* IMF: world economy has lost momentum due to higher interest rates, but…

* IMF raises US growth forecast for 2023

* Israel shuts down Tamar offshore natural gas field after Hamas attack

* China reportedly considering new stimulus to boost slowing economy

* China’s Country Garden property developer says it may not repay debts

* Fed officials say rise in bond yields may allow Fed to forego more rate hikes:

Category Archives: Uncategorized

Will US Stock Market’s Outsized Leadership Persist In Q4?

American shares have been the upside outlier for performance leadership for much of the year for the major asset classes, based on set of proxy ETFs through Friday’s close (Oct. 6). But applying a hefty dose of optimism to US equities may become increasingly challenged as various risk factors resonate in the fourth quarter.

Macro Briefing: 9 October 2023

* US sends aircraft carrier group to eastern Mediterranean after attack on Israel

* Oil prices rise after Hamas attack on Israel

* OPEC raises long-term oil demand outlook

* Weighing the odds that Treasury yields will keep rising

* Private-credit firms are rapidly rising source of lending for corporate America

* Bank stocks under pressure from rising rates

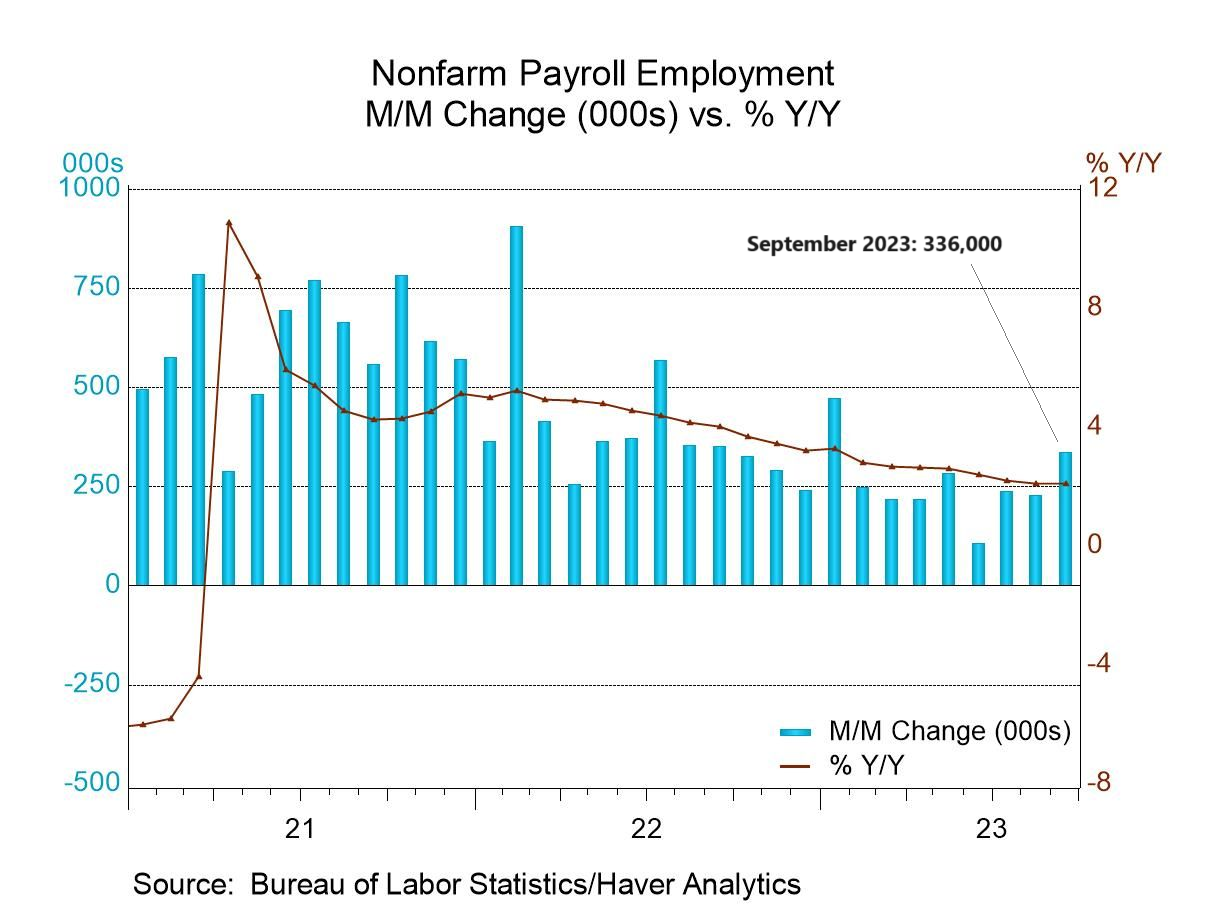

* Strong rise in September US payrolls will nudge Fed toward another rate hike:

Book Bits: 7 October 2023

● Economics in America: An Immigrant Economist Explores the Land of Inequality

Angus Deaton

Review via NPR

Deaton (and Case) argue that the alarming rise in deaths of despair amongst non-college-educated Americans — which accounts for almost two-thirds of the adult population — is intimately related to their fading economic prospects. Deaton writes that “the decline of good jobs” is a crucial driver of despair. “This decline, in response to globalization and, more importantly, technical change (robots), is made much worse in the United States than elsewhere by the grotesquely exorbitant cost of healthcare,” Deaton writes. “Beyond that, when bad things happen and people need help, the safety net in the United States is fragmentary compared with those in other rich countries.”

Several Corners Of Bond Market Manage To Shine This Year

The ongoing bear market in Treasury bonds is among the worst on record, but several sectors of the fixed-income market remain ports in a storm, based on year-to-date results through Thursday (Oct. 5) for a set of fixed-income ETFs.

Macro Briefing: 6 October 2023

* The slide in Treasury bond prices since 2020 is among the worst on record

* China’s economy faces years of headwinds due to real estate crisis

* More than 40% of small firms report difficulty in finding workers

* Oil prices set for biggest weekly decline in 6 months

* Average US mortgage rate rises to 23-year high: 7.49%

* Exxon Mobil near deal in acquiring shale driller Pioneer

* Narrowing US trade gap in August expected to support Q3 GDP growth

* US jobless claims remain low, suggesting labor market strength in near term:

Is Hard-Landing Risk Rising (Again) For The US Economy?

Just when you thought it was safe to assume that the soft-landing fix was in, the bond market has thrown a wrench into the machine. So it goes with the constantly shape-shifting risk profile for the US business cycle. Most of the time the changes are relatively trivial. Is this time different?

Macro Briefing: 5 October 2023

* Hard landing risk for US economy rising as Treasury yields increase

* Rise in interest rates creates bigger challenge for managing deficits

* A stock market crash may be the only savior for a falling bond market: Barclays

* Earth on track for hottest year on record, predicts European climate agency

* ISM Mfg Index edged lower in September but still reflects moderate growth

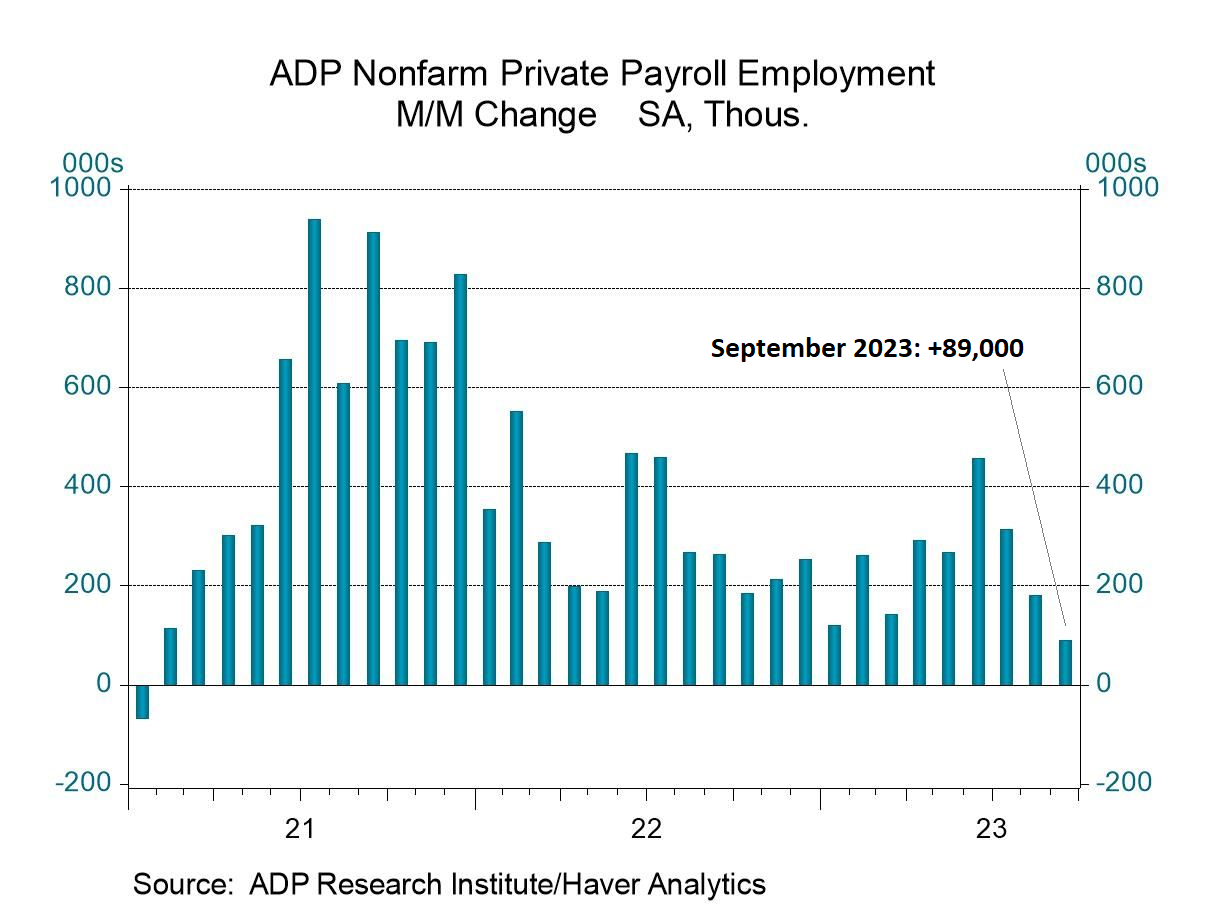

* US private employment growth slowed sharply in September via ADP data:

US Median Q3 GDP Nowcast Holds Above 3%

Rising interest rates may threaten the “soft landing” outlook for the US economy, but the upcoming preliminary estimate of third-quarter GDP from the government still looks set to report that output picked up from Q2.

Macro Briefing: 4 October 2023

* Republicans remove House speaker, leaving chamber in chaos

* Rising Treasury yields threaten ‘soft landing’ scenario for US economy

* Two Fed officials say interest rates will likely stay high

* US auto sales rose in Q3 despite strikes and higher interest rates

* ‘Stalling and divergent’ global economy expected, UN trade division predicts

* Saudi Arabia says its oil production cuts will last through end of year

* US job openings post unexpected gain in August: