● You Will Own Nothing: Your War with a New Financial World Order and How to Fight Back

Carol Roth

Interview with author via Hidden Forces

The argument that Carol makes in the book is that we are on the precipice of a new financial world order, one that will fundamentally change the fortunes of hundreds of millions if not billions of people across the western world. How this new financial world order is being brought about and the role being played by international organizations, governments, and multinational corporations in facilitating it forms a large part of today’s conversation. The second part of the episode examines the deeper technological, socio-cultural, and spiritual forces that are driving peoples awakening. This part of the discussion focuses on how to differentiate betwen the fear-mongering misdirection of many media entrepreneurs and other, more credible sources of information, as well as what we can do to fight back by regaining control over our finances, over our lives, and over the narratives that define our reality.

Research Review | 21 July 2023 | Forecasting Markets

Betting on War? Oil Prices, Stock Returns and Extreme Geopolitical Events

Knut Nygaard (Oslo Metropolitan U.) and L.Q. Sørensen (Storebrand Asset Mgt.)

July 2023

We show that the ability of oil price changes to predict stock returns is largely limited to five extreme geopolitical events: the 2022 invasion of Ukraine, the 2003 invasion of Iraq, the 1990/91 Persian gulf war, the 1986 OPEC collapse, and the 1973 Arab-Israel war. In the counterfactual scenario where these events did not occur, the t-statistics are reduced on average 75% as compared to that reported by Driesprong, Jacobsen, and Maat (2008). We also find that a market-timing trading strategy based on oil price changes typically generates insignificant abnormal returns, contradicting previously published results. Our findings serve as an example of how a significant predictor in a time series forecasting regression does not necessarily constitute a useful or profitable market-timing signal.

Macro Briefing: 21 July 2023

* US Treasury Sec. visits Vietnam to strengthen ‘friendshoring’ of supply chains

* Damaged Pfizer plant will “likely lead to long-term shortages” of medicine

* US Leading Economic Index continues to issue warning for economy

* Federal Reserve launches instant payments services

* US existing home sales fell in June to slowest pace in 14 years

* Philly Fed Mfg Index continues to reflect weak sector activity in July

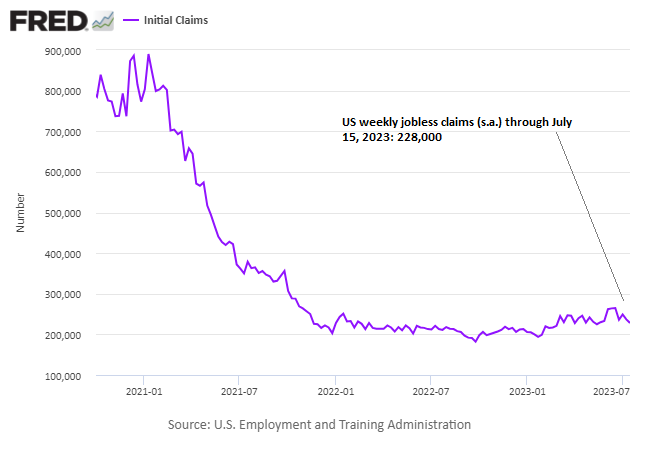

* US jobless claims fell last week, holding near multi-decade lows:

Desperately Seeking Yield: 20 July 2023

Are we at or near peak yields for risk assets? The possibility is looking more likely these days.

Macro Briefing: 20 July 2023

* Final Fed rate hike expected, according to new Bloomberg survey of economists

* Recession risk still looks low for the US economic outlook

* Just 1% of all US homes change hands in first half of 2023, lowest in a decade

* Net inflows into Chinese stocks falls below other Asian markets

* China’s use of coal for energy is deepening

* TSMC, world’s largest chipmaker, reports 10% drop in Q2 profits vs. year ago

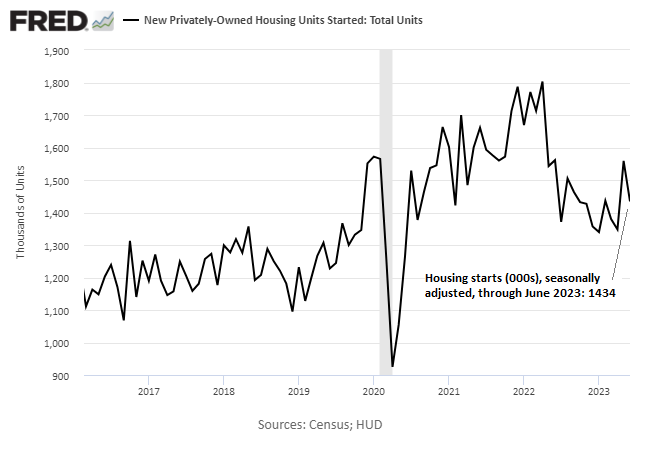

* US housing starts fall more than forecast in June:

Macro Briefing: 19 July 2023

* Extreme heat bakes large parts of the US, Europe and Asia

* Will China deflation/disinflation soon be exported to the rest of the world?

* Investment banking, trading downturn ‘bottomed’, says Morgan Stanley chief

* US GDP growth set to pick up in Q2: Atlanta Fed’s GDPNow model

* Wave of corporate bankruptcies brewing as easy money era fades

* US homebuilder sentiment edges up in July, highest level since June 2022

* US industrial output falls for second month in June

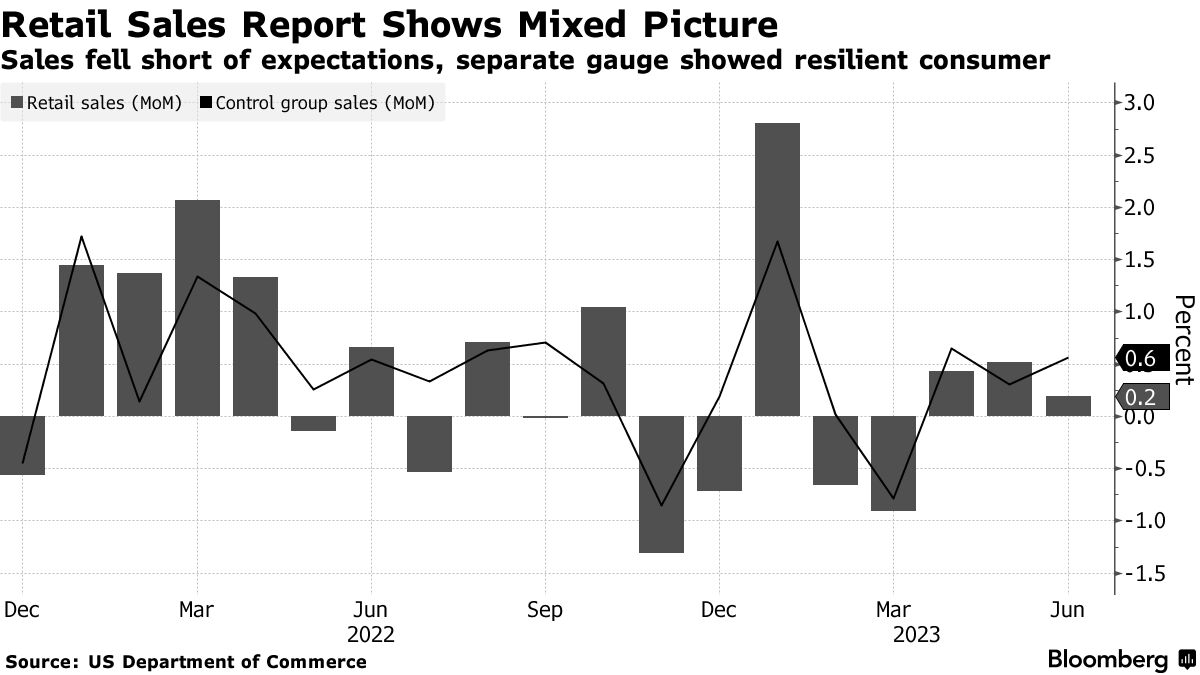

* US retail sales rise for third month, reflecting slow but resilient spending trend:

Risk-On Signals Strengthen In Several Market Trend Profiles

One of Wall Street’s famous maxims is that bull markets climb a wall of worry. On that score there’s no shortage of real and potential hazards lurking. But as recent history suggests, the crowd isn’t intimidated, at least not yet. Quite the opposite, in fact, as investor sentiment seems to have been stoked in favor of buying, according to various trend profiles in markets around the world that point to price strength that highlights risk-on positioning.

Macro Briefing: 18 July 2023

* Victory still not imminent on inflation war, advise economists

* Teamsters president asks White House not to intervene in looming UPS strike

* JP Morgan and Goldman Sachs lower US recession odds

* Slower China growth not a first-order risk for America, according to US officials

* Russia steps up economic war on West by seizing assets of two companies

* CNN Money Fear and Greed index stays in “Extreme Greed” zone on Monday

* US housing market recession appears to be fading

* US chip industry presses Biden to refrain from additional China curbs

Strong Gains Lift Most Major Asset Classes This Year

Across-the-board rallies in all the major asset classes last week strengthened year-to-date performances in markets around the world, based on a set of ETFs. The downside outlier: a broad measure of commodities, which continues to post a moderate loss so far in 2023 as of Friday’s close (July 14).

Macro Briefing: 17 July 2023

* Market’s high weights in big stocks suggest investors uncertain on economy

* China GDP growth for Q2 rises substantially less than forecast

* Analysts cut China growth outlook after disappointing Q2 data

* Russia suspends grain deal that allowed Ukraine exports to world

* As the demographics of aging unfold, it will reshape the global economy

* Markets cautiously optimistic that inflation will continue to ease

* Equity strategists lift S&P 500 earnings forecasts

* US stocks (S&P 500) on Friday closed at highest weekly high since March 2022: