Healthcare risk isn’t usually the leading factor in economic analysis, but the rise of coronavirus (Covid-19) has changed the focus and the calculus. Covid-19, in short, is on everyone’s short list for modeling the near-term macro outlook, in the US and around the world. At some point this, too, shall pass and something approximating a “normal” environment for economic analysis will return. Meantime, the uncertainty surrounding Covid-19 is shredding the usual macro modeling efforts. With that in mind, here begins a preliminary and evolving effort by CapitalSpectator.com for projecting the near-term path of cumulative reported cases of Covid-19 on a global basis, using a proprietary econometric forecasting methodology.

Macro Briefing | 27 February 2020

Govt’s around the world take more aggressive stance on coronavirus: Reuters

Trump announces VP Mike Pence to lead US coronavirus response: USA Today

First US coronavirus infection reported not linked to int’l travel: NY Times

New coronavirus cases reported in S. Korea tops China for first time: SCMP

US-S. Korea military drills on hold due to coronavirus: Reuters

Is the stock market selloff just getting started? Bloomberg

Eurozone economic sentiment rebounds in Feb–fourth month of improvement: EC

New US home sales surged to 13-year high in January: Bloomberg

US Economy Still Expected To Expand At Moderate Pace In Q1

The coronavirus is weighing on economic estimates around the world and it’s likely that the US will eventually feel some of this pain. The degree of the macro price tag for America remains a guessing game at this point. As a baseline, we can monitor how the first-quarter nowcasts evolve in the days and weeks ahead. On that front, the latest numbers point to a slightly softer increase in output for Q1 vs. the previous quarter.

Macro Briefing | 26 February 2020

Global equities continue to slide on Wed amid escalating coronavirus worries: WSJ

US prepares for spread of coronavirus: Reuters

Several European countries announce coronavirus cases: BBC

Fed’s Clarida: “still too soon” to discuss a rate cut: MW

Globalization faces a new front of attack with coronavirus: NY Times

JP Morgan warns investors on climate-change risk: Bloomberg

US home price growth picked up in Dec, marking eighth year of price gains: Mstar

Mfg activity ticked lower in February in Richmond Fed district: Richmond Fed

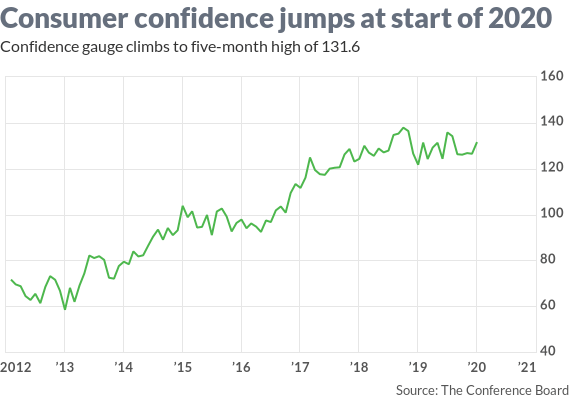

US Consumer Confidence Index rose in January to five-month high: MW

Assessing The Damage After Monday’s Sharp Decline In Stocks

Well, that was painful. The increasingly hazy risk outlook linked to the coronavirus outbreak inspired a 3.35% haircut in the US stock market (S&P 500). The tumble was certainly a bracing counterpoint to the idea that sunny optimism is the only game in town. But before we let recency bias flip to the opposite extreme, let’s review where we stand after yesterday’s smackdown.

Macro Briefing | 25 February 2020

Forecasting the economic impact of coronavirus is mostly guessing: WSJ

It’s premature to rule out a global recession triggered by coronavirus: MW

Is black swan blowback from coronavirus stalking Trump’s re-election? Politico

Will US stocks bounce after Monday’s dramatic selloff? CNBC

Iran may become the main source for spreading coronavirus: NY Times

Italy appears to be Europe’s epicenter for coronavirus: Bloomberg

Deadly protests rock Delhi as Trump visits India: Guardian

Dallas Fed Mfg Index rises sharply in February: Dallas Fed

US economic trend strengthened in January: Chicago Fed

Commodities And US Bonds Rose Last Week As Stock Markets Fell

Risk-off sentiment driven by coronavirus worries took a bite out of stocks around the world last week. The selling has spilled over today’s trading in Asia and Europe and looks set to weigh on American shares once markets open in a few hours. While we’re waiting for the opening bell to ring in New York, here’s a quick look at how the major asset classes fared for the trading week through Friday, February 21, based on a set of exchange-traded funds.

Macro Briefing | 24 February 2020

Coronavirus cases top 79,000 as outbreaks spread across the globe: CNN

US health officials preparing for coronavirus to become pandemic: USA Today

China eases curbs as new coronavirus infections in the country fall: Reuters

Coronavirus blowback threatens global supply chains: WSJ

German business sentiment steady despite coronavirus risk: Bloomberg

Former Putin advisor re: US election preference: “Our candidate is chaos”: GQ

JP Morgan economists: climate crisis threatens human race: The Guardian

What are the telltale signs of a bear market? Here’s a short list: CNBC

US Composite PMI survey data indicates economic contraction in Feb: IHS Markit

Book Bits | 22 February 2020

● The Wolf at the Door: The Menace of Economic Insecurity and How to Fight It

By Michael J. Graetz and Ian Shapiro

Q&A with co-author (Graetz) via Yale News

Q: Why prioritize economic insecurity over economic inequality?

A: There are several reasons. The first is that economic insecurity is rampant in the United States. About 40% of Americans say they couldn’t cover an unexpected $400 emergency expense with cash or a credit card charge they could pay off at the end of the month. Unless this insecurity is addressed, our politics will become increasingly ugly. You’ll see increased polarization and anti-immigration sentiment.

Second, as we learned from Daniel Kahneman and Amos Tversky’s critique of conventional economics, the prospect of loss is a more potent political motivator than the prospect of gain. Trump’s slogan “Make America Great Again” was effective because it implies that he would restore something that was taken away. It wasn’t about addressing inequality. He didn’t promise to make people rich or redistribute wealth. In fact, he bragged about his own wealth. Two-thirds of Trump’s primary voters earned above the U.S. median income of $50,000 for a family of four. These are not blue-collar folks, but they fear that they’re losing things. They’re worried about downward mobility — that their kids will be less successful than they are.

Continue reading

Will Recent Downside Momentum In Treasury Yields Accelerate?

The fear trade that’s animating Treasury buying is alive and well. Although you might have missed it by focusing on the soaring US equity market, the rush into safe-haven Treasuries has hardly missed a beat this year — a preference that’s pushed bond prices up and yields down.