The US economy continues to show signs of stabilizing after last year’s second-half slowdown. In addition, revised projections for the business cycle trend hint at the possibility that growth is rebounding in early 2020. Although an upbeat outlook for this year remains tentative, today’s forward review points to a mildly stronger output for the US in the first quarter.

Continue reading

Macro Briefing | 21 January 2020

China confirms that new virus can spread through human contact: Reuters

China’s coronavirus outbreak prompts flight screenings in Australia: NY Times

U. of Hong Kong: virus has likely spread to 20 cities: SCMP

Trump to speak at World Economic Forum as impeachment trial begins: AP

Hundreds of US-bound migrants cross Mexico’s southern border: BBC

US Treasury Sec. warns UK and Italy re: digital-tax plans: WSJ

Moody’s downgrades Hong Kong’s long-term debt rating due to gov’t ‘inertia’: BBG

Foreign investment by firms around the world fell in 2019 to near-decade low: WSJ

IMF predicts world growth will pick up in 2020: CNBC

US REITs Rebound, Closing At Record High

Real estate investment trusts (REITs) in the US topped last week’s returns for the major asset classes and ended the week at a record high, based on a set of exchange traded funds, as of Friday, Jan. 17.

Continue reading

Macro Briefing | 20 January 2020

China reports 140 new cases of Sars-like virus: CNBC

Supply disruptions in Iraq and Libya lift oil prices: Bloomberg

White House plans to keep pressure on Iran: WSJ

Hundreds of migrants are trying to cross Mexico’s southern border: Reuters

Venezuela’s Guaidó defies travel ban, attends counter-terrorism meeting: BBC

Global survey: Capitalism doing ‘more harm than good’: Reuters

Palladium’s extraordinary surge is expected to continue: Bloomberg

New US housing construction surged in December: MW

US industrial production continued to fall in December: MW

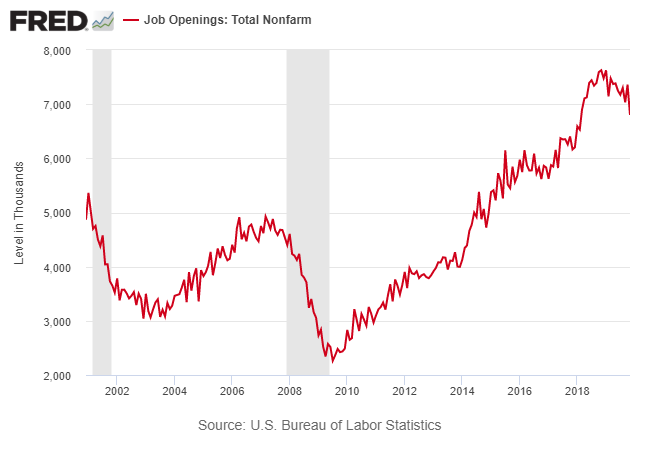

Job openings in US fell in November to 1-1/2-year low: Reuters

Book Bits | 18 January 2020

● A World Without Work: Technology, Automation, and How We Should Respond

By Daniel Susskind

Review via The New York Times

If humans’ fears that technology would replace them have been unfounded in the past, this time is different. So argues Daniel Susskind, a fellow in economics at Oxford, in his new book, “A World Without Work: Technology, Automation, and How We Should Respond.” Susskind declares that machines are getting so smart that they’ll soon replace humans at a growing list of jobs, potentially including doctors, bricklayers and insurance adjusters, thus ending what he calls the “Age of Labor.” Without some sort of intervention, he says, the inequality inherent in today’s economy will metastasize into an even greater divide between the haves and have-nots.

Continue reading

Research Review | 17 January 2020 | Volatility

Macro News and Long-Run Volatility Expectations

Anders Vilhelmsson (Lund University)

December 10, 2019

I propose a new model-free method for estimating long-run changes in expected volatility using VIX futures contracts. The method is applied to measure the effect on stock market volatility of scheduled macroeconomic news announcements. I find that looking at long-run changes gives qualitatively different results compared to previous studies that only look at realized variance and the VIX. I further find that FOMC announcements on average resolve uncertainty, but only during times when policy uncertainty is higher than average. Real side macro announcements increase long-run volatility during times of low policy uncertainty, but the effect is reversed during times of high policy uncertainty.

Continue reading

Macro Briefing | 17 January 2020

Trump impeachment hearing begins in Senate: WSJ

Second death reported in new SARS-like virus in China: CNN

China’s GDP rose 6.1% in 2019, slowest gain since 1990: CNBC

Worrisome decline in UK retail sales continued in December: Bloomberg

US jobless claims continue to fall, indicating strong labor market: CNBC

US home builder confidence slips in January but remains bullish: CNBC

Trend growth in US import prices remained subdued in December: Reuters

Philly Fed Mfg Index rose sharply in January: Philly Fed

US retail spending accelerated in Dec to annual 5.8% increase — 1-1/2 year high:

Are Current Risk Levels For The US Stock Market Extraordinary?

Earlier this month we reviewed how recent performance for the S&P 500 Index stacked up relative to history. Let’s extend the analysis to risk. As we’ll see, deciding if risk is unusual, or not, depends on how you’re defining risk. As a result, there’s quite a bit more subjectivity in this corner or market analytics.

Continue reading

Macro Briefing | 16 January 2020

US and China sign trade deal that eases tensions: WSJ

A closer look at US goods that China pledged to buy in trade deal: CNBC

Key part of trade deal is already in doubt: Bloomberg

Senate begins to consider removal of President Trump: Reuters

Russia’s gov’t resigns, paving way for Putin to consolidate power: CNBC

Fed Beige Book: ‘modestly favorable’ outlook for 2020: MW

NY Fed Mfg Index ticks up, reflects modest growth in Dec: NY Fed

Business inflation expectations are steady at +1.9% in Jan: Atlanta Fed

VIX Index falls back to level that’s near 2-year low after recent increase:

It’s Been A Good Year So Far For (Most) Equity Markets

The broad upside momentum for most slices of the world’s equity markets has spilled over into 2020, at least so far. But the distribution of performance, as usual, is uneven. Here’s a quick look at how the bull run stacks up so far (through Jan. 14) for US and global stock markets, based on a set of exchange-traded funds.