Great Divergence: Nominal vs. Real Treasury Yields

The Treasury market’s implied inflation forecast continues to rise, but the source of this reflationary trend is born of a growing divergence between nominal and real (inflation-adjusted) Treasury yields. Explaining the divergence and pondering the implications can take several paths. But no matter your preference, all roads begin with monitoring the data that highlights this expanding gap.

Macro Briefing: 9 February 2021

* Dems propose additional $1400 payment for $1.9 trillion relief package

* Senate leadership announces plan for today’s Trump impeachment trial

* US carrier groups conduct joint exercises South China Sea

* Hacker attempts to poison water supply in Florida city

* US average junk bond yield falls below 4% for the first time

* Italian government bond yields fall to record low

* Bitcoin rises to record high after Tesla discloses $1.5 billion purchase

* US crude oil benchmark rises for 6th day to nearly $58–a 1yr high:

Emerging Markets Stocks Lead Returns For Major Asset Classes

Shares in emerging markets moved to first place for one-week and one-year returns for the major asset classes, based on a set of exchange-traded funds through Friday’s close (Feb. 5). In addition to topping returns last week, emerging markets equities have widened a first-place performance lead over US stocks, which are in second place for one-year results.