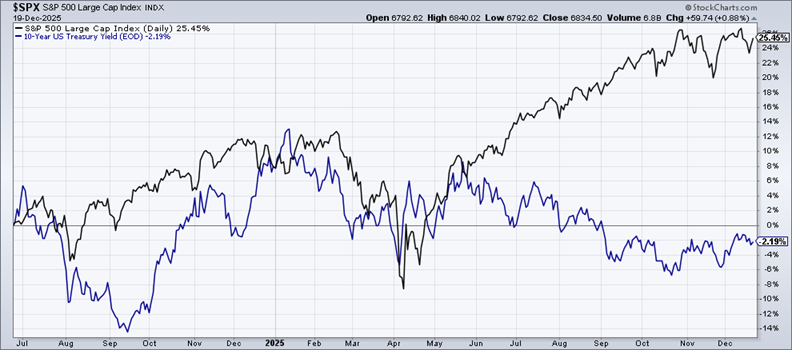

Identifying the reasons why the stock market rises or falls is challenging, if not impossible, but the slide in interest rates has surely bees a non-trivial factor in lifting equities this year. A key question for 2026: Will the tailwind continue?

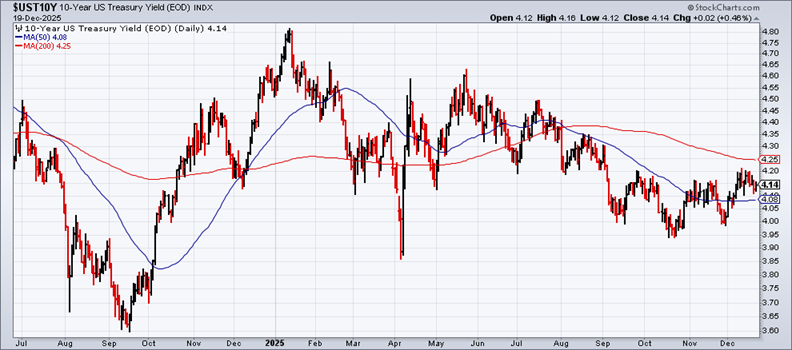

Consider the 10-year Treasury yield, perhaps the world’s most important rate, given its influence over a wide range of lending activity. Although it’s the 10-year yield has had a volatile ride at times in 2025, looking back over the year reminds that the general trend has been down.

Despite various threats, from tariff-related inflation to concerns related to the rise of the US government’s budget deficit, the 10-year yield looks set to end 2025 well below where it started the year: 4.14% on Friday, Dec. 19, down from a peak of roughly 4.80% at one point in January. Expectations for a softer economy are helping drive the trend.

Dovish Fed policy has also helped. Although the central has limited, at times nil, influence over the long end of the yield curve, three interest rate cuts this year have provided support for keeping the bond market happy, or at least reluctant to revolt.

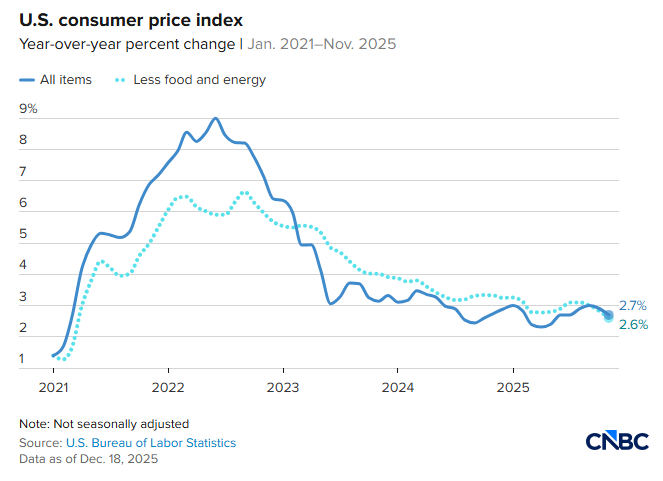

Another bullish factor for bonds is the lack of a clear effect on inflation following the rise in tariffs. Although many economists expected a sharp increase in pricing pressure, official statistics have yet to show a clear connection. The delayed release of the November consumer price data last week highlights the lack of follow-through for inflation following higher tariffs. The government reports that inflation has been relatively steady in the 2.5%-3.0% range in 2025. Although that’s still above the Fed’s 2% target, the official numbers indicate that inflation has remained comparatively steady this year.

Skeptics argue that the November CPI data looks a bit too good to be true. “It’s hard to read too much into the November inflation data. The shutdown clearly had a big impact on data collection,” Heather Long, chief economist at Navy Federal Credit Union, advised in a note to clients.

Reliable or not, the bond market appears to accept the view that inflation is holding in a 2.5%-3.0% range. Even the 30-year Treasury yield – the most inflation-sensitive maturity on the curve – has been relatively calm lately. Although it’s up about 30 basis points over the past two months, it continues to trade in a middling range this year, closing on Friday at 4.82%.

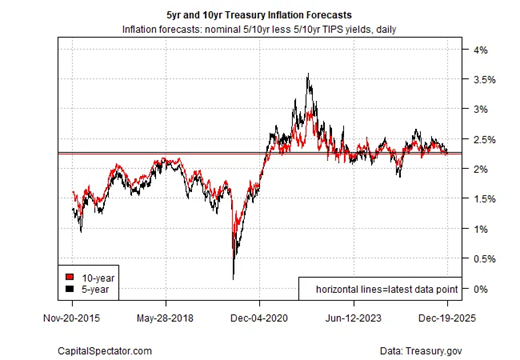

The Treasury market’s implied inflation forecasts are also steady, trading modestly above the Fed’s 2% target. According to this corner of the bond market, investors appear unconcerned about inflation risk in the near term.

Consumer inflation expectations are still running well above the Fed’s target, but show signs of easing lately, according to polling this month by the University of Michigan.

The New York Fed’s survey of consumer expectations highlight similar results: “Median inflation expectations remained unchanged at the one-year-ahead horizon at 3.2%.”

Market expectations for more Fed rate cuts in the new year are unsettled at the moment. Fed funds futures are pricing in high odds for leave rates unchanged at the January FOMC meeting, but the prospects for a March cut look more promising.

Keeping the bond market happy, or at least calm, will be crucial for the stock market in 2026. “A tame CPI will reinforce the Fed is focused on protecting the employment market. And that means a Fed ‘put’ is now in place for the economy,” Tom Lee, head of research at Fundstrat, said in a note last week. “In other words, if the Fed is concerned about downside risks to the economy, the Fed ‘put’ comes into play and this would be for stocks to rise.”

The rise of the stock market since President Trump announced higher tariffs in April has been closely correlated with a slide in the 10-year yield.

Although no one can see into the future, it’s reasonable to assume that the direction of Treasury yields in 2026 will cast a long shadow over stocks.

For the moment, markets seem comfortable with assuming that yields will hold in a range. The key task in the new year is watching the incoming data and deciding if it’s time to change the calculus on bonds. Hanging in the balance is the outlook for stocks. Yields don’t have to continue falling to keep equities bubbling, but my guesstimate is that the mood in the bond market will be a crucial factor for how equities fare in 2026.