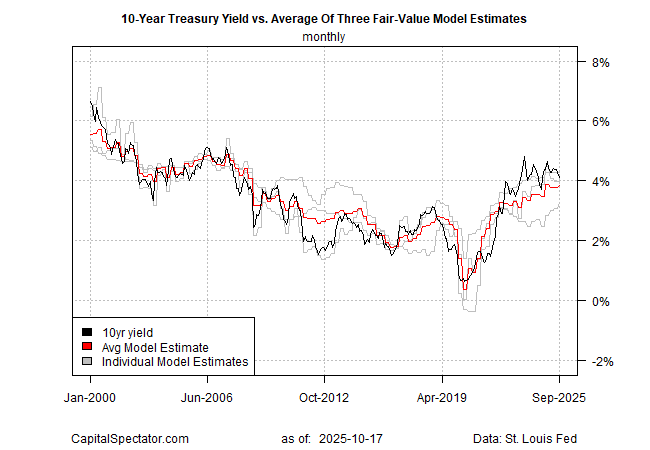

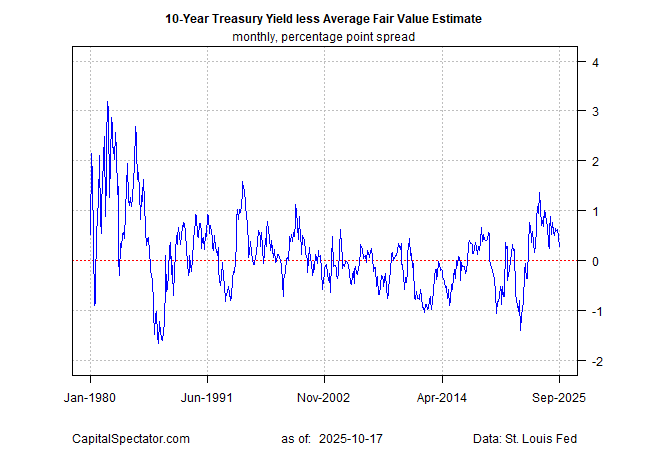

The spread for the US 10-year Treasury yield over a “fair value” estimate has narrowed to the smallest gap in a year, based on the average estimate for three models run by CapitalSpectator.com.

The latest analysis, which is monthly and reflects numbers through September, reflects an ongoing decline in the market premium this year. The current fair value estimate for the 10-year yield is 3.85%, which is 27 basis points below the market’s average 4.12% rate in September.

The latest downturn in the market premium over the fair value estimate extends a downside trend that’s been unfolding in recent history. The downshift highlights a mean-reversion tendency in the 10-year yield’s shifting premium and discounts relative to the fair value estimate. For the currency cycle, the premium peaked at nearly 1.4 percentage point in late-2023.

Keep in mind that the latest estimate reflects modeling that’s missing several economic data points due to the government shutdown. For example, the September update on consumer inflation, which was scheduled for release earlier this week, has been delayed. The missing numbers to date have had a minimal effect on average fair value analytics due to the use of three models that use a wide range of economic and market data. Presumably the government will reopen soon and publish the delayed reports will be issued. Shortly after, we’ll re-run the analysis and present an updated fair value report.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report