* Millions of jobless Americans are about to lose federal unemployment benefits

* Japan’s prime minister announces he’ll quit after a year in office

* Looking for clues for predicting how the Taliban will govern Afghanistan

* China Services PMI: sector contracted in August for first time since April 2020

* US jobless claims remained strong in August

* GM to halt most production at North American plants due to chip shortage

* One of biggest hedge funds agrees to pay up to $7 billion to settle tax dispute

* US rent inflation will accelerate, predict two Fed economists predict:

Yearly Archives: 2021

Risk Premia Forecasts: Major Asset Classes | 2 September 2021

The expected risk premium for the Global Market (GMI) ticked up in August, reaching an annualized 6.1%, slightly above the previous month’s estimate. That’s a relatively elevated level compared with recent history. The forecast relates to the long-run outlook for GMI’s return over the “risk-free” rate, which is based on the yield for a 3-month Treasury bill.

Macro Briefing: 2 September 2021

* Hurricane Ida’s remnants bring widespread flooding to US Northeast

* Global mfg growth slipped to six-month low in August via PMI survey data

* US construction spending ticked up to 9.0% annual gain, a pandemic high

* Will ending eviction protections harm the economic recovery?

* The outlook for merger arb trades looks encouraging, predicts GMO

* US manufacturing posts slightly stronger growth in August

* US private payrolls grew faster in August, but less than forecast via ADP data:

The ETF Portfolio Strategist: 1 September 2021

Is it risk-on again for emerging markets? It’s an intriguing question that resonates a bit more these days, courtesy of rallies in several of the leading EM nations.

Major Asset Classes | August 2021 | Performance Review

The winning streak for American shares rolled on in August. US stocks rose for a seventh straight month and posted the strongest gain for the major asset classes.

Macro Briefing: 1 September 2021

* Assessing the shift in global power relations in wake of US exit from Afghanistan

* China mfg sector posts slight decline in Aug–first drop in 1-1/2 years

* OPEC+ lifts forecast for oil demand in 2022

* India’s economy rebounded at record rate in second quarter

* German retail sales fell far more than expected in July

* US home prices post record gain in June

* Chicago PMI pulls back to 2-month low in Aug, but still reflects strong growth

* Is the stock market immune to bad news?

* US Consumer Confidence Index fell in August to six-month low:

US Q3 GDP Estimates Continue To Indicate Solid Growth

The resurgence in coronavirus cases, hospitalizations and fatalities in the US hasn’t taken a bite out of third-quarter growth estimates, at least not yet.

Macro Briefing: 31 August 2021

* Last US military planes left Afghanistan, marking end of America’s longest war

* Assessing the damage in Louisiana after Hurricane Ida

* Pandemic complicates Fed’s task of defining employment goals

* Eurozone inflation rises to 3% pace in August, highest in a decade

* China’s economy comes under pressure in August via PMI survey data

* Factory growth in China slows to a crawl in August via PMI survey data

* Supply shortages continue to bedevil the economy

* Dallas Fed Mfg Index indicates softer growth in August

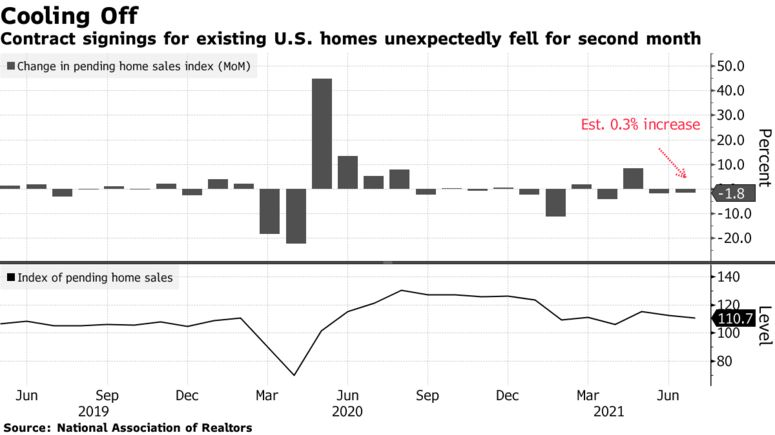

* US pending home sales fell for a second straight month in July:

Broad-Based Rallies Last Week Lifted Most Asset Classes

US bonds were last week’s outlier, posting a slight decline. Otherwise, all the major asset classes rose last week, based on a set of ETFs for the trading week through Aug. 27.

Macro Briefing: 30 August 2021

* New Orleans loses power as Hurricane Ida rages over Louisiana coast

* Kabul airport subject to multiple but apparently failed rocket attacks

* Europe considers blocking non-essential travel from US due to Covid-19

* N. Korea appears to have restarted operations for producing nuclear weapons

* US Covid-19 hospitalizations rebound to highest level since last winter

* Weighing the outlook for China tech stocks as regulatory crackdown continues

* Veteran investor Mark Mobius recommends a 10% allocation to gold

* US personal consumption expenditures rose for a second month in July: