The once-bulletproof argument that investors could do no wrong by owning China stocks has suffered a reversal of fortunes in 2021. Cue up the contrarians, who are wondering if the correction in the country’s equity market this year, in sharp contrast with much of the rest of the world, hints at a buying opportunity.

Macro Briefing: 15 October 2021

* President Biden signs bill to lift US debt ceiling through December

* Powell’s prospects for 2nd term at Fed dented but not derailed

* Brent oil futures top $85 a barrel for first time since October 2018

* Microsoft plans to close LinkedIn in China, citing onerous regulations

* United Auto Workers strike at John Deere, first time in 35 years

* US workers appear to be revolting against low pay and underpay

* State-run oil firms filling output gap left by lower production at Western firms

* SEC set to allow first US bitcoin futures fund to start trading

* Prices paid to US producers eased in September

* US jobless claims fell to a new pandemic low last week:

Inflation Trend Index Continues To Forecast Extended Peaking

Inflation is no longer accelerating, but it’s not showing clear signs of declining from recent peaks either.

Macro Briefing: 14 October 2021

* Gas shortage expected to force power plants to switch to oil

* US home heating costs projected to rise sharply this winter, federal gov’t advises

* Fed minutes: ‘gradual tapering process’ could start as early as mid-November

* Flatter 30yr-5yr Treasury yield curve suggests recession risk is rising

* Foreclosures surging as Covid mortgage bailouts expire

* China’s factory-gate prices soared to a near-26-year high in September

* Chinese developers shut out of global debt markets after Evergrande crisis

* Turkish currency at record low after president fires central bankers

* US headline consumer inflation ticked up to 5.4% annual rate in September:

10-Year Treasury Yield ‘Fair Value’ Estimate: 13 October 2021

Last month’s estimate of “fair value” for the US 10-year Treasury yield suggested that an upside bias for this benchmark rate was likely, or at least plausible. A month later, that outlook turned out to be spot on. Today’s update still suggests that more upside for the 10-year rate is still a reasonable view.

Macro Briefing: 13 October 2021

* House votes to raise the US borrowing limit through December

* IMF cuts US and global economic growth estimates for 2021

* Global supply chain bottlenecks could “get worse before they get better”

* US will open borders with Canada and Mexico to vaccinated travelers

* China’s export growth was surprisingly strong in September

* UK economy continued recovering in August

* Eurozone industrial output fell in August amid supply constraints, slower growth

* US small business sentiment ticked lower in Sep, well below recent peak

* US workers quit their jobs at record pace in August:

Fossil Fuel Stocks Are On Fire This Year

Alternative energy may be the future, but the past isn’t dead yet.

Macro Briefing: 12 October 2021

* House set to vote on US debt-limit increase approved by Senate last week

* Global tax deal in doubt in US over obscure legal issue

* JPMorgan’s Dimon predicts supply-chain issues for economy will ease soon

* China’s financial sector under increased scrutiny from government

* India faces rising risk of an energy crisis

* Iran reportedly hacked US and Israeli defense tech companies, says Microsoft

* South Korea’s central bank holds rates steady but signals hike in November

* Three US economists share Nobel prize in economics

* US oil price benchmark tops $80/barrel for the first time since 2018:

Commodities Topped Returns For Major Asset Classes Last Week

Amid ongoing concerns over inflation, commodities continued to rise, posting the strongest gain for an otherwise mixed week for global markets through Oct. 8, based on a set of ETFs.

Macro Briefing: 11 October 2021

* Global rebound at risk from supply bottlenecks, rising energy prices and inflation

* Congress faces a challenging autumn as crucial legislation awaits approval

* China property bonds tumble as default worries lurk over industry

* Inflation threat rises as energy prices increase

* Analysts predict that the recent surge in corporate earnings has peaked

* America’s port crisis, born of supply chain disruption, shows no sign of easing

* US payrolls didn’t surge in September as jobless benefits were cut

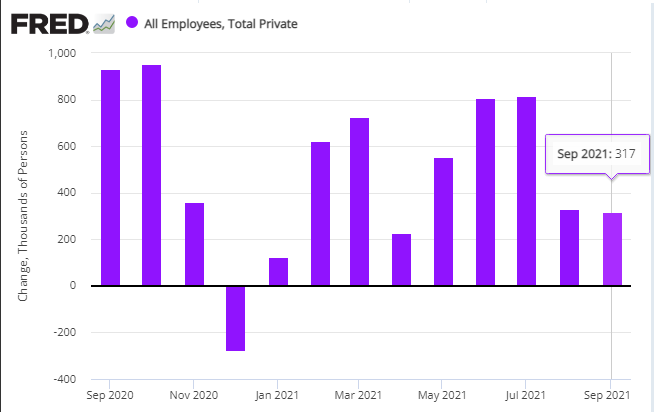

* US companies added fewer jobs than expected in Sep, close to Aug’s gain: