The government shutdown is delaying economic reports, but the latest numbers available continue to indicate a solid increase in the upcoming third-quarter GDP report, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com. The longer the shutdown lasts, however, the greater the uncertainty as the nowcast inputs age and fail to reflect the latest economic changes.

Monthly Archives: October 2025

Macro Briefing: 10 October 2025

A third of US state economies are contracting and another 13 are “treading water,” according to analysis from Moody’s Analytics. Two of the states with the biggest influence on US GDP — California and New York — appear to be at the tipping point. “Those two states are treading water. They’re big states, and if they go into the red then that’ll probably take the national economy with them into recession,” predicts Moody’s chief economist, Mark Zandi.

Micro-Cap Stocks Are Outperforming This Year

Much of the attention on this year’s bull run in stocks has focused on AI-fueled Big Tech and its rising influence in benchmarks such as the S&P 500 Index. But while Wall Street remains obsessed with the largest companies, the smallest slice of the market-cap pie has quietly pulled ahead of the pack in recent weeks.

Macro Briefing: 9 October 2025

Federal Reserve officials are leaning toward additional interest-rate cuts this year, according to Fed minutes for latest policy meeting. The reasoning: weakness in the labor market. “In considering the outlook for monetary policy, almost all participants noted that, with the reduction in the target range for the federal funds rate at this meeting, the Committee was well positioned to respond in a timely way to potential economic developments,” the minutes stated. Meanwhile, the policy-sensitive US 2-year Treasury yield continues to trade near its low for the year to date.

Red Ink In A Green Year: 2025’s ETF Underdogs

The year to date has been notable for a broad rally that’s lifted all the major asset classes, but it’s not hard to find a wide array of losers when you look below the surface. As a result, contrarians and deep-value investors can easily find opportunities in the search for battered assets, based on a select review of ETFs through Tuesday’s closing prices (Oct. 7).

Macro Briefing: 8 October 2025

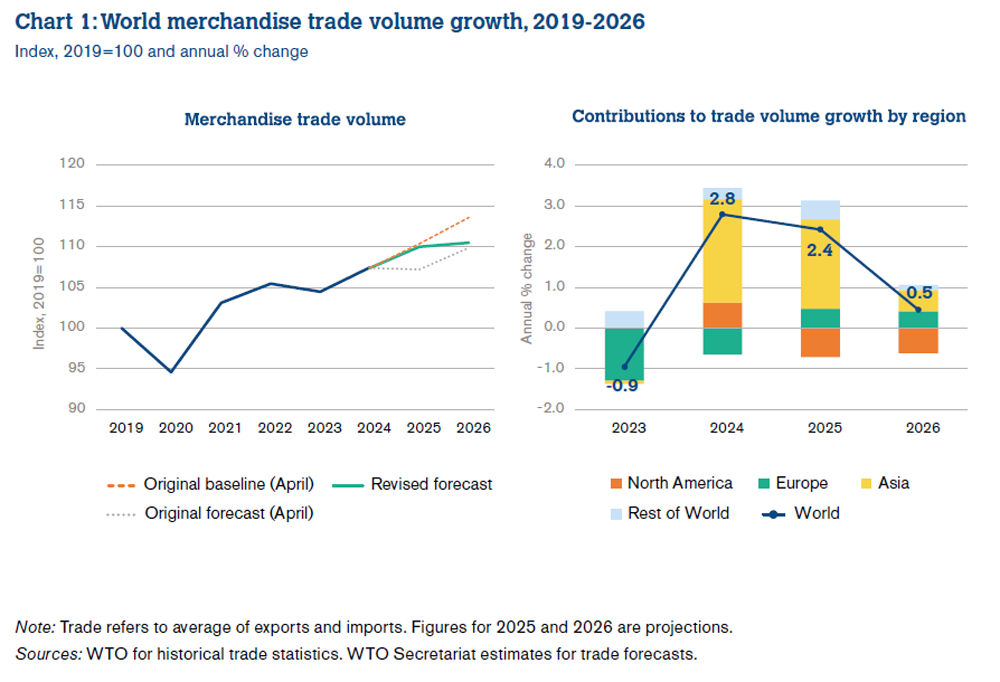

Global trade expected to rise more than previously expected in 2025, but next year’s volume is projected to slow to a lackluster 0.8% increase, according to the World Trade Organization. “Trade growth will likely slow in 2026 as the impact of the cooling global economy and new tariffs set in,” the group predicts.

Tech Stocks Still Lead Equity Sectors This Year

The dominance of the technology sector is old news for the stock market, but it’s no less potent at the start of the fourth quarter. A set of ETFs continues to highlight that the biggest tech firms are still leading the market, based on trading through Monday’s close (Oct. 6).

Macro Briefing: 7 October 2025

Gold rallies to yet another record high at a time of growing uncertainty on multiple fronts. “Strong ETF demand remains key, driven by ‘FOMO’ and eroding trust in traditional safe havens,” said Ole Hansen, head of commodity strategy at Saxo Bank, adding that central bank demand and lower bond yield are also factors.

Will Markets Continue To Ignore The Government Shutdown?

The US government shut down last week, and markets barely noticed. If the closing of federal agencies, which is delaying key economic reports, is a risk factor, it’s not obvious on Wall Street. All the major asset classes continued to rally through for the trading week through Friday, Oct. 3, based on a set of ETFs.

Macro Briefing: 6 October 2025

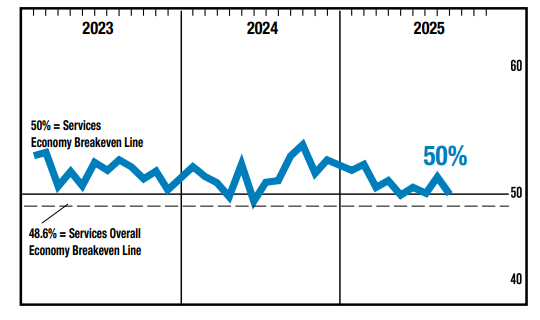

The US services sector stalled in September, downshifting to the weakest pace since 2020 via the survey-based ISM Services Index. The index dropped to a neutral 50 reading. The employment component of the ISM services gauge shows shows the number of workers in the sector contracting for fourth straight month.