Senate panel vote on Kavanaugh’s Supreme Court nomination set for Fri: Politico

Arizona prosecutor to question Kavanaugh and accuser in Senate hearing: The Hill

Trump outlines ‘maximum pressure’ policy in UN speech: The Hill

China cancels scheduled US warship visit to Hong Kong: CNN

Fed on track to raise rates today and may end ‘accommodative’ policy: Reuters

S&P Corelogic Case-Shiller: growth rate of US home prices eased in July: CNBC

Richmond Fed Mfg Index rises to record high in Sepetmber: MarketWatch

Consumer Confidence Index surges in September, near record high: MarketWatch

Author Archives: James Picerno

This Year’s Rally In US Small-Cap Stocks Begins To Stumble

Small-capitalization equities in the US have been on a tear this year, but investors are wondering if the headwinds in recent weeks are a sign that the strong upside momentum has run its course.

Continue reading

Macro Briefing: 25 September 2018

Supreme Court nominee denies sexual misconduct charges on TV: Fox

Questions swirl about future of Deputy Attorney General Rosenstein: CNN

Trump’s lawyer calls for ‘a time out’ in Mueller probe if Rosenstein leaves: ABC

Russia plans to install advanced missiles in Syria: Axios

European Union rolls out plan to sidestep US sanctions on Iran: BBC

JP Morgan strategist: Trump risks ‘major miscalculation’ over US-China trade: MW

Dallas Fed Mfg Index: slower but still healthy growth in Sep: Dallas Fed

Chicago Fed Nat’l Activity Index (3mo avg) jumps to 4-mo high in Aug: Chicago Fed

Commodities And Foreign Stocks Led Global Markets Last Week

Broadly defined commodities surged over the five trading days through Friday, September 21, posting last week’s strongest gain for the major asset classes, based on a set of exchange-traded products. Foreign stocks in developed and emerging markets accompanied the commodities rally, delivering the second- and third-highest gains, respectively.

Continue reading

Macro Briefing: 24 September 2018

Kavanaugh confirmation suffers a new setback after 2nd assualt claim: Politico

US and China impose new round of trade tariffs today: CNBC

UK’s May under growing pressure to abandon Chequers Brexit plan: Guardian

Iran warns US and Israel of revenge after attack on military parade: Reuters

OPEC and allies struggle to replace Iran’s falling oil supply: Reuters

Brent oil at 4-year high after OPEC punts on raising output: Bloomberg

Does US-China trade war put US tech and telecom leadership at risk? NY Times

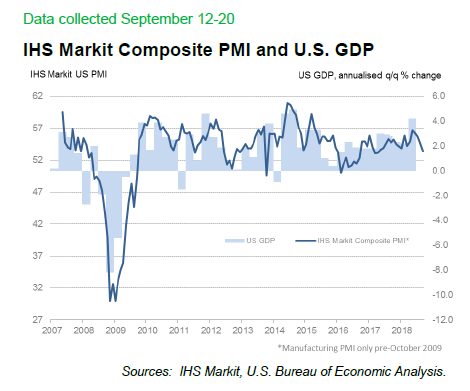

US Composite Output Index: growth slips to 17-mo low is September: IHS Markit

Book Bits | 22 September 2018

● Fighting Financial Crises: Learning from the Past

By Gary B. Gorton and Ellis W. Tallman

Summary via publisher (University of Chicago Press)

If you’ve got some money in the bank, chances are you’ve never seriously worried about not being able to withdraw it. But there was a time in the United States, an era that ended just over a hundred years ago, in which bank customers had to pay close attention to whether the banking system would remain solvent, knowing they might have to rush to retrieve their savings before the bank collapsed. During the National Banking Era (1863–1913), before the establishment of the Federal Reserve, widespread banking panics were indeed rather common. Yet these pre-Fed banking panics, as Gary B. Gorton and Ellis W. Tallman show, bear striking similarities to our recent financial crisis. In both cases, something happened to make depositors—whether individual customers or corporate investors—“act differently” and find reason to question the value of their bank debt.

Continue reading

Research Review | 21 September 2018 | Volatility

Hedging With Volatility

Mario Alagoa (Sacred Heart University)

May 9, 2018

A risk-averse investor with a long equity position is presumably interested in identifying a hedging strategy that protects the value of that investment. The common approach encompasses using either financial derivatives or holding assets (such as gold or Swiss francs) as portfolio hedges as they show negative correlation with equities. This paper proposes using volatility indexes as portfolio hedges instead; it shows that a volatility-based dynamic hedging strategy is the most effective at protecting the value of an equity investment.

Continue reading

Macro Briefing: 21 September 2018

US imposes sanctions on China for buying Russian military equipment: Reuters

European Council president: UK’s Brexit plan “will not work”: BBC

Fed Chairman Powell talks to Congress re: the central bank’s independence: CNBC

Existing home sales in US unchanged in August: Reuters

Leading indicators for US signaling continued economic expansion: CB

US stock market indexes — Dow & S&P 500 — close at record highs: LA Times

US jobless claims slip to 49-year low, partly due to Hurricane Florence: MW

Philly Fed Mfg Index rebounds in September following sharp fall in August: MW

US 10yr/German 10-year yield spread at record high: 2.60 percentage points:

US Business Cycle Risk Report | 20 September 2018

US economic growth remains strong, based on data published to date, but today’s business-cycle profile continues to suggest that we’ve seen the peak. Recession risk remains low and near-term projections point to more of the same. The question is whether there’s trouble brewing for 2019?

Continue reading

Macro Briefing: 20 September 2018

US prepared to resume denuclearization talks with North Korea: Reuters

Polls continue to give Dems edge for taking back House in Nov: RCP

China set to cut average trade tariffs for most of its partners: Bloomberg

Will China retaliate in trade war by selling its massive Treasury holdings? NY Post

The paradoxical US economy: low wages and low unemployment: The Atlantic

JP Morgan’s Dimon: cyber warfare is biggest risk to the financial system: CNBC

2-year Treasury yield returns to 2008 highs: CNBC

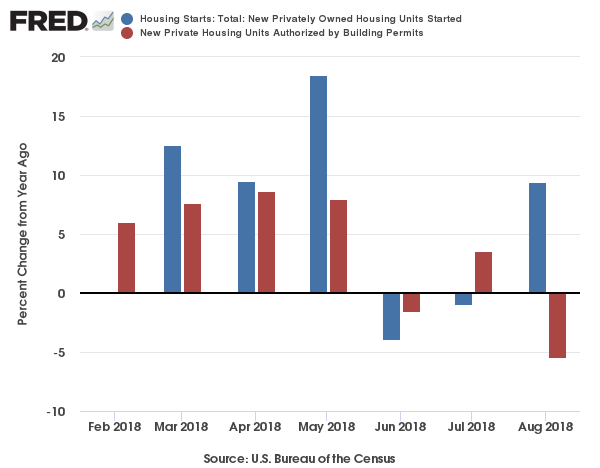

US housing starts: 1yr change rebounded in Aug as trend for building permits fell: