The recent economic slowdown has fanned worries that the US is headed for a rough year in 2020. But some analysts are practicing the art of seeing the glass half full and are now calling for improved odds that economic activity will pick up in the new year. All the usual caveats apply, of course, when mere mortals attempt to divine the future. But let’s run this idea through a mild stress test using hard data and a set of combination forecasts to see if the case for optimism holds up. As a preview, the results below imply that while it’s premature to rule out the possibility for firmer growth next year, The Capital Spectator’s view is that growth appears more likely stabilize at a relatively modest pace for the near term.

Continue reading

Macro Briefing | 12 December 2019

House prepares for impeachment vote on Trump: Reuters

Here’s the outlook for today’s new ECB head’s first policy meeting: MW

UK goes to polls today in third general election in less than 5 years: BBC

Wharton study: Warren’s wealth tax will raise $1 trillion less than expected: CNBC

Fed leaves interest rates unchanged at policy meeting: NY Times

Fed economic projections continue to anticipate slow/slowing growth: Fed

So-called black-swan index flashes warning for stocks: Reuters

Eurozone industrial production continued to fall in October: Reuters

No sign of US recession on the horizon, predicts BCA: MW

Atlanta Fed business inflation expectation steady at +1.9% for Dec: AF

US headline consumer inflation (1-year change) jumps to 12-month high: MW

Tech Stocks Leading US Sectors By Wide Margin In 2019

As horse races go, this one isn’t close. Shares of technology stocks are far ahead of the rest of the equity sector field this year, based on a set of exchange traded funds. Barring a dramatic reversal in the final weeks of December, it appears that tech will close out 2019 with an outsized gain.

Macro Briefing | 11 December 2019

House Democrats unveil two articles of impeachment against Trump: The Hill

Democrats announce new US-Mexico-Canada trade agreement: CNN

Fed expected to leave interest rates unchanged in today’s policy meeting: Reuters

China expects US will delay Dec. 15 hike in tariffs: Bloomberg

US judge bars Trump from using military funds to build border wall: LA Times

Saudi Aramco shares — biggest IPO ever — surge on first day of trading: CNBC

US economic productivity declined in Q3 — first drop since 2015: MW

US small business optimism rose sharply in November: NFIB

US Q4 GDP Growth Outlook Strengthens… Slightly

Economic activity in the fourth quarter edged higher in the latest round of estimates, based on the median for a set of nowcasts compiled by The Capital Spectator. Output is still on track to slow vs. previous quarters, but new data point to a mildly firmer increase.

Macro Briefing | 10 December 2019

House set to announce impeachment articles against Trump today: USA Today

White House and House eye deal on North American trade agreement: The Hill

No sign of US-China trade deal, but China buys more US-grown soybeans: CNBC

Will upcoming UK election offer a preview for Trump in 2020? BBC

UK economy stagnated in October: Bloomberg

Ukraine’s Zelensky and Russia’s Putin talk about possible peace process: CNN

China reportedly bans foreign computers: CNBC

US mfg sector’s demand for college-educated workers is rising: WSJ

Germany’s ZEW economic sentiment index up sharply in Dec: ZEW

Commodities Led Most Asset Classes Higher Last Week

Breaking a three-week losing streak, broadly defined commodities topped last week’s returns for the major asset classes, based on a set of exchange traded funds. Other than US bonds and real estate investment trusts (REITs), all the primary slices of global markets posted gains for the trading week through Friday, Dec. 6.

Macro Briefing | 9 December 2019

Will new US tariffs on Chinese goods kick in next week? WSJ

US payrolls surged in November: CNBC

True alpha is elusive in active bond strategies, AQR research finds: InstInv

Jobs of the future found mostly in small number of US cities: Reuters

US Consumer Sentiment Index rises to 7-month high in December: Bloomberg

Consumer credit rose at second-strongest monthly rate this year in Oct: MW

The World Trade Organization’s days may be numbered: NY Times

German exports rose in Oct, defying global trade tensions: BT

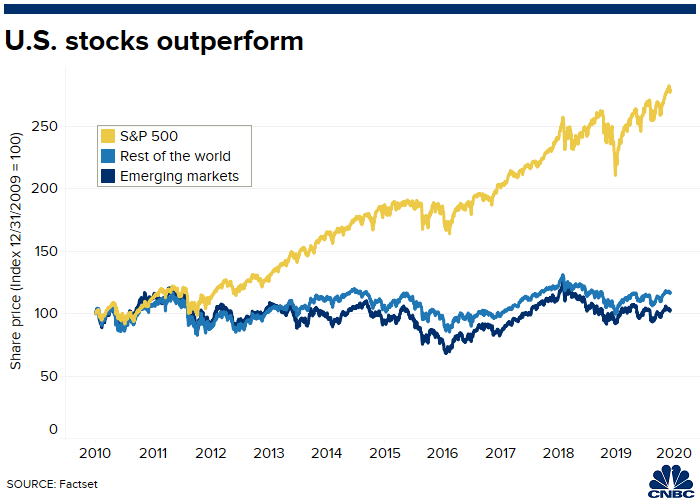

Are foreign stocks poised to outperform US? CNBC

Book Bits | 7 December 2019

● Fewer, Richer, Greener: Prospects for Humanity in an Age of Abundance

By Laurence B. Siegel

Summary via publisher (Wiley)

Why do so many people fear the future? Is their concern justified, or can we look forward to greater wealth and continued improvement in the way we live? Our world seems to be experiencing stagnant economic growth, climatic deterioration, dwindling natural resources, and an unsustainable level of population growth. The world is doomed, they argue, and there are just too many problems to overcome. But is this really the case? In Fewer, Richer, Greener, author Laurence B. Siegel reveals that the world has improved—and will continue to improve—in almost every dimension imaginable. This practical yet lighthearted book makes a convincing case for having gratitude for today’s world and optimism about the bountiful world of tomorrow.

Continue reading

Is The November Payrolls Report As Good As It Looks?

US companies hired substantially more workers than economists expected in November, providing an upside jolt to economic sentiment. From a monthly perspective, the 254,000 increase in private payrolls marks the best gain since January. No matter how you slice it, it’s a strong increase. But a closer look suggests that the slow-growth trend is still with us, even though a myopic focus on the latest employment number inspires thinking otherwise.