Coronavirus cases spike in South Korea: Time

Will the soaring US dollar create headwinds for US stocks? MW

Eurozone economic growth is still weak but pace picked up in Feb: IHS Markit

US Leading Economic Index rose sharply in January: MW

Jobless claims in US remain near post-recession low: MW

Philly Fed Mfg Index soars in Feb, suggesting US mfg recession is over: CNBC

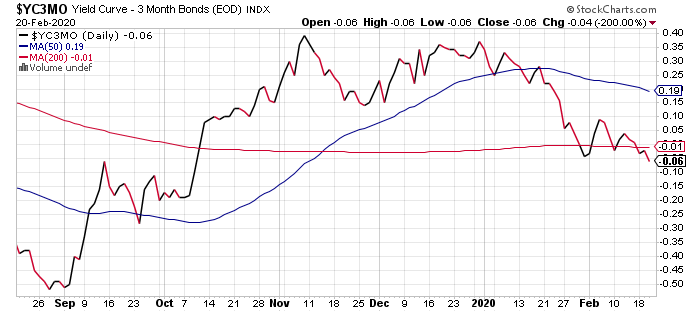

Inverted 10-year/3-month Treasury yield curve dips to 4-month low:

US Business Cycle Risk Report | 20 February 2020

The US economy’s slowdown in the second half of last year continues to show signs of mildly rebounding in early 2020 but a preliminary estimate for March suggests the revival is fading. There’s still no sign that recession risk is elevated, based on data published to date. Yet the revised outlook through next month (see third chart below) points to stabilization at a moderate pace of growth rather than a continuation of the recent rebound following a softer macro trend in late-2019.

Continue reading

Macro Briefing | 20 February 2020

Wide-ranging attacks at Democratic debate with Bloomberg in the mix: Reuters

China’s manufacturing sector struggles to restart after virus outbreak: SCMP

White House admits that Trump’s trade policy slowed US economy: Bloomberg

Fed minutes suggest rates will remain unchanged for near term: CNBC

Gold rises to 7-year high: Bloomberg

Is soaring US stock market underestimating coronavirus risk? CNBC

Rebound in UK retail sales suggest firmer Q1 after economy stumbled: MNI

German consumer confidence expected to slightly ease in March: RTT

IMF mgr dir is wary but cautiously optimistic on global economic outlook: IMF

US wholesale inflation rose sharply in Jan, but gain may be temporary: MW

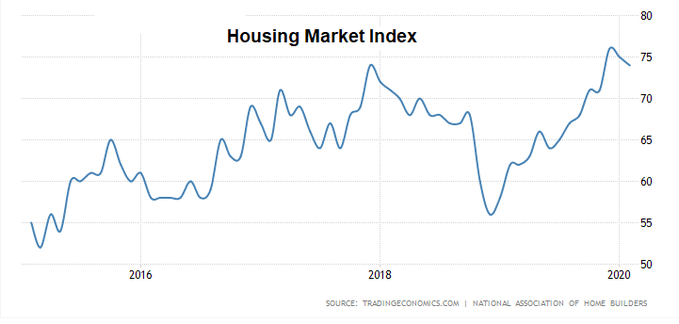

US housing starts eased in January but remain near post-recession high:

Is Pressure Building For Another US Rate Cut?

Looking at a select set of recent economic releases suggests the US economy is humming along, providing room for the Federal Reserve to let current monetary policy glide forward on autopilot. But a closer look at key trends in the Treasury market and the monetary base – along with the economic challenges roiling China and increasingly spilling out to the global economy – suggest the future may be more uncertain and risky than widely assumed with respect to evaluating the case for rate changes.

Macro Briefing | 19 February 2020

China faces increased risk of an economic crisis: CNBC

Sanders leads by wide margin in new national poll: CNBC

Trump announces multiple pardons and commutations: Politico

China expels 3 Wall Street Journal reporters: NY Times

The global economy is closing its doors to China amid virus outbreak: WSJ

Hong Kong faces first back-to-back annual recession: Bloomberg

Is Bloomberg LP for sale? It is if Mike Bloomberg is elected president: WSJ

NY Fed manufacturing Index rises to 9-month high in February: MW

US home builder sentiment dipped in February but remains strong: NAHB

US Economic Growth Expected To Slow In First Quarter

US economic activity is expected to ease in the first quarter, based on the median for a set of nowcasts compiled by The Capital Spectator. The current estimate reflects the softest quarterly gain in over a year, although the anticipated increase is still strong enough to keep the economic expansion alive in early 2020.

Continue reading

Macro Briefing | 18 February 2020

China to grant tariff exemptions on 696 US goods: Reuters

How fast will China’s economy rebound from coronavirus outbreak? Bloomberg

Coronavirus blowback could impact 50,000 firms, new research estimates: CNBC

Despite Brexit turmoil, UK employment rose in fourth quarter: Bloomberg

HSBC, Europe’s biggest bank, plans to cut 35,000 jobs: WSJ

German economic sentiment fell sharply in Feb, driven by coronavirus risk: ZEW

Apple doesn’t expect to meet quarterly revenue target due to coronavirus: BBG

WTO’s trade barometer anticipates “further weakening” of trade in Q1: WTO

US Real Estate Investment Trusts Surged Last Week

Real estate is hot – sizzling, in fact, based on last week’s trading activity. In relative and absolute terms, REITs in the US delivered a spectacular run for the trading week ended Friday (Feb. 14) — the strongest gain by far for the major asset classes, based on a set of proxy ETFs.

Continue reading

Macro Briefing | 17 February 2020

Coronavirus risk on the world’s cruise ships in focus Reuters

Fierce storm is pummeling western Europe: CBS

Japan’s economy fell sharply in Q4: Bloomberg

Iran’s hardliners expected to gain power after this week’s elections: Reuters

Munich security conference highlights divergence between US and Europe: Politico

Tech investing: Nothing succeeds like success: WSJ

Consumer sentiment in US rose to highest level in nearly 2 years: Bloomberg

US industrial production continued to contract in January: MW

Retail sales rose moderately in January: CNBC

US commercial & industrial loans 12-month change slips to 2-year low in January:

Book Bits | 15 February 2020

● The Information Trade: How Big Tech Conquers Countries, Challenges Our Rights, and Transforms Our World

By Alexis Wichowski

Summary via publisher (HarperCollins)

In this provocative book about our new tech-based reality, political insider and tech expert Alexis Wichowski considers the unchecked rise of tech giants like Facebook, Google, Amazon, Apple, Microsoft, and Tesla—what she calls “net states”— and their unavoidable influence in our lives. Rivaling nation states in power and capital, today’s net states are reaching into our physical world, inserting digital services into our lived environments in ways both unseen and, at times, unknown to us. They are transforming the way the world works, putting our rights up for grabs, from personal privacy to national security.

Continue reading