The US 10-Year Treasury yield briefly crossed above the 5% mark yesterday (Oct. 19) — the highest since 2007 — before settling at 4.98%, based on Treasury.gov data. For buy-and-hold investors, the elevated yield looks compelling, at least relative to recent years, when interest rates were much lower. But the better question is: How does a 5% yield compare with US stock market performance?

Macro Briefing: 20 October 2023

* Fed Chair Powell says “inflation is still too high”

* Economists lift US growth projections through early 2024

* China to curb exports of key material used in batteries for electric vehicles

* US 10-year Treasury yield rises to 5%, highest since 2007

* Existing home sales in US drop to 13-year low in September

* US Leading Economic Index continues to forecast weak economic outlook

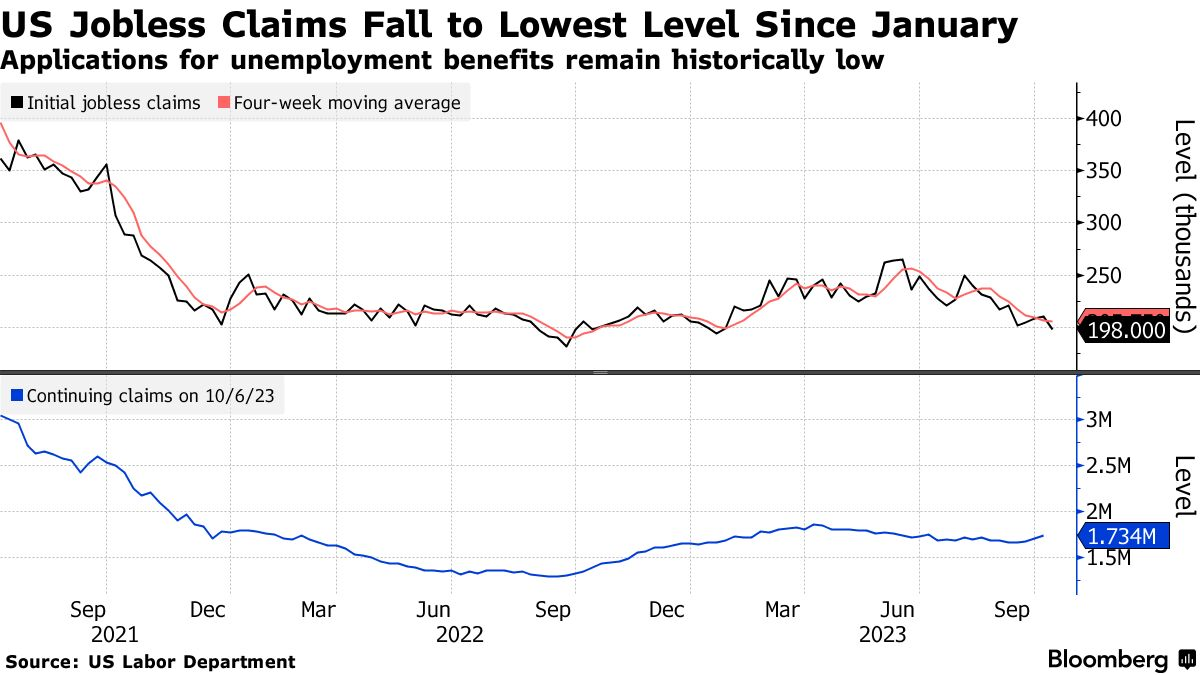

* US jobless claims fall to 9-month low, near multi-decade low:

US Stock Market’s Current Drawdown Is 9th Longest Since 1950

Although American shares continue to hold on to a strong rally from the year-ago bottom, reclaiming the previous market peak is nowhere on the near-term horizon. The combination of heightened geopolitical risk, uncertainty about inflation and interest rates and the ongoing political dysfunction in Washington provide compelling reasons for investors to adopt a wait-and-see posture.

Macro Briefing: 19 October 2023

* House GOP speaker race in stalemate as Jordan loses second vote

* Inflation is easing and economic growth is softening: Fed Beige Book

* 10-year Treasury yield above 4.9% for first time since 2007

* US household wealth rose at record 37% pace during pandemic

* Finnish telecom giant Nokia to cut 14,000 jobs

* US housing starts rebound in September after sharp fall in August:

US Q3 GDP Nowcast Still Indicates Accelerating Growth

The US recession forecasts persist for some analysts, but the start date keeps moving forward as incoming economic data continues to reflect strength. The trend is reflected in today’s upwardly revised nowcast for the upcoming third-quarter GDP report.

Macro Briefing: 18 October 2023

* Biden’s Israel visit is a high-stakes gamble to reduce tensions

* China GDP growth beats forecasts for Q3

* The odds of a soft US economic landing continue to rise

* Homebuilder sentiment in US fades in October, falling to x-month low

* US industrial production rebounds in September

* US retail sales rise more than expected in September:

10-Year US Treasury Yield ‘Fair Value’ Estimate: 17 October 2023

The US 10-year Treasury yield continues to rise, pushing ever higher above above CapitalSpectator.com’s “fair-value” estimate, which is based on averaging three models. The trend highlights the limitations of models, at least in the short, for estimating near-term changes in bond yields. But reviewing the recent divergence reminds that the current spread, although extreme by the standards of recent years, isn’t unprecedented.

Macro Briefing: 17 October 2023

* Biden will visit Israel in bid to keep conflict from escalating

* Early data suggest the earnings recession is over for S&P 500 companies

* Higher-for-longer interest-rate outlook strengthens

* China Q3 economic data expected to show growth below target

* US holiday spending expected to rebound to pre-pandemic levels

* SEC chief warns AI-linked financial crisis is a threat in years ahead

* NY Fed Manufacturing Index edges down into contraction in October

* US oil production rises to record high in first week of October:

US Stocks Still Lead Global Assets In 2023

The Israeli-Palestinian conflict is a new risk factor for financial markets, but for now there’s no contest between US shares and other asset classes as the year moves into its final stretch, based on a set of ETFs through Friday’s close (Oct. 13).

Macro Briefing: 16 October 2023

* Outlook turns cautious for global economy as Israel-Gaza conflict rages

* Economic blowback from Israeli-Palestinian conflict still unclear, says Yellen

* House expected to vote Tuesday to elect a new speaker

* US oil production reached all-time high last week

* US home sales set for slowest year in more than a decade

* Rite-Aid pharmacy chain files for bankruptcy

* US consumer sentiment fell in October after two months of stability: