No change is expected in US industrial production in tomorrow’s August report vs. the previous month, according to The Capital Spectator’s average point forecast for several econometric estimates. The average prediction for a flat performance compares with a robust 0.6% increase in July.

Continue reading

Author Archives: James Picerno

US Retail Sales: August 2015 Preview

US retail sales are expected to increase 0.2% in tomorrow’s August report vs. the previous month, according to The Capital Spectator’s average point forecast for several econometric estimates. The average prediction reflects a deceleration in growth after the previous month’s 0.6% rise.

Continue reading

Negative Momentum Weighs On All The Major Asset Classes

Emerging-market stocks have been getting hammered this year, but last week offered some relief. The Vanguard FTSE Emerging Markets ETF (VWO) jumped 3.9% for the week through Sep 11, delivering the best weekly performance–based on price-only returns–for our standard set of proxies for monitoring the major asset classes. Is it time to jump back into this battered-and-bruised corner of global equities? Probably not.

Continue reading

Initial Guidance | 14 September 2015

QE4 Web Searches Pop To 3-Year High. Hmmm…

The Federal Reserve may raise interest rates when the dust clears from its policy meeting that concludes this Thursday (Sep. 17), although that’s looking like a shaky proposition in the wake of global market turmoil and mixed economic news for the US. Meantime, at the other end of the expectations spectrum, certain quarters of the perma-bear club are considering if conditions are again ripe for more monetary easing. The Fed’s multi-phase bond-buying program ended last October by winding down the third wave of quantitative easing (QE3). Reviving the effort with QE4 faces long odds, at least for this week, but the thought has crossed the minds of certain web travelers. For some visual perspective, let’s turn to Google Trends for some charting candy.

Continue reading

Book Bits | 12 September 2015

● Wealth, Poverty and Politics: An International Perspective

By Thomas Sowell

Review via The Washington Post

Sowell’s central message is that the reason some people are poor — in any country, at any period in history — is not discrimination or exploitation or malicious actions on the part of the rich. Rather, people are poor because they don’t or won’t produce. For him, the only mystery is why.

Geography may have something to do with it. Civilizations that shut themselves off from the rest of the world, Sowell writes, are those that lag behind.

Continue reading

A New Research Service For Monitoring Recession Risk

Starting today, The Capital Spectator is offering a subscriber-only research service for monitoring US business cycle risk—The Business Cycle Risk Report. Regular readers are already familiar with the monthly updates of this data—see the August review, for instance. The monthly reports will continue to appear on CapitalSpectator.com, but now there’s a higher level of service that will keep you informed in real time. For details, including subscription options and a sample issue that’s hot off the press today, click on the “Premium Research” tab above or follow this link.

Continue reading

The Trend Turns Negative For The Real Monetary Base

High-powered voices are calling on the Federal Reserve to delay raising interest rates beyond its policy meeting next week, but it’s not obvious that a stay of execution for squeezing liquidity is a done deal. One reason for thinking that the central bank is still considering the case for pushing rates higher this month: inflation-adjusted money supply continued to contract in year-over-year terms for the third month in a row through August. The slide marks the first run of red ink for base money (M0) in real terms in three years. Meanwhile, the effective Fed funds rate continues to inch higher. These aren’t definitive signs that a rate hike is fate, but on the margins the data supports a hawkish outcome next week.

Continue reading

Initial Guidance | 11 September 2015

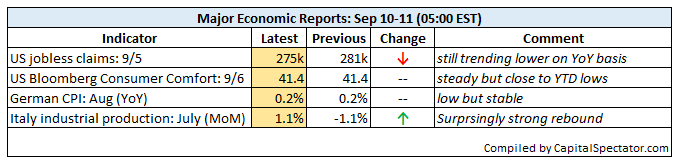

US Jobless Claims Continued Falling In Early September

The number of new filings for unemployment benefits in the US fell last week, delivering another encouraging round of numbers for the economy, according to this morning’s release from the US Labor Dept. The news follows upbeat data for the labor market overall in August. Considering all the numbers to date reaffirms the view that business cycle risk remains low.

Continue reading