* China’s Xi Jinping secures unprecedented third term as president

* Selling of bank shares spreads as troubles for tech lender SVB deepen

* UK reports stronger-than-expected growth for January GDP

* OPEC is again the main factor influencing global oil supply

* Credit card debt reaches new high, putting consumers at ‘breaking point’

* US jobless claims rise to 2023 high but remain historically low

* US stock market falls to lowest level since late-January:

Median US GDP Estimate For Q1 Ticks Slightly Positive

Several indicators are flashing recession warnings for the US, but the median estimate for economic activity in the first quarter leaves room for doubt about the timing, suggests the median for a set of GDP nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 9 March 2023

* White House set to release deficit-cutting budget proposal

* Netherlands joins US in banning key microchip exports to China

* Markets cautiously await tomorrow’s payrolls report for February

* Markets see higher recession odds after Fed Chair Powell’s hawkish testimony

* Housing shortage persists in US by 6.5 million units, realty firm estimates

* China consumer inflation eases to slowest pace in a year in February

* Crypto bank Silvergate is shutting down, marking latest FTX aftershock

* US firms hire more workers than expected in February, ADP reports

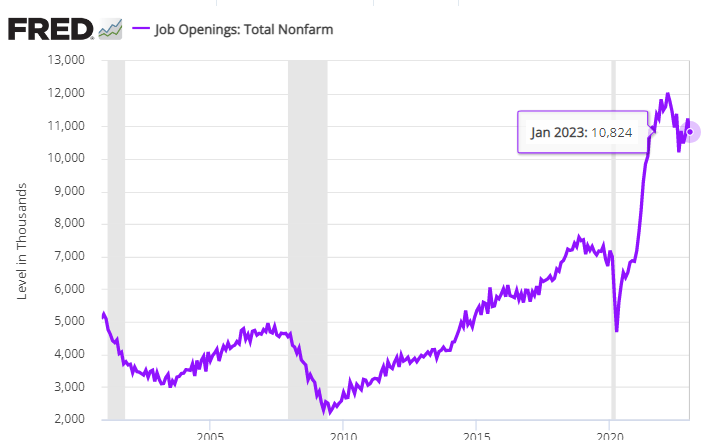

* US job openings eased in January, but remain elevated vs. history:

The Best Solution For Reducing Noise In Recession-Risk Estimates

US recession risk is high, unless it’s not. After months of conflicting signals from various business-cycle indicators, debate and disagreement reign supreme in the land of nowcasting and forecasting the odds for an economic downturn. In other words, the value of combination forecasting in the current environment has rarely been higher.

Macro Briefing: 8 March 2023

* Fed’s Powell says rate hikes may go higher than previously expected

* 2yr/10yr Treasury yield spread falls deeper into below-zero readings

* Workers across France protest pension reform proposal

* China announces shake-up of government oversight of financial system

* Eurozone GDP change revised down to zero for Q4

* US shale-oil boom appears close to peaking

* Buffett’s Berkshire Hathaway buys more Occidental Petroleum shares

* US 2-year Treasury yield (proxy for rate expectations) rises to 5%, a 16-year high:

Markets Continue To Flirt With Risk-On Signals

There’s no shortage of threats lurking, ranging from inflation, elevated interest rates that may go higher still, and various geopolitical threats. But market sentiment has improved recently, climbing a wall of worry and suggesting that investors are presuming that the worst has passed for the world economy, based on various ETF pairs through yesterday’s close (Mar. 6).

Macro Briefing: 7 March 2023

* China foreign minister warns of conflict with US

* China exports fell 2.8% in Jan-Feb vs. year-ago levels

* Debt-ceiling risk for US economy in focus today in Senate panel

* Fed Chair Powell will testify in Congress today on economic outlook

* US supply chains return to normal in February, says NY Fed

* Meta plans for another round of job cuts

* US factory orders continue to decelerate in January via 1-year trend:

Global Markets Recovered Some Of February’s Losses Last Week

Repair and recovery was on display last week as the major asset classes clawed back some of the across-the-board losses in February.

Macro Briefing: 6 March 2023

* Fed submits report to Congress: more rate hikes needed to tame inflation

* China sets lowest growth target (roughly 5%) in decades as challenges loom

* Base metals mostly lower after China sets modest growth target

* Veteran emerging markets investor says he can’t get his money out of China

* Housing headwinds strengthen ahead of crucial spring selling season

* US services sector growth remains moderate in February via survey data

* Former Fed Vice Chair Blinder predicts Fed won’t raise rates to 6%, but…

* San Francisco Fed President Daly sees tighter policy for longer as ‘likely’

* US Treasury yield curve remains deeply inverted as hawkish Fed policy prevails:

Book Bits: 4 March 2023

● Blood Money: The Story of Life, Death, and Profit Inside America’s Blood Industry

Kathleen McLaughlin

Summary via publisher (Simon & Schuster)

Journalist Kathleen McLaughlin knew she’d found a treatment that worked on her rare autoimmune disorder. She had no idea it had been drawn from the veins of America’s most vulnerable. So begins McLaughlin’s ten-year investigation researching and reporting on the $20-billion-a year business she found at the other end of her medication, revealing an industry that targets America’s most economically vulnerable for immense profit. And she unearths an American economic crisis hidden in plain sight: single mothers, college students, laid-off Rust Belt auto workers, and a booming blood market at America’s southern border, where collection agencies target Mexican citizens willing to cross over and sell their plasma for substandard pay.