* Does a surprising rise in unemployment signal a recession?

* Economist says Fed waited too long to cut interest rates

* Growth in China’s services activity strengthened in July

* Eurozone economy “stalls” in July via PMI survey data

* US 10-year yield fell sharply last week, settling at 3.79%–lowest since December:

Category Archives: Uncategorized

Book Bits: 3 August 2024

● Demography and the Making of the Modern World: Public Policies and Demographic Forces

● Demography and the Making of the Modern World: Public Policies and Demographic Forces

John Rennie Short

Summary via publisher (Agenda Publishing via Columbia U. Press)

John Rennie Short critically explores the implications of demographic change from a social and economic perspective and considers what this means for public policy. He shows how events as varied and important as the Arab Spring, migration from Africa to Europe, budget negotiations in the United States, and economic growth in India and Brazil – all seemingly diverse issues from around the world – are shaped by forces of demography. Using the demographic transition model as a framework, the book examines the demographic forces that underlie major social and economic issues, and in particular, the range of public policies that have been developed, adopted and rejected to meet these population challenges.

Total Return Forecasts: Major Asset Classes | 02 August 2024

The total return outlook for the Global Market Index (GMI) ticked lower in July, marking the first downshift in several months for this forecast. GMI’s long-term estimate now points to an annualized 7.0% performance, down slightly from the previous month, based on the average of three models (defined below). GMI is an unmanaged benchmark that holds all the major asset classes (except cash) according to market weights via a set of ETF proxies.

Macro Briefing: 2 August 2024

* US jobless claims rise to one-high year

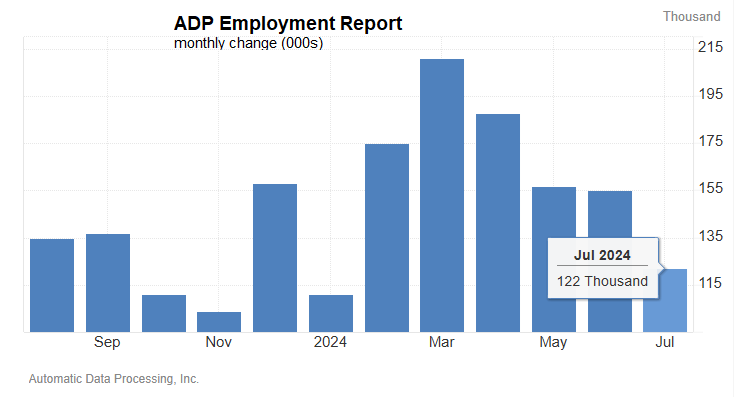

* Wage growth in US for Q2 eased to slowest pace in 3-1/2 years

* US light-vehicle sales rebounded modestly in July

* Construction spending in the US fell for second month in June

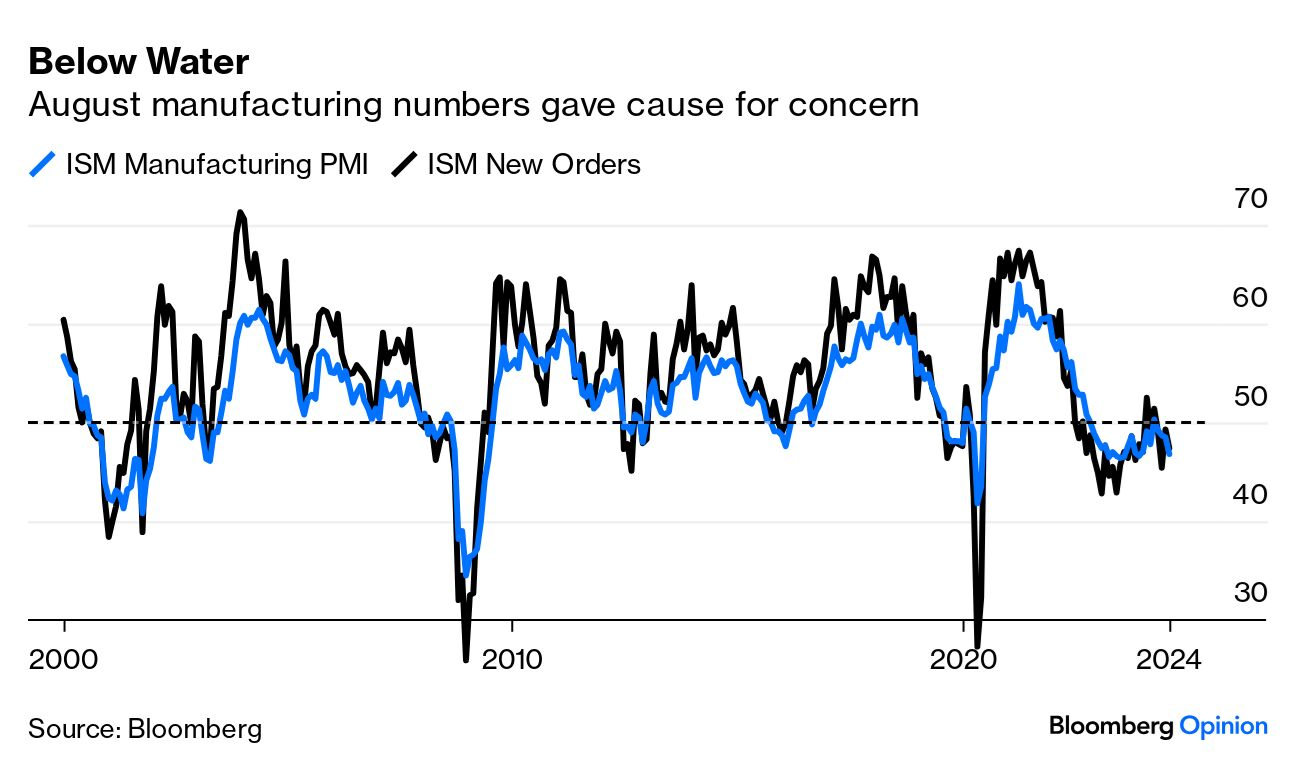

* ISM Mfg Index dips in July, signaling ongoing sector contraction:

Major Asset Classes | July 2024 | Performance Review

US real estate investment trusts led a widespread rally in July for the major asset classes. The only laggard: commodities, which fell last month. Otherwise, global markets rallied across the broad for the start to the third quarter, based on a set of ETF proxies.

Macro Briefing: 1 August 2024

Most Slices Of The US Bond Market Posting Gains In 2024

Year-to-date returns for US fixed income are skewing positive this year ahead of the Federal Reserve policy announcement this afternoon. Although the central bank is expected to leave rates unchanged today, markets are pricing in a September cut and much the US fixed-income market is all-in on anticipating that outcome.

Macro Briefing: 31 July 2024

* Hamas leader killed in Iran in alleged Israeli strike, threatening escalation

* Japan raises interest rates as it unwinds long-running easy policy

* Fed expected to leave rates unchanged today

* US consumer confidence remains middling in July vs. recent history

* US home prices reach a new record high: Case-Shiller Home Price Index

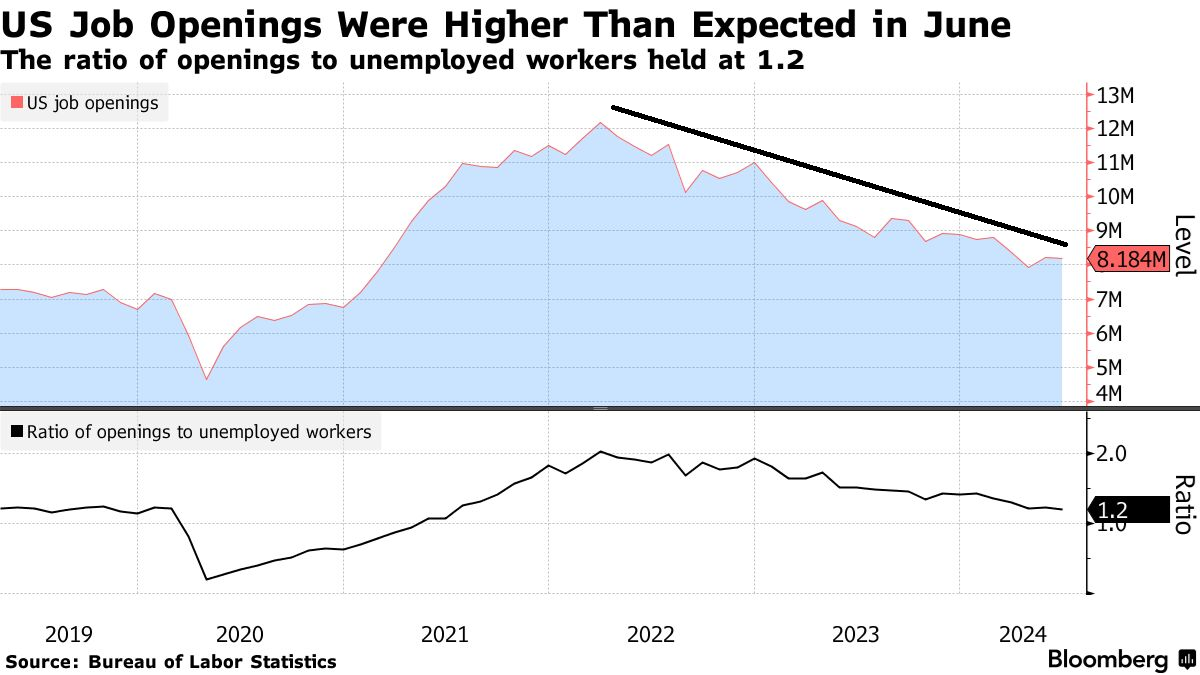

* US job openings edge down in June, reaffirming ongoing downtrend:

Will The Fed Meeting Support A September Rate Cut Forecast?

The market’s convinced that the Federal Reserve will start cutting interest rates at the Sep. 18 policy meeting. Tomorrow’s central bank announcement and press conference is still a wild card, but only by the smallest of margins, according to market sentiment. Indeed, it’s fair to say that the crowd’s super confident that the future is clear.

Macro Briefing: 30 July 2024

* Longest, deepest US Treasury yield curve inversion may be close to ending

* Eurozone maintains sluggish growth in second quarter

* Sen. Lummis announces bill for US Treasury to establish bitcoin reserve

* AI is improving the accuracy and timeliness of weather forecasting

* Texas manufacturing activity stays flat in July as demand weakens

* Despite expectations of rate cuts, long-term bonds still look risky: