US economic activity for the third quarter is expected to accelerate, according to the Atlanta Fed’s GDPNow model. Q3 output is expected to rise 4.2% in the July-through-September quarter, modestly above Q2’s strong 3.8% increase. The official report on Q3 should have been published by now, but has been delayed due to the government shutdown.

Monthly Archives: November 2025

Hints Of A Weak Jobs Market Ahead Of Thursday’s Payrolls Report

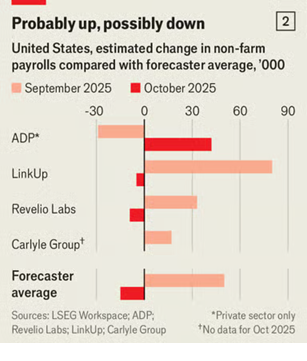

The government has reopened and the task of piecing together the missing economic data points has started. Early clues suggest that hiring slowed in October. Meanwhile, the Labor Department will release its delayed payrolls report for September tomorrow.

Macro Briefing: 19 November 2025

The generation of baby boomers holds more than $85 trillion in assets thanks to economic conditions Gen X, millennials and others would be hard-pressed to replicate. “It’s astonishing how their relative wealth has taken off in the last 30-plus years,” Edward Wolff, an economics professor at New York University, tells The Washington Post. “They started out as among the poorest groups in terms of wealth back in 1983.” In a working paper for the National Bureau of Economic Research, he reviewed the data for 1983-2022, a period when older boomers saw their wealth climb and their younger peers recorded relative declines.

Tech And Utilities Still Lead US Equity Sectors This Year

Stocks in the technology sector, closely followed by utilities, remain the hot hands for the US stock market in 2025, based on a set of ETFs through Monday’s close (Nov. 17).

Macro Briefing: 18 November 2025

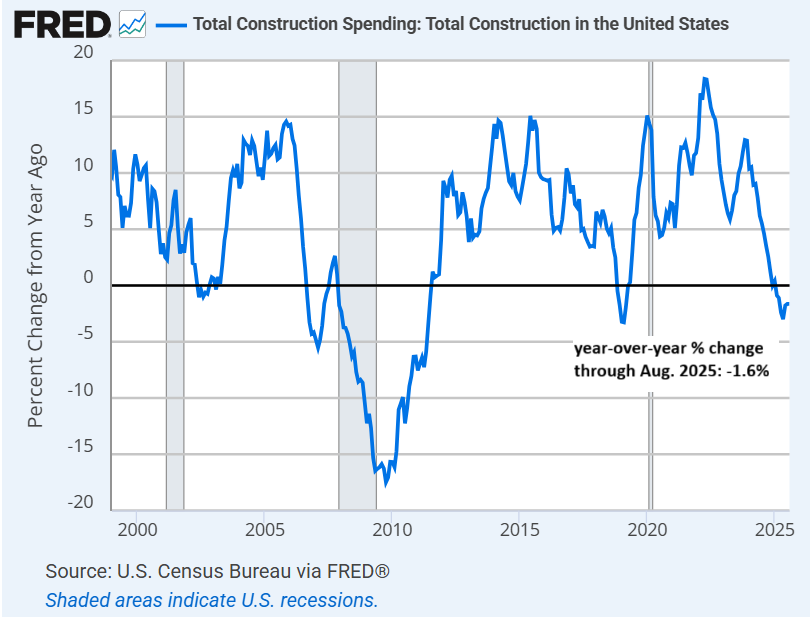

US construction spending continued to decrease in year-over-year terms, dropping 1.6% in August vs. the year-ago level. Spending on an annual basis has been contracting continuously since Feburary.

Is Wall Street Starting To Rethink Inflation Risk?

In early November, markets were moderately confident that a slowing labor market would persuade the Federal Reserve to cut interest rates for a third time at the Dec. 10 policy meeting. But confidence on that bet is unravelling amid concerns that inflation may not be as benign as recently expected.

Macro Briefing: 17 November 2025

The US Labor Department said it will release the delayed payrolls report for September this week, on Thursday (Nov. 20). “The absence of timely official numbers left the markets and the Fed operating in a data fog, forced to scour alternate sources to gauge the underlying outlook,” Bank of America economist Shruti Mishra said in a note. “With the shutdown resolved, all eyes will now be on the incoming data dump.” The Economsit reports: “ADP’s numbers point to a decline in September, followed by a rebound in October. Those of Revelio Labs, a competitor, point to a rise in September and a decline in October.”

The US Labor Department said it will release the delayed payrolls report for September this week, on Thursday (Nov. 20). “The absence of timely official numbers left the markets and the Fed operating in a data fog, forced to scour alternate sources to gauge the underlying outlook,” Bank of America economist Shruti Mishra said in a note. “With the shutdown resolved, all eyes will now be on the incoming data dump.” The Economsit reports: “ADP’s numbers point to a decline in September, followed by a rebound in October. Those of Revelio Labs, a competitor, point to a rise in September and a decline in October.”

Book Bits: 15 November 2025

● The History of Money: A Story of Humanity

● The History of Money: A Story of Humanity

David McWilliams

Review via New York Post

Looking at various moments in history, McWilliams reveals an unsettling through-line: humans keep making the same mistakes with money because money’s fundamental nature hasn’t changed. It’s still about trust, still about pricing time and risk, still capable of building empires or destroying them. Lenin and Hitler understood what Tiberius knew two millennia earlier.

“Money can be more powerful than religion, ideology, or armies,” McWilliams writes. “Mess with money and you mess with far more than the price system, inflation, and economics — you mess with people’s heads.”

Research Review | 14 November 2025 | Bubble Risk

Bubble Beliefs

Christian Stolborg (Copenhagen Bus. School) and Robin Greenwood (Harvard)

October 2025

We study expert beliefs during boom-bust episodes in which highly valued individual US stocks experience a price run-up followed by a crash. As prices surge, analysts forecast exceptional earnings growth and high near-term returns. Short interest stays low. Media coverage rarely mentions the word “bubble”, even as crashes unfold. Optimism portends crashes: the most bullish forecasts predict the highest crash risk. The results are consistent with accounts of bubbles driven by overly optimistic expectations about fundamentals and future prices, with only limited presence of skeptics who recognize the bubble, apart from a few cases where the share lending market offers signals.

Macro Briefing: 14 November 2025

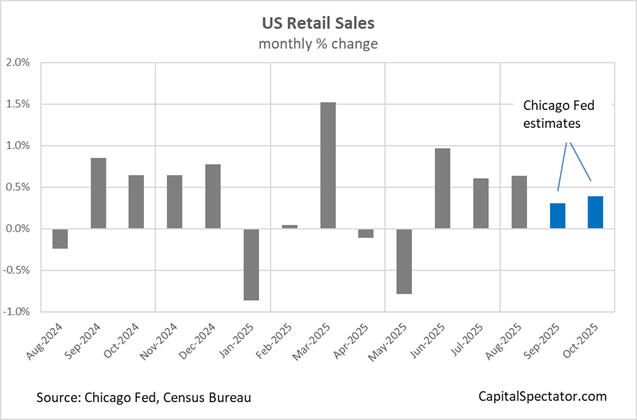

US retail spending rose for a fifth straight month in October, according to data published by the Chicago Federal Reserve. The estimate tracks retail and food services sales excluding motor vehicles & parts and indicates a 0.4% rise last month, up slightly from a 0.3% gain in September, according to the regional Fed bank. The last two monthly advances also mark softer gains vs. the official retail sales data from the Census Bureau, which published numbers through August before the government shutdown paused updates.