Trump decides to de-escalate war risk with Iran: ABC

US-Iran tensions are down but risk is still lurking: CNBC

China’s vice premier expected to sign trade deal with US next week: Reuters

US likely added 2.14mm jobs last year–least since 2011: Bloomberg

World Bank cuts global growth expectations: WB

German industrial production rebounded sharply in November: Reuters

Gloomy economics conference contrasts with expanding economy: NY Times

ADP: US private jobs growth rebounded in Dec but 1yr trend continued to ease:

Moderate Growth Expected In Upcoming US GDP Report For Q4

The US economy remains on track to expand at a moderate pace in the final three months of 2019. The outlook is based on a median nowcast for the initial estimate of the fourth-quarter GDP report that’s scheduled for release by the Bureau of Economic Analysis on Jan. 30. If correct, output will rise at or near Q3’s pace, which suggests that recession risk remained low through the end of last year.

Macro Briefing | 8 January 2020

Iran retaliates, firing missiles at US bases in Iraq: CNBC

Taiwan’s pro-independence president looks set for re-election: NY Times

Eurozone economic sentiment edged up for second month in Dec: Reuters

Germany’s manufacturing ‘misery’ continued in Nov as new orders fell: Reuters

US services sector continued to expand moderately in December: ISM

US trade deficit narrowed to 3-year low in November: MW

Atlanta Fed’s Q4 GDP growth nowcast for US holds at moderate +2.3%: AF

US factory orders continued to decline via 1-year trend in Nov:

Are Current US Stock Market Returns Extraordinary?

The bull run in US equities in recent years strikes many investors as something other than a run-of-the-mill rally. Although Mr. Market has dispensed several sharp corrections, it’s hard to overlook the fact that a buy-and-hold strategy for, say, an S&P 500 Index fund has been a mostly non-stop party of late. Is that unusual? The answer depends on your definition of “unusual” and your choice of a time window. For some perspective, let’s stack up the latest trailing performances for the S&P against its track record through the decades.

Continue reading

Macro Briefing | 7 January 2020

Bolton willing to testify but no sign Senate will issue subpoena: Politico

White House denies visa to Iranian diplomat to attend UN meeting: The Hill

Does escalating US-Iran conflict offer strategic opportunities for China? CNN

France and EU prepare to respond to new US tariffs: AP

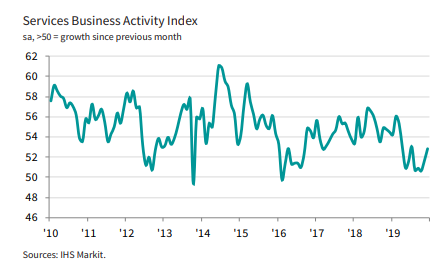

Global growth picked up in December via PMI survey data: IHS Markit

Is latest jump in Eurozone inflation, retails sales a temporary bounce? ING

US Services PMI: moderate growth picked up to 5-month high in Dec: IHS Markit

Will US-Iran Geopolitical Risk Upend Global Markets?

The trading week begins with a spike in uncertainty following last week’s US airstrike that killed Qassem Soleimani, Iran’s top military official. Although most of the major asset classes posted gains last week and still reflect across-the-board profits for the one-year trend, repricing risk has become substantially more challenging – and critical.

Macro Briefing | 6 January 2020

Sec. of State Pompeo warns Iran against attacks on US interests: NY Times

Trump threatens Iraq with sanctions after US troops asked to leave: BBC

Huge crowds mourn Iran’s military commander at funeral in Tehran: Reuters

House to vote on limiting Trump’s military powers re: Iran: CNBC

Confusion hangs over Trump’s Middle East strategy after Soleimani Killing: BBG

NY Fed president: US should stick to 2% inflation target: WSJ

Monetary experts question if Fed can effectively fight next recession: MW

Brexit economic uncertainty spreads near and far: BBG

Revised Eurozone PMI: economy remained near stagnation in Dec: IHS Markit

Book Bits | 4 January 2020

● The Rise of Carry: The Dangerous Consequences of Volatility Suppression and the New Financial Order of Decaying Growth and Recurring Crisis

By Tim Lee, et al.

Summary via publisher (McGraw-Hill)

Protect yourself from the next financial meltdown with this game-changing primer on financial markets, the economy—and the meteoric rise of carry. The financial shelves are filled with books that explain how popular carry trading has become in recent years. But none has revealed just how significant a role it plays in the global economy—until now. The Rise of Carry explains how carry trading has virtually shaped the global economic picture—one of decaying economic growth, recurring crises, wealth disparity, and, in too many places, social and political upheaval. The authors explain how carry trades work—particularly in the currency and stock markets—and provide a compelling case for how carry trades have come to dominate the entire global business cycle.

Continue reading

Risk Premia Forecasts: Major Asset Classes | 3 January 2020

The Global Market Index’s expected risk premium ticked higher again in December, marking the fourth straight monthly rise. The latest advance lifts GMI’s long-term ex ante return to an annualized 5.0% (before factoring in a “risk-free” rate).

Macro Briefing | 3 January 2020

Iran vows revenge after US strike kills top Iranian commander: Reuters

Will world economy suffer blowback following US strike on Iranian general? BBG

Some observers see dangerous escalation in US killing of Iranian general: CNBC

Oil prices surge, stock futures sink following US strike on Iranian: MW

US Mfg PMI continued to reflect modest rebound in December: IHS Markit

Job cuts in the US fell in Dec to lowest level since July 2018: CG&C

US jobless claims fell last week, close to 50-year low: MW