Predicting Financial Crises: The Role of Asset Prices

Tristan Hennig (International Monetary Fund), et al.

August 2023

We explore the early warning properties of a composite indicator which summarizes signals from a range of asset price growth and asset price volatility indicators to capture mispricing of risk in asset markets. Using a quarterly panel of 108 advanced and emerging economies over 1995-2017, we show that the combination of rapid asset price growth and low asset price volatility is a good predictor of future financial crises. Elevated levels of our indicator significantly increase the probability of entering a crisis within the next three years relative to normal times when the indicator is not elevated. The indicator outperforms credit-based early warning metrics, a result robust to prediction horizons, methodological choices, and income groups. Our results are consistent with the idea that measures based on asset prices can offer critical information about systemic risk levels to policymakers.

Monthly Archives: August 2023

Macro Briefing: 31 August 2023

* US GDP for Q2 revised down to +2.1% from +2.4%

* China manufacturing sector contracts 5th month in August via PMI survey

* One of China’s biggest property developers warns of possible default on debt

* Eurozone inflation is higher than expected in August

* US pending home sales in July post gain for second straight month

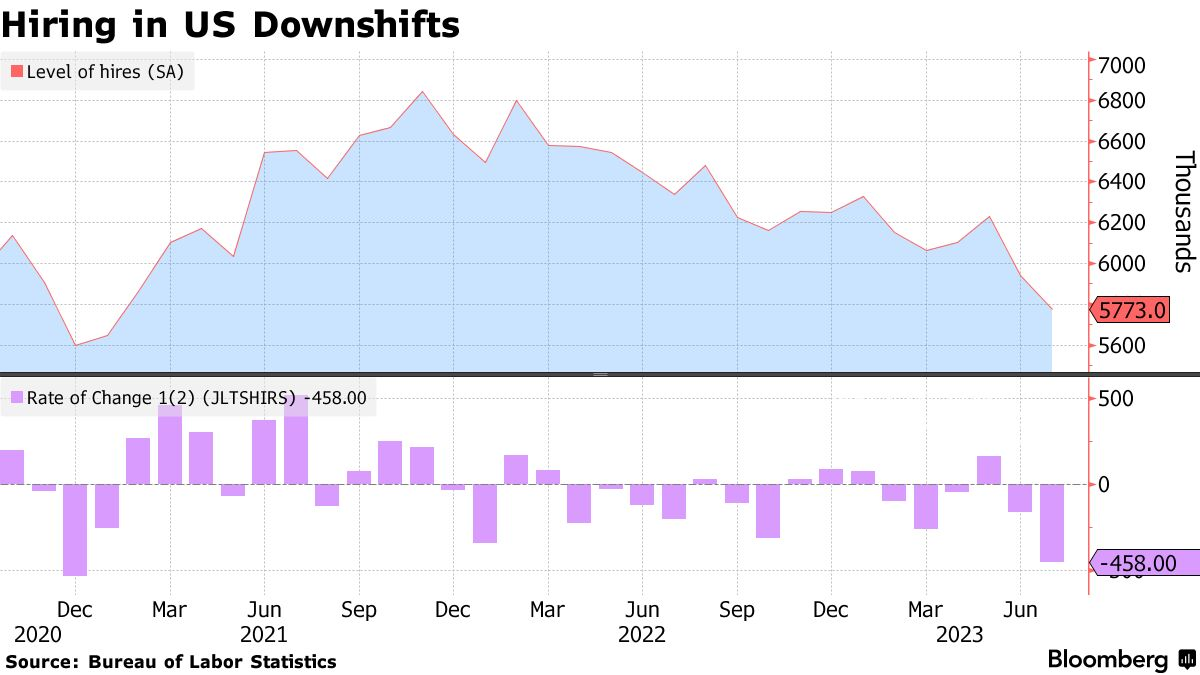

* Hiring by US companies slows sharply in August via ADP data:

Is US Economic Resilience Peaking?

Nothing lasts forever, as any student of the business cycle knows. But recognizing that the economy is dynamic, and constantly shape shifting, doesn’t make it any easier to spot trend changes in real time.

Macro Briefing: 30 August 2023

* Some House members flirt with possibility of a US government shutdown

* US firms complain China is ‘uninvestable’, says US commerce secretary

* Peak China may be shaping up to be a key challenge for US

* Home prices in US rose for fifth straight month in June

* US court clears path for first US-listed spot bitcoin ETF

* US Consumer Confidence Index declined in August after two month gains

* US job openings fall in June to lowest level since March 2021:

So Many Equity Risk Premium Models, So Little Time: Part II

Last week I briefly profiled the earnings yield as a tool for estimating the US stock market’s equity risk premium, the return on stocks over a “risk-free” rate. For comparison, let’s add the dividend yield model (DYM) in today’s update.

Macro Briefing: 29 August 2023

* US and China agree to take steps to ease trade tensions

* China vows to speed up fiscal spending to support slowing economy

* Is geothermal the next big thing for US energy?

* German economy appears to be sliding into stagnation

* Goldman Sachs sells investment advisory business to Creative Planning

* Texas mfg production activity in Aug contracts at deepest level in 3 years:

Global Markets Rally, Posting First Weekly Gain In A Month

After three straight weekly declines, the Global Market Index (GMI) rebounded for the trading week through Friday, Aug. 25. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

Macro Briefing: 28 August 2023

* Inflation “remains too high,” says Fed Chairman Powell

* World’s central bankers unsure if rates high enough to tame inflation

* Fallout from China slowdown is probably limited for US economy

* Shares in Evergrande (crisis-hit Chinese developer) crash as trading resumes

* US government shutdown risk for autumn appears to rising

* US home prices have bottomed and will rebound in 2024, predicts Zillow

* Inflation and jobs are in focus for this week’s US economic updates

* Rally in US large-cap growth stocks looks overbought, says RBC analyst:

Book Bits: 26 August 2023

● The Rise and Fall of the EAST: How Exams, Autocracy, Stability, and Technology Brought China Success, and Why They Might Lead to Its Decline

Yasheng Huang

Review via The Wall Street Journal

In the past few years, Yasheng Huang has found himself becoming disenchanted as a scholar, tired of the shackles placed on him by academic journals. Their excessive specialization has led, he complains, to a “suboptimal supply of big ideas.” So he set out to liberate himself from refereed publications and write a sweeping and “self-consciously ambitious” book about his native China. The riveting result is “The Rise and Fall of the EAST,” whose last word isn’t a reference to the Orient but is, instead, an acronym—for Exams, Autocracy, Stability and Technology—the interplay of which has shaped China for nearly 1,500 years.

US Economic Data Still Point To Moderate Growth For Q3

US economic growth in the first half of the year appears on track to continue in the third quarter, based on the median estimate via several sources that are aggregated by CapitalSpectator.com.