● Blood in the Machine: The Origins of the Rebellion Against Big Tech

Brian Merchant

Review via San Francisco Chronicle

In today’s tech-obsessed world, the Luddites, 19th century British worker rebels known for smashing the machines made to replace them, are considered hammer-wielding, anti-progress primitives who we’d do well to leave in the dustbin of history. But according to Los Angeles Times tech columnist Brian Merchant, that popular conception is dead wrong. In his new book, “Blood in the Machine: The Origins of the Rebellion Against Big Tech,” Merchant zooms in on the misunderstood movement to show us that those machine-smashing rebels were anything but ignorant — in reality, they were grappling with the same questions about automation and labor that we are now.

Monthly Archives: September 2023

Surprise, Surprise: US Crude Oil Production Is Surging

We may be toiling in the post-truth age, but here at CapitalSpectator.com we stubbornly remain stuck in old-school habits and favor hard data over the rising preference in some circles for creatively reframing facts.

Macro Briefing: 29 September 2023

* US government shutdown likely with one day left before Sep. 30 deadline

* US pending home sales continue to tumble in August

* US housing sales slowdown will last a “long time,” says Redfin CEO

* Largest US healthcare worker strike in history brewing for next week

* Credit card data suggests US consumer spending slowed in September

* BlackRock CEO Larry Fink predicts US 10-year Treasury yield will top 5%

* Revised US GDP data for Q2 unchanged at 2.1% growth rate

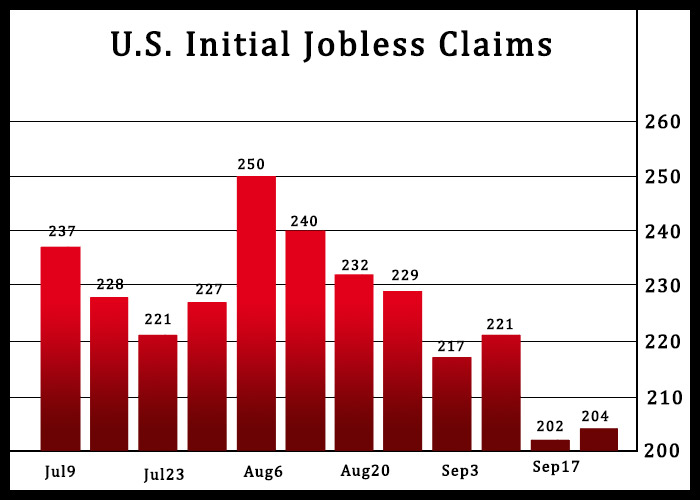

* US jobless claims remain low, suggesting ongoing labor-market resilience:

Higher-For-Longer Risk Continues To Grip US Treasury Market

A perfect storm may be brewing for the bond market as a combination of factors drive yields higher.

Macro Briefing: 28 September 2023

* Government shutdown looks increasingly likely as Sep. 30 deadline nears

* Workers union threatens to expand strikes at Detroit automakers

* Shares suspended in Evergrande, China’s troubled property development

* Oil futures rise to highest level of the year on Wednesday

* US durable goods orders unexpectedly rise in August

* US GDP Q3 nowcast continues to indicate strong acceleration in growth vs. Q2:

Risk-Off Odds Rising As Markets Retreat And Bond Yields Rise

Earlier this month I wrote that there was still room for debating if a broad-based risk-off signal was brewing. Three weeks later, the space is narrowing for keeping an open mind, based on several sets of ETF pairs for markets through yesterday’s close (Sep. 26).

Macro Briefing: 27 September 2023

* Senate passes spending bill to avert government shutdown, but…

* Odds are low that House will approve Senate’s stop-gap bill

* FTC and 17 states file antitrust lawsuit against Amazon

* Strong US dollar may be a new headwind for stocks

* China’s struggling property developer Evergrande misses another bond payment

* Consumer confidence in US slips for second month in September

* New US home sales fall in July to lowest level since March

* US home prices rose for sixth straight month, reaching new high in July:

Is The “Most-Anticipated” US Recession In History Still Lurking?

Late last year, and into early 2023, the crowd was all in on the inevitability of a US recession starting in the near future. A Bloomberg headline captured the zeitgeist as the new year dawned: “The Most-Anticipated Downturn Ever.” But as September draws to a close, the current business-cycle nowcast continues to indicate low risk as the economy chugs along.

Macro Briefing: 26 September 2023

* Moderate Republicans plan to work with Democrats to avert Oct. 1 shutdown

* Buying a home or car is “unaffordable” for typical American, says economist

* China and Europe try to reduce trade tension

* Nissan plans to sell only electric cars in Europe by 2030

* Soaring demand for critical metals raises ethical challenges for investors

* Biggest long-Treasury ETF plunges as bond rout deepens

* Texas manufacturing activity rebounds in September via Dallas Fed survey

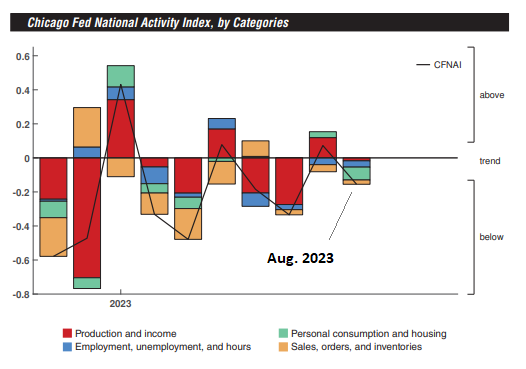

* US economic activity slows in August: Chicago Fed Nat’l Activity Index:

Will US Stocks Continue To Outperform Global Markets This Year?

Market sentiment is turning cautious as several risk factors come into focus for the fourth quarter, but for the moment the lofty year-to-date performance premium for US shares relative to the rest of the major asset classes endures.