* US delegation including Indiana’s governor in Taiwan for trade talks

* Russia sees no chance for diplomatic solution to end the war in Ukraine

* Daughter of Putin ally killed in car explosion near Moscow

* US, S. Korea start biggest military drills in years amid threats from N. Korea

* China cuts lending rates again, following a cut last week

* Germany likely headed for recession, Bundesbank predicts

* US ‘effectively peak employment,’ says ZipRecruiter CEO Ian Siegal

* Severe droughts snarling supply chains and lifting food prices

* Fed expected to slow rate hikes to 50 basis points in September

* Business community overwhelmingly expects a recession within next 18 months

* US Dollar Index near 20-year high:

Book Bits: 20 August 2022

● Danger Zone: The Coming Conflict with China

Michael Beckley and Hal Brands

Excerpt via Foreign Policy

The greatest geopolitical catastrophes occur at the intersection of ambition and desperation. Xi Jinping’s China will soon be driven by plenty of both.

In our new book, Danger Zone: The Coming Conflict with China, which this article is adapted from, we explain the cause of that desperation: a slowing economy and a creeping sense of encirclement and decline. But first, we need to lay out the grandness of those ambitions—what Xi’s China is trying to achieve. It is difficult to grasp just how hard China’s fall will be without understanding the heights to which Beijing aims to climb. The Chinese Communist Party (CCP) is undertaking an epic project to rewrite the rules of global order in Asia and far beyond. China doesn’t want to be a superpower—one pole of many in the international system. It wants to be the superpower—the geopolitical sun around which the system revolves.

The Hierarchy of Portfolio Decisions: Part I

Portfolio design and management tends to fare best when the rules and structure are relatively simple. But there are limits and so deciding on the degree of simplicity can be a gray area, depending on your definition of “simple” and “complicated,” along with expectations and investment goals. The debate on how far to go with simplicity inspires a fresh look at what I call the hierarchy of decisions in the process of building and managing portfolios through time.

Macro Briefing: 19 August 2022

* US Leading Economic Index falls for fifth straight month

* US jobless claims edged lower last week, continue to reflect low level of layoffs

