Considering the case for why the Fed may cut rates again: WSJ

California declares state of emergency due to coronavirus: Reuters

Opec expected to call for big cut in oil production to counter falling prices: CNBC

Global economy contracted in February, according to survey data: IHS Markit

Coronavirus impact on US economy shows up in Fed Beige Book reoprt: MW

US services sector growth picked up in Feb via ISM Non-Mfg Index: ISM

US Services PMI shows mild contraction in Feburary: IHS Markit

US private hiring slowed in Feb but continued to rise at healthy pace: ADP

Fed Cuts Rates As Global Coronavirus Risk Continues To Rise

It’s unclear if yesterday’s emergency 50-basis-point cut in interest rates by the Federal Reserve will help immunize the US economy against coronavirus-related blowback. Meanwhile, a rise in reported cases of covid-19 on a global basis remains the baseline forecast, based on today’s update of CapitalSpectator.com’s modeling (see today’s revised outlook below).

Macro Briefing | 4 March 2020

Joe Biden enjoys stunning comeback in Super Tuesday voting: CNN

Fed cuts target interest rate by 1/2 point to combat coronavirus: CNBC

China services economy effectively ground to a half in Feb: IHS Markit

Japan slipped into recession in February via PMI survey data: IHS Markit

Eurozone shows a bit of resilience with modest growth in Feb: IHS Markit

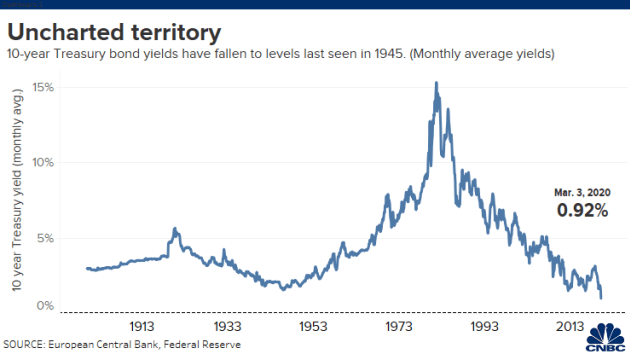

10-year Treasury yield falls under 1.0%–a new record low: CNBC

Risk Premia Forecasts: Major Asset Classes | 3 March 2020

The Global Market Index (GMI) is expected to earn an annualized risk premium of 4.5% over the long run in today’s revised estimate (before factoring in a “risk-free” rate). The new projection reflects a downgrade from last month’s 5.0% forecast and no change from the year-ago estimate.

Macro Briefing | 3 March 2020

World finance officials consider economic response to coronavirus: Reuters

World’s top-3 central banks look set to respond to coronavirus: Reuters

World Health Organization chief: we’re in “uncharted territory”: CNN

Global manufacturing sector fell into deep recession in February: IHS Markit

US construction spending rose in January to record level: AP

US Mfg PMI: modest growth continued to weaken in February: IHS Markit

US manufacturing sector barely expanded in February via ISM survey data: ISM

Major Asset Classes | February 2020 | Performance Review

Nearly every corner of the major asset classes took a beating in February, courtesy of coronavirus-related worries. Only investment-grade US bonds, US inflation-indexed government bonds and cash bucked the risk-off sentiment. Otherwise, red ink swept across markets near and far.

Continue reading

Macro Briefing | 2 March 2020

OECD: Covid-19 is biggest threat to global economy since financial crisis: OECD

A degree of calm returns to Asian markets on Monday: Reuters

Syria’s war escalates as Turkey responds to attack with drone strikes: BBC

Greece ends asylum as migrants mass on its border with Turkey: NY Times

North Korea fires two missiles into Sea of Japan: CNN

US and Taliban sign deal to end 18-year war in Afghanistan: BBC

Caixin China General Manufacturing PMI crashed in February: IHS Markit

Eurozone mfg recession eased in Feb but Covid-19 weighs on outlook: IHS Markit

US consumer spending slowed in January: Reuters

US Consumer Sentiment Index rose in February, near post-recession high: UoM

Chicago PMI edged up in Feb but still below neutral 50 mark: Chicago PMI

Comparing last week’s stock market loss with previous 5-day declines: CNBC

Book Bits | 29 February 2020

● The Long Deep Grudge: A Story of Big Capital, Radical Labor, and Class War in the American Heartland

By Toni Gilpin

Summary via publisher (Haymarket Books)

This rich history details the bitter, deep-rooted conflict between industrial behemoth International Harvester and the uniquely radical Farm Equipment Workers union. The Long Deep Grudge makes clear that class warfare has been, and remains, integral to the American experience, providing up-close-and-personal and long-view perspectives from both sides of the battle lines. International Harvester – and the McCormick family that largely controlled it – garnered a reputation for bare-knuckled union-busting in the 1880s, but in the 20th century also pioneered sophisticated union-avoidance techniques that have since become standard corporate practice. On the other side the militant Farm Equipment Workers union, connected to the Communist Party, mounted a vociferous challenge to the cooperative ethos that came to define the American labor movement after World War II.

Continue reading

Welcome To Financial And Economic Re-education Camp

For the casual observer, the stock market’s rapid slide looks like madness. It was, after all, only last week that the S&P 500 closed at a record high. Six trading days later, the market has lost 12% (as of Feb. 27)–the fastest correction on record for declines of 10%-plus. But before we let recency bias take complete control of our minds, let’s consider if there’s a method in Mr. Market’s madness.

Macro Briefing | 28 February 2020

World Health Organization: coronavirus outbreak at “decisive point”: BBC

World markets set for worst week since financial crisis: CNBC

Profiling stock market corrections since World War II: CNBC

Dozens of Turkish soliders killed in Syria by missile strike: NY Times

Turkey will no longer stop Syrian refugees from migrating to Europe: Reuters

Philly Fed’s ADS business cycle index still reflects modest growth: PF

Revised Q4 GDP data for US remains unchanged at +2.1%: Reuters

US durable goods orders edged lower in January: MW

US jobless claims rose last week but remain near historic lows: CNBC

World economy headed for worst year since financial crisis: BBG