A New Index of the Business Cycle

William B. Kinlaw (State Street Global Markets), et al.

January 2020

The authors introduce a new index of the business cycle that uses the Mahalanobis distance to measure the statistical similarity of current economic conditions to past episodes of recession and robust growth. Their index has several important features that distinguish it from the Conference Board’s leading, coincident, and lagging indicators. It is efficient because as a single index it conveys reliable information about the path of the business cycle. Their index gives an independent assessment of the state of the economy because it is constructed from variables that are different than those used by the NBER to identify recessions. It is strictly data driven; hence, it is unaffected by human bias or persuasion. It gives an objective assessment of the business cycle because it is expressed in units of statistical likelihood. And it explicitly accounts for the interaction, along with the level, of the economic variables from which it is constructed.

Continue reading

Macro Briefing | 14 February 2020

Attorney General Barr criticizes Trump for tweets re: Justice Dept: ABC

CDC director: coronavirus is “probably with us beyond this season”: CNN

Tension rising between Turkish and Russian-backed Syrian forces: NBC

Eurozone GDP growth slowed in Q4, weaker than previously estimated: Reuters

Is Europe’s largest economy prepared for trade and coronavirus risks? BBG

US core consumer inflation firmed up in January: CNBC

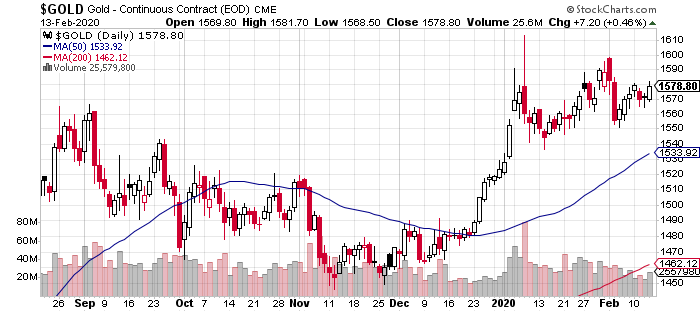

Gold price edges up as gold-standard advocate’s Fed nomination stumbles: THill

Treasury Market Flashes New Warning As Real Yields Go Negative

It happened before, in 2012-2013, but the US economy muddled through a soft patch. Is it different this time? It’s a question worth pondering as the global economy struggles to model the spreading coronavirus that’s weighing on China and, increasingly, reverberating in economies around the world. The European Commission today, for example, advises that coronavirus is a “key downside risk” for the bloc’s economy.

Macro Briefing | 13 February 2020

Coronavirus cases rise sharply as death toll surges in China: CBS

Trump’s intervention in Stone case shocks Washington: Politico

Trump says proposed cut in military pact with Philippines is no problem: Reuters

Central banks taking a wait-and-see policy approach to coronavirus: WSJ

European Commission: coronavirus is “key downside risk” for Eurozone: BBG

Oil demand expected to drop in Q1–first slide in a decade: CNBC

Senate hearing today will address Judy Shelton, controversial Fed pick: BBG

DFA: new bond factors appear to be irrelevant for fixed-income investing: InstInv

Driven by global search for yield, Greece’s ‘junk’ 10-yr bond yield dips below 1%: FT

US Equities Dominate Global Market Returns So Far In 2020

It’s not even close. As early starts for calendar years go on a global basis, the US stock market’s roaring debut in 2020 so far has left the rest of the world in the dust, based on a set of exchange-traded funds.

Macro Briefing | 12 February 2020

Bernie Sanders wins New Hampshire primary: CNN

US officials: China’s Huawei can covertly access mobile-phone networks: WSJ

Official data suggest coronavirus infection rate is peaking in China Reuters

Fed Chairman Powell gave upbeat outlook on US economy to Congress: Reuters

Eurozone industrial output fell 2.1% in December, deepest slide in 4 years: BBG

Will coronavirus blowback push Europe into recession? NY Times

Small business sentiment in January ‘solid as ever’ in January: NFIB

US job openings fell to a 2-year low in December: CNBC

Will Coronavirus Derail The Latest Bounce In US Economic Output?

Last November, the US stock market was making a seemingly risky bet that the economy would muddle through the soft patch that was weighing on output. The S&P 500 Index was making new highs, in sharp contrast with the stumbling ADS Index — the Philadelphia Fed’s real-time measure of the US business cycle was flirting with a recession signal at the time. As it turned out, the economy stabilized and the stock market has since soared to even loftier heights. But just when it looked like the macro danger had passed, the coronavirus that’s roiling on China, and spreading near and far, is increasingly seen as posing some as-yet unknown threat for the global economy and perhaps the US as well.

Macro Briefing | 11 February 2020

Coronavirus death toll tops 1,000: Bloomberg

Is economic risk from coronavirus exaggerated? Maybe, says Ray Dalio: CNBC

US charges four Chinese intelligence officers with data hacking: Politico

Philippine President Duterte ends troop agreement with US: Reuters

Fed Chair Powell expected to give upbeat economic testimony this week: Reuters

UK economy was flat in Q4, stumbling after solid gain in Q3: Guardian

White House projections for falling US deficit look shaky: WSJ

Big tech dominates the S&P 500: CNN

Is the party over for tech stocks? Not yet, predicts Goldman Sachs: MW

10yr-3mo Treasury yield curve inverted (again) on Monday: Reuters

US Stocks Were Resilient Last Week As Coronavirus Roils China

China, the world’s second-largest economy, continues to suffer in human and economic terms from the coronavirus, but there were minimal signs of concern in last week’s performance of the US equity market, which posted the strongest increase for the major asset classes, based on a set of ETFs.

Macro Briefing | 10 February 2020

Trump’s budget proposal targets large cuts in non-defense spending: Politico

As China returns to work after holiday, coronavirus deaths top 900: Reuters

Taiwan scrambles jets for 2nd day to intercept Chinese planes: Reuters

China’s Hubei province, an industrial powerhouse, is shut for 3rd week: BBG

Political turmoil in Germany after far-right candidate wins vote: NY Times

Stock bull Ed Yardeni: How long will investors shrug off coronavirus? CNBC

Big tech dominates holdings in funds marketed as ‘sustainable’ investments: WSJ

Hiring rebounded sharply in US during January: MW

10yr Treasury yield curve looks poised to invert… again: