Economic output is estimated to downshift sharply in next month’s official GDP report for the first quarter, based on the median nowcast from several sources compiled by CapitalSpectator.com. Recessionary conditions will likely be avoided, at least for now, but Q1 data appears set to highlight an increased vulnerability in Q2 and beyond.

Category Archives: Uncategorized

Macro Briefing: 28 March 2025

US jobless claims edged lower last week, holding at a middling level relative to recent history. Initial claims for unemployment insurance eased to 224,000, seasonally adjusted, which reflects a low number compared with the historical record and suggests ongoing growth, or at least stability, for the labor market.

Bonds Continue To Offer A Haven Amid High Macro Uncertainty

President Trump’s latest announcement on tariffs is a reminder that macro uncertainty is high and will probably remain so for the near term. “What we’re going to be doing is a 25% tariff on all cars not made in the US,” he said on Wednesday. It wasn’t exactly a surprise, given the President’s preference for tariffs, but it’s another wake-up call that the White House intends to pursue its policies, which suggests a rough ride for making assumptions based on the standard playbook for the economy and financial markets.

Macro Briefing: 27 March 2025

Trump announces 25% tariffs on imported autos, which are expected to raise prices on cars in the US. “We’re looking at much higher vehicle prices,” said economist Mary Lovely, senior fellow at the Peterson Institute for International Economics. Roughly 45% of US-sold vehicles are imported, with the largest percentage coming from Mexico and Canada. The automakers that are most vulnerable are Volvo, Mazada and Volkswagon, which have the lowest share of their US-sold vehicles manufactured in this country, according to Wards Automotive and Barclays research.

Low-Volatility Strategy Continues To Lead Equity Factors In 2025

The US stock market is struggling this year, but the low-volatility equity risk premium is still outperforming by a wide margin year to date, based on a set of ETFs through Tuesday’s close (Mar. 25). The solid increase for the risk premium so far in 2025 is especially stark compared with the modest loss for stocks overall.

Macro Briefing: 26 March 2025

US Consumer Confidence Index fell in March for a fourth straight month. The latest decline marks a drop below “the relatively narrow range that had prevailed since 2022,” said Stephanie Guichard, a senior economist at The Conference Board. “Of the Index’s five components, only consumers’ assessment of present labor market conditions improved, albeit slightly. Views of current business conditions weakened to close to neutral. Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low.”

US Economy Is Slowing, But Recession Risk Remains Low

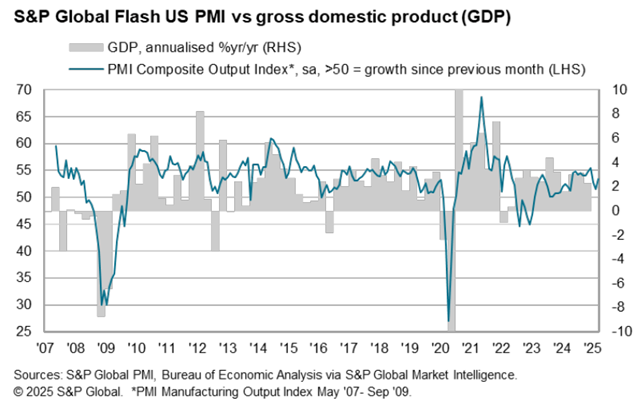

New data published on Monday reaffirm that US economic is still growing and the odds remain low that a recession has started or is imminent. The rapidly changing state of tariffs could change the outlook, but for the moment economic activity looks relatively resilient.

Macro Briefing: 25 March 2025

US business activity growth strengthened in March, rising to a 3-month high, according to US PMI Composite Output Index, a survey-based GDP proxy. A pickup up in growth for the services industry drove the improvement as activity in the manufacturing sector weakened. “A welcome upturn in service sector activity in March has helped propel stronger economic growth at the end of the first quarter,” says the chief business economist at S&P Global Market Intelligence. “However, the survey data are indicative of the economy growing at an annualized 1.9% rate in March and just 1.5% over the quarter as a whole, pointing to a slowing of GDP growth compared to the end of 2024.”

Energy And Healthcare Stocks Are Big Winners This Year

It’s been a rough year for the US stock market so far, but you wouldn’t know it by looking at year-to-date returns for energy and healthcare shares, based on a set of ETFs through Friday’s close (Mar. 21). Both equity sectors are posting strong gains in 2025, marking them as standout winners when the market overall is nursing a moderate loss.

Macro Briefing: 24 March 2025

The US Treasury yield curve has inverted again, based on the 10-year less 3-month spread. The difference between maturities was a slightly negative -0.03. Historically, a negative spread implies that recession risk is elevated for the near term, although this widely followed indicator doesn’t have a perfect record. The only blemishes on its record are the 1998 and mid-2022 inversions, which produced no subsequent economic recessions. Most recently, the curve inverted in 2022 and 2023 without leading to a recession.