● The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy

Stephanie Kelton

Review via San Antonio Express-News

We live in extraordinary times. Revolutionary times. The upstarts, originally marginalized and dismissed as irresponsible, suddenly see their radical ideas embraced. The holders of power shift, first imperceptibly and then all at once, to the side of the revolutionaries in the streets.

I refer, of course, to the takeover of the Washington establishment and consensus by adherents of the Modern Monetary Theory, aka MMT, of economics.

A quick refresher: MMT begins with the principle that governments that control and create their own currency, like the United States, never have to worry about defaulting on excessive government debt. Taxes do not have to match spending now. Or ever. Borrowing and money creation can always fill the gap between spending and taxation.

Continue reading

Research Review | 12 June 2020 | Forecasting

Breaking Bad Trends

Ashish Garg (Research Affiliates), et al.

May 7, 2020

We document and quantify the negative impact of trend breaks (i.e., turning points in the trajectory of asset prices) on the performance of standard trend-following strategies across several assets and asset classes. The frequency of trend breaks has increased in recent years, which can help explain the lower performance of monthly trend following in the last decade. We illustrate how to repair trend-following strategies by exploiting the return forecasting properties of the different types of trend breaks: market corrections and rebounds. We construct dynamic multi-asset trend-following portfolios, which harvest more than double the average returns of standard trend-following investing strategies over the last decade.

Continue reading

Macro Briefing | 12 June 2020

Some US states reporting post-Memorial Day Covid-19 surges: WSJ

IMHE’s US model forecasts second-wave risk for Covid-19 in Q4: IMHE

US stock futures rebound in early Friday trading after Thursday’s sharp loss: CNBC

Survey shows most Americans support sweeping police reform proposals: Reuters

N. Korea all but ends diplomacy effort with US with harsh announcement: BBC

Survey: economists expect US economy to start recovering in Q3: WSJ

UK economy contracted by a shockingly steep 20% in April: Bloomberg

Eurozone industrial output down a record 17.1% in April vs. March: Reuters

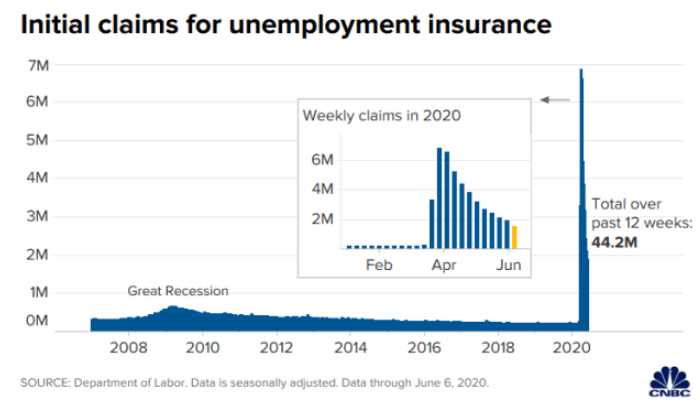

US jobless claims continued to rise sharply last week: CNBC

Are Foreign Bonds Adding Value In 2020 For US Investors?

If ever there was a case for a fixed-income allocation, 2020 has delivered the goods in no uncertain terms in 2020. As the coronavirus crisis derailed equity markets around the world, bonds – government bonds, in particular – have providing critical support for portfolio strategies. But for US investors, the fixed-income edge has been primarily a domestic phenomenon. Foreign bonds, by contrast, have posted weak gains at best so far this year (through June 11), based on a set of proxy ETFs.

Macro Briefing | 11 June 2020

As Covid-19 cases top 2 million, concern lingers over a second wave: BBG

Harvard health expert: US Covid-19 deaths will double by September: CNN

Covid-19 cases are rising as economies around the world reopen: NY Times

Fed expects no interest rate increases through 2022: WSJ

US jobless claims expected to rise sharply again in today’s update: MW

Cash hoarding in Europe suggests economic recovery will be anemic: BBG

Few signs that active management capitalized on recent volatility: II

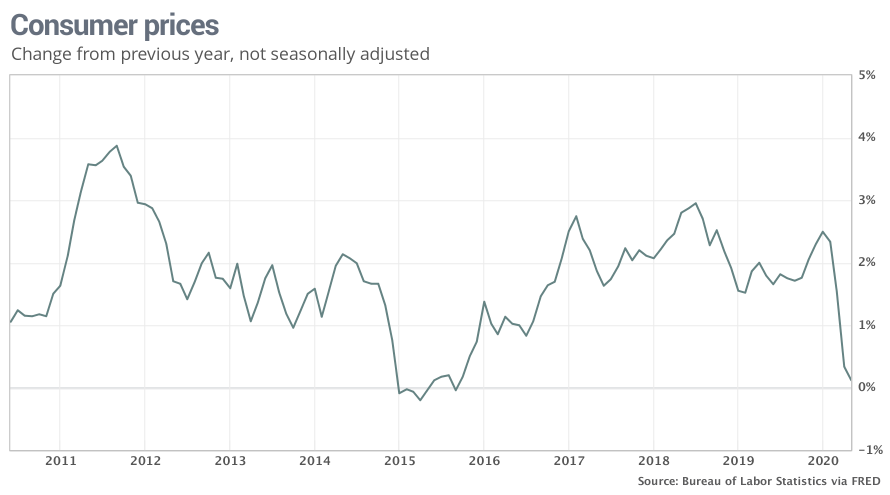

US consumer inflation’s 1-year trend fell to near zero in May: MW

New Fed Economic Projections Due Amid Dark Q2 GDP Estimates

The worst phase of the pandemic crisis in the US may be easing, but economic projections for the immediate future remain grim. Recent estimates for the upcoming second-quarter report for GDP tell the story—a tsunami of deeply negative projections. Amid the macro darkness, the Federal Reserve today, as part of a monetary statement, is scheduled to release its own set of revised economic projections.

Macro Briefing | 10 June 2020

White House adviser says new stimulus bill odds ‘are very, very high’: WSJ

OECD considers economic impact of a second coronavirus wave: Bloomberg

Worrisome Covid-19 trends in India, Brazil and South Africa: Vox

Consumer inflation in China slowed to 14-month low in May: Caixin

China’s industrial deflation continued to deepen in May: MW

What’s expected for today’s Federal Reserve meeting? CNBC

Pandemic threatens to upend business models for retail properties: NY Times

Small Business Optimism Index in the US rebounded moderately in May: NFIB

US job openings fell to a five-year low in April: CNBC

Is The Treasury Market Starting To Price In Reflation?

The clues are starting pile up that the deepest phase of the economic loss for the US coronavirus recession has passed. There’s still a long way to go to climb out of the hole, but data published to date suggest that the recovery process has started.

Macro Briefing | 9 June 2020

Politicians consider defunding police after George Floyd protests: NY Times

22 US states report rising cases of Covid-19 infections: CNN

Daily change in US Covid-19 deaths falls to new post-peak low: Reuters

North Korea cuts off communication with South Korea: CNN

India and China agree to peacefully settle border tensions: CNBC

Will strong US jobs report for May fuel a rise in Treasury yields? CNBC

Up to 25,000 US stores may close this year: Bloomberg

Longest US economic expansion on record officially ended in February: NBER

US stocks (S&P 500) closed on Monday with a fractional year-to-date gain: CNN

Real Estate Shares Surged Last Week

US and foreign property shares led returns in last week’s broad rise in global markets, based on a set of exchange traded funds tracking the major asset classes. over the trading week ended June 5.

Continue reading