* Philly Fed Manufacturing Index rebounded in August

* Norway and New Zealand’s central banks announce latest rate hikes

* Turkey’s central bank cuts interest rates despite surging inflation

* Extreme heat strikes world’s three largest economies simultaneously

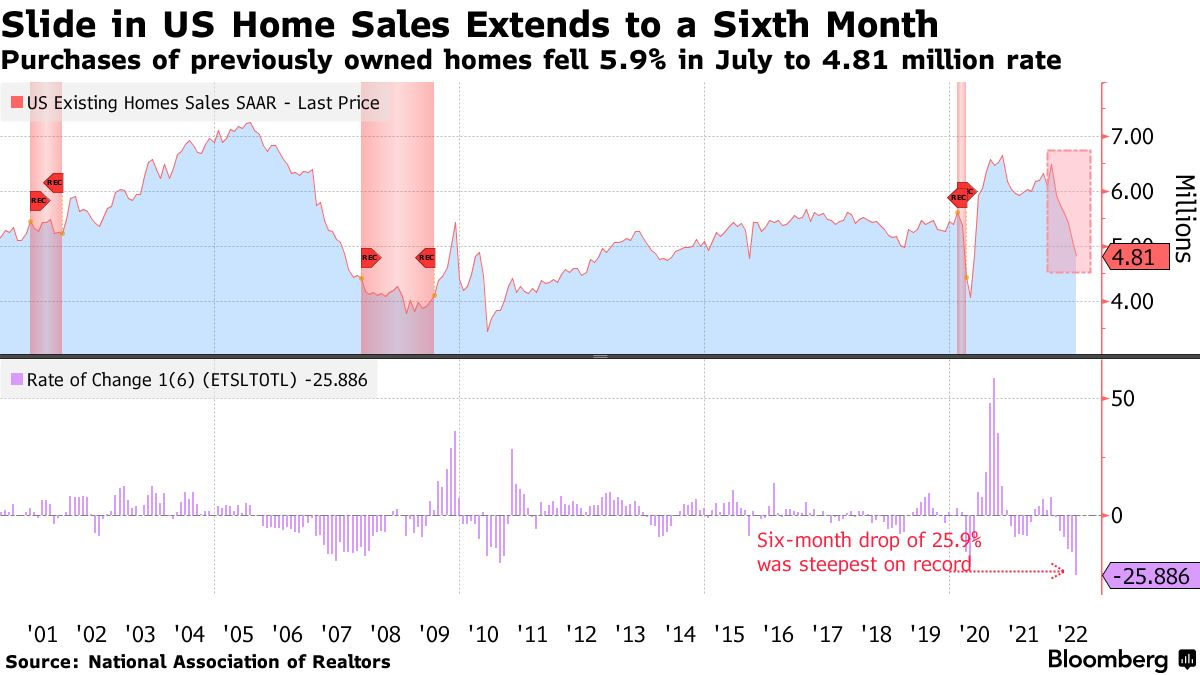

* US existing home sales fell for sixth straight month in July:

Is The Fed Making Progress On Taming Inflation?

Yesterday’s release of Federal Reserve minutes for the July FOMC meeting reaffirms that the central bank won’t ease off on interest-rate hikes until inflation is tamed. Good thing, too, since the latest inflation data suggests there’s still a long road ahead before policy goals and pricing pressures are aligned. But the Treasury market is always looking ahead and at the moment it seems to be hinting at the possibility that hawkish monetary policy may be close to peaking, based on comparing the 2-year yield with effective Fed funds rate (EFF).

Macro Briefing: 18 August 2022

* US government will hold trade talks with Taiwan to counter China

* Renewed Iran nuclear deal appears “closer than we’ve been before”

* Fed minutes: rate hikes will continue until inflation slows substantially

* Nearly 3/4 of US farmers say drought is damaging their harvests

* Europe’s summer heat is exacerbating energy challenges

* China deploys cloud seeding to ease toll from record heat wave

* Mortgage boycotts spread across China

* US retail sales were flat in July but spending ex-gas and autos is still solid:

S&P 500 Risk Profile: 17 August 2022

After stabilizing in late-June/early July, the US stock market has continued to rebound. The S&P 500 appears on track to post its fifth straight weekly advance, based on trading through yesterday’s close (Aug. 16). Encouraging, although all the risk factors that unleashed a powerful run of selling in the first half of the year are still lurking. That includes high inflation, rising interest rates and elevated geopolitical tension vis-à-vis Russia and China. But for the moment, the trend if friendly, leaving the crowd to decide if this is a bear market rally or the start of a new extended bull run.

Macro Briefing: 17 August 2022

* Biden signs climate and health care bill into law

* Ukraine widens attacks on Russian-controlled territory in Crimea

* America’s retirement crisis is getting worse

* China’s stimulus efforts to boost slowing economy are relatively mild

* UK inflation reaches another new 40-year high in July

* US industrial production rebounds more than expected in July

* Heatwave in China is forcing factories to close

* Q3 GDP rebound for US revised down to +1.8% via GDPNow model

* US housing starts continue to weaken, falling to slowest pace since early 2021:

Short-Term Bonds Are Savior For Fixed-Income Strategies This Year

The rout in bonds so far in 2022 has been deep and wide, with a notable exception: short maturities, which have provided valuable stability that’s otherwise in short supply.

Macro Briefing: 16 August 2022

* Russian military base in Crimea hit by a series of explosions

* Recession worries take a bite out of oil prices

* China’s housing market weakens in July after briefly stabilizing

* Weak economic data in US and China weigh on commodities prices

* US gasoline prices may continue falling to $3 a gallon, says analyst

* German sentiment among financial analysts near all-time low in August

* US homebuilder sentiment points to recession for housing sector

* NY Fed Mfg Index falls re: current conditions, indicating contraction in August: