The resumption of US economic reports continues this week with two key updates for November: payrolls report and consumer inflation. Analysts will be closely watching how markets react.

Monthly Archives: December 2025

Macro Briefing: 16 December 2025

US homebuilder sentiment edged up in December, but continues to reflect negative sentiment about the market outlook. Builder confidence for newly built single-family homes is 39 this month, well below the neutral 50 mark. “The recent easing of monetary policy should help builder loan conditions at the start of 2026,” said NAHB Chief Economist Robert Dietz. “However, builders continue to face supply-side headwinds, as regulatory costs and material prices remain stubbornly high. Rising inventory also has increased competition for newly built homes.”

US Economic Updates This Week Will Help Clear The Data Fog

Lingering effects from the government shutdown continue to blur economic analysis, but two reports scheduled this week will provide markets with some much-needed clarity on how the fourth-quarter is unfolding.

Macro Briefing: 15 December 2025

US 30-year Treasury yield starts the trading week at its highest level in more than three months. The long-bond rate, the most inflation-sensitive maturity, closed up on Friday at 4.84%, the highest since early September.

Best Of Book Bits 2025: Part I

Another year (nearly) over and so it’s time again to look back on the Book Bits columns of 2025 and highlight the volumes that caught your editor’s eye for one reason or another. As usual in this year-end review, we’ll feature ten books that appeared on these pages during the course of the year. We’ll start with five today, followed by the balance in a week. Happy reading!

● How Countries Go Broke: The Big Cycle

● How Countries Go Broke: The Big Cycle

Ray Dalio

Review via Inc.

Billionaire investor Ray Dalio, who founded Bridgewater Associates, the largest hedge fund in the world, is warning that the debt situation in the United States is approaching a “death spiral” that could eventually threaten the entire U.S. economy.

In his new book, How Countries Go Broke: The Big Cycle, Dalio joins a growing chorus of financial experts and billionaires who have been sounding the alarm about government debt levels. The book comes as a report from the Congressional Budget Office released Wednesday found that Donald Trump’s budget bill would add $2.4 trillion to national debt, which currently stands at $36.9 trillion. The problem, Dalio said, is “urgent.”

Silver Surges, Far Outpacing Gold’s Rally This Year

The casual reader of financial news is probably aware that gold’s glitter is shining brightly this year on the heels of a 60%-plus year-to-date rally. But the sparkle looks dull next to silver’s rise.

Fed’s “Hawkish” Rate Cut Raises New Questions For Policy Outlook

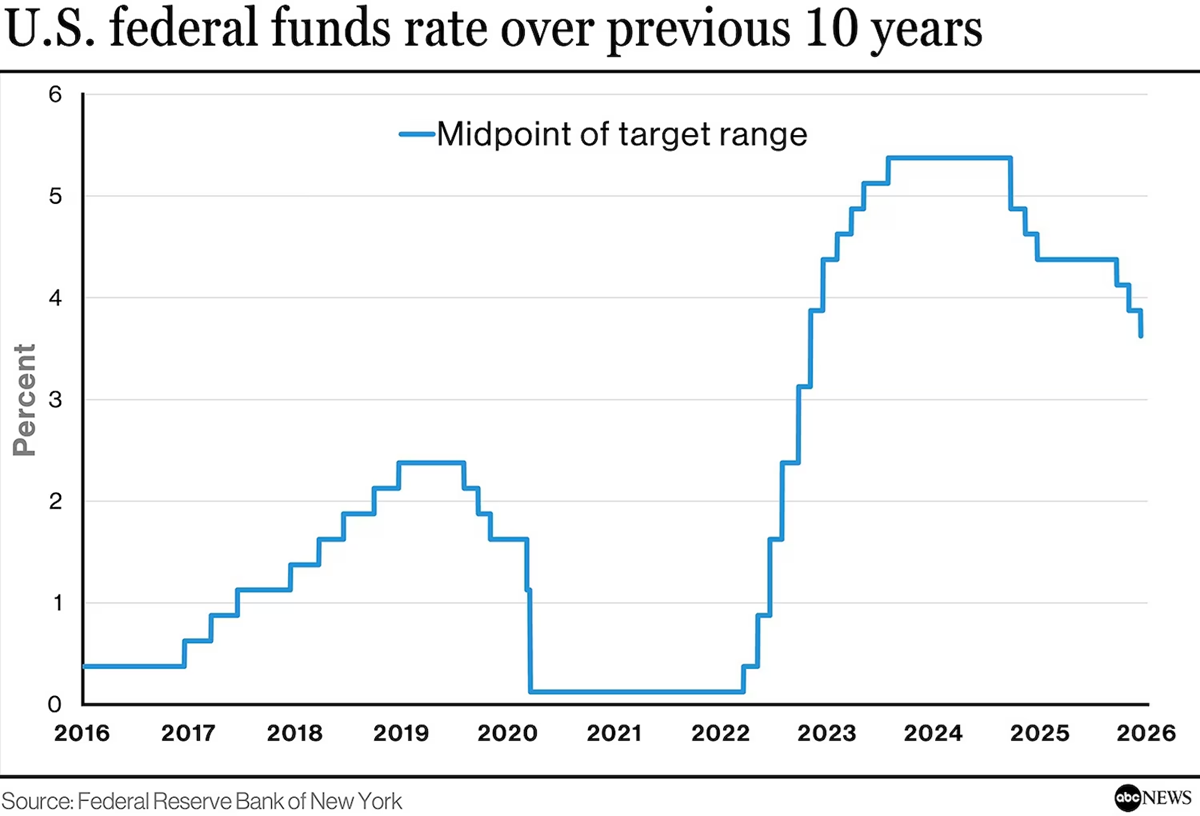

The Federal Reserve cut interest rates by a ¼-point yesterday, as expected. The stock market rallied and Treasury yields fell. But the cut is considered “hawkish” because the central bank remained vague about the prospects for more policy easing in the near term.

Macro Briefing: 11 December 2025

The Federal Reserve cut its target rate by 1/4 point to a 3.50%-to-3.75% range, marking the third reduction this year. Fed Chair Jerome Powell suggested the central bank would remain cautious on whether to cut further. “We’re well positioned to wait and see how the economy evolves,” he said.

US Economy Looks Set For Substantially Slower Growth In Q4

The official government third-quarter GDP report remains a mystery as the Bureau of Economic Analysis (BEA) struggles to recover its data collection and analysis efforts following the government shutdown. The best guess at this point is that output rose at a solid pace in Q3, based on several sources. Q4, by contrast, looks set for a substantially softer increase, according to various private estimates.

Macro Briefing: 10 December 2025

US job openings rose slightly in October, enough to to mark a 5-month high, the Labor Dept. reports. “The job market isn’t collapsing but it is certainly losing steam,” said Oren Klachkin, financial markets economist at Nationwide. “We anticipate Fed officials will try to get ahead of labor market weakness with another 25 basis points rate cut tomorrow even as inflation remains above the 2% goal.”