Pompeo hints at broader US restrictions for Chinese tech: CNBC

US: Iran briefly seized oil tanker near the strategic Strait of Hormuz: AP

Next big Covid-19 hurdle: producing hundreds of millions of vaccines: Politico

US favors new tariffs on certain goods made in France and Germany: BBG

China fears deepening financial war as tensions rise with US: Reuters

US economic recovery headwind: state budget cuts due to coronavirus: WSJ

Buffett Indicator — stock-market-cap-to-GDP ratio — is flashing warning: MW

Are new US reporting rules for Covid-19 creating risks for accuracy? NYT

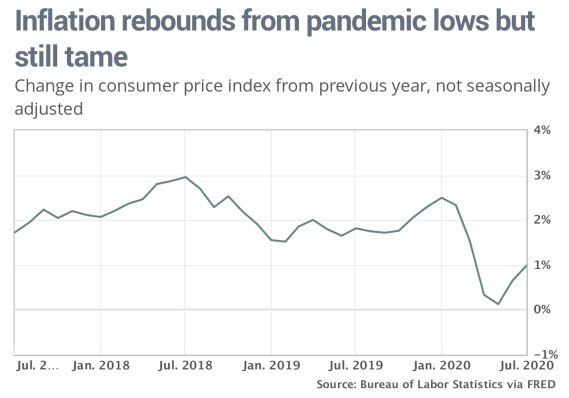

US consumer inflation continues to rebound but 1-year trend remains mild: MW

Author Archives: James Picerno

Will The US Economic Rebound Falter In 2020’s Second Half?

A number of encouraging economic indicators suggest that the US is recovering from the coronavirus recession that crushed output in the second quarter. But deciding if a bounce off a very deep bottom is laying the foundation for a robust, sustained recovery remains unclear. There are still too many unknowns lurking to develop a high-confidence forecast for the second half of 2020.

Macro Briefing | 12 August 2020

Kamala Harris beats rivals to become Biden’s running mate: Politico

Is Russia’s rush to roll out a coronavirus vaccine at risk of backfiring? CNBC

China accelerates effort to be more reliant on domestic economy: WSJ

UK economic activity crashed in Q2 with a record 20.4% decline in GDP: CNBC

Eurozone industrial output rose for a second month in June: MW

Small Business Optimism Index edged down in July after strong gain in June: NFIB

US wholsale inflation rose sharply in July but 1yr trend still negative: MW

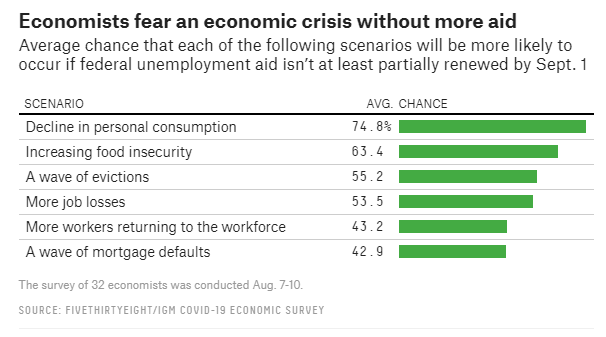

Economists warn that economic-crisis risk will rise without more jobless relief: FTE

China Continues To Lead World Equity Markets In 2020

Reviewing the global equity market as a single portfolio reveals a sleepy affair for year-to-date results through yesterday’s close (Aug. 10). But slicing and dicing shares into the major equity regions reveals a more dramatic story, including a strong lead for China’s stock market, based on a set of exchange traded funds.

Continue reading

Macro Briefing | 11 August 2020

Putin says Russia is the first country to approve a Covid-19 vaccine: Reuters

Trump may block some US citizens returning to America due to Covid-19: Reuters

Trump says he’s considering a capital gains tax cut: BBG

Employers are skeptical of Trump’s plan for deferring payroll taxes: WSJ

New US sanctions on Hong Kong complicate banking industry links to China: CNBC

Big Tech meets the Biden campaign: NYT

German investor sentiment rebounded more than expected in August: Reuters

UK employment fell the most in over a decade in Q2: BBC

US job openings rose more than expected in June: BBG

Stocks In Foreign Developed Markets Led Gainers Last Week

Shares in foreign developed-market nations topped returns last week for the major asset classes. After retreating for two weeks, this corner of global equity markets rebounded and led a wide-ranging rally in risk assets for the trading week through Aug. 7, based on a set of exchange-traded funds.

Continue reading

Macro Briefing | 10 August 2020

Trump signs executive order extending some pandemic relief: CNBC

US virus relief package at standstill after failed negotiations in Congress: BBG

US’ top health official praises Taiwan’s democracy, raising US-China tension: NYT

China briefly sends fighter jets into Taiwan airspace: Reuters

Financial crisis spawned by pandemic is especially bad for millennials: WSJ

Global extreme poverty expected to rise by 100 million, World Bank predicts: AP

US payrolls rose 1.763 million in July, beating Wall Street expectations: CNBC

Consumer borrowing picked up in June, first monthly gain during pandemic: MW

30%-to-40% of US renters may be at risk of eviction: NLIHC.org

Three Risk-Managed Portfolio Strategies

Here’s a quick review of three proprietary strategies that will feature regularly in The ETF Portfolio Strategist:

https://etfps.substack.com/p/three-proprietary-strategies

Book Bits | 8 August 2020

● Boom and Bust: A Global History of Financial Bubbles

William Quinn and John D. Turner

Summary via publisher (Cambridge U. Press)

Why do stock and housing markets sometimes experience amazing booms followed by massive busts and why is this happening more and more frequently? In order to answer these questions, William Quinn and John D. Turner take us on a riveting ride through the history of financial bubbles, visiting, among other places, Paris and London in 1720, Latin America in the 1820s, Melbourne in the 1880s, New York in the 1920s, Tokyo in the 1980s, Silicon Valley in the 1990s and Shanghai in the 2000s. As they do so, they help us understand why bubbles happen, and why some have catastrophic economic, social and political consequences whilst others have actually benefited society. They reveal that bubbles start when investors and speculators react to new technology or political initiatives, showing that our ability to predict future bubbles will ultimately come down to being able to predict these sparks.

Relaunched: The ETF Portfolio Strategist

Last November, The ETF Portfolio Strategist (ETF-PS) debuted in beta form. The original plan was to formally roll it out in Q1:2020. But thanks to a certain health crisis that reordered life as we know it, priorities shifted and, well, here we are in August. No matter — the case for market intelligence and analytics on ETF-based portfolio strategies is an evergreen topic and so we’re back – delayed but no less committed to crunching the numbers and analyzing the crucial trends for making informed decisions on portfolio design and management via ETFs.

The design has changed a bit from the initial concept. The main difference is that ETF-PS components will be published individually on a semi-regular schedule rather than in one complete issue on a given day. The other big change: the newsletter will appear here: etfps.substack.com To receive updates of future editions, subscribe today!