With each passing month, the current US economic expansion sets a new record for duration (125 months and counting through November). That’s a good thing, of course, but for some analysts it’s a warning sign. Expansions, like milk and airline tickets, have a limited shelf life, or so this line of thinking goes. But the hard evidence to support this view is thin, particularly for the post-World War Two era. That doesn’t mean that recession risk is zero these days, or that storm clouds aren’t gathering. But expecting a downturn to start because the expansion’s clock has been ticking longer than before is mostly myth rather than fact.

Macro Briefing | 6 December 2019

House to draw up articles of impeachment against Trump: Reuters

N. Korea reacts to Trump’s Nato comments with fiery rhetoric: USA Today

Opec and Russia plan on deeper oil-production cuts: CNBC

Germany’s industrial recession deepened in October: FT

Looking ahead to today’s November employment report: NY Times

Atlanta Fed’s GDPNow model: Q4 GDP growth estimate ticks up to +1.5%: AF

US trade gap narrowed to 16-month low in Oct as Chinese imports decline: MW

Factory orders in the US rebounded in Oct after 2 monthly losses: Reuters

Job cuts in US fell 13% over the 12 months through November: CG&C

US jobless claims fell to a 7-month low last week: CNBC

Is US Employment Data Flirting With An Economic Warning Sign?

Depending on the employment indicator, the US economic outlook is upbeat or worrisome. Focusing on yesterday’s ADP Employment Report for November leans toward the latter.

Macro Briefing | 5 December 2019

China wants US tariffs cut before agreeing to a trade deal: Reuters

US considering new deployment of troops to Middle East to counter Iran: WSJ

Iran has secretly moved missiles into Iraq: NY Times

Eurozone retail spending fell more than forecast in October: MW

Japan is planning a $120 billion economic stimulus program: Reuters

Global economic growth remains slow but pace strengthened in Nov: IHS Markit

ISM Non-Mfg Index: US services sector slowed more than forecast: CNBC

Services PMI for US reflects modest growth in November: IHS Markit

US private employment growth slowed sharply in November: MW

Quality Is The Lone Equity Factor Beating The Market This Year

Volatility has returned to the stock market this week after a couple months of relative calm. Not surprisingly, the sharp wave of selling on Monday and Tuesday has reordered the horse race for primary equity factors. As a result, the so-called quality factor is the last man standing for outperforming the broad market year to date, based on a set of exchange-traded funds.

Macro Briefing | 4 December 2019

House impeachment report: Trump abused power: The Hill

Trump suggests US-China trade war could continue beyond 2020 election: WSJ

Despite recent tension, US and China reportedly closer to trade deal: BBG

Will a new round of US tariffs on Chinese goods roll out on Dec 15? CNBC

China Composite PMI for Nov shows solid rebound for economy: IHS Markit

Eurozone economy continued to post near-stagnant growth in Nov: IHS Markit

10-year Treasury yield falls sharply to 1.72% — lowest since Oct 31:

Risk Premia Forecasts: Major Asset Classes | 3 December 2019

The outlook for the Global Market Index’s risk premium ticked higher for a third month in a row in November. The adjustment, due to evolving market conditions, lifted GMI’s expected long-term return to an annualized 4.9% (before factoring in a “risk-free” rate). The new estimate is fractionally above last month’s forecast (4.8%) and modestly higher vs. the year-ago estimate (4.6%). GMI is an unmanaged, market-value-weighted portfolio that holds all the major asset classes (except cash).

Macro Briefing | 3 December 2019

US threatens new tariffs on French goods in response to digital tax: CNBC

France says it will retaliate over new US tariff threat: Bloomberg

Global Mfg PMI reflects growth in November–first gain in 7 months: IHS Markit

Is the fate of global economy tied to the health of US consumers?: Bloomberg

US construction spending fell in Oct but 1yr trend returns to growth

In contrast with ISM data (see below), US Mfg PMI rebounds in Nov: IHS Markit

US ISM Mfg Index continues to show mild contraction for sector in Nov: ISM

Major Asset Classes | November 2019 | Performance Review

The US stock market was the clear performance leader for the major asset classes in November. The strong gain in American shares was all the more striking in a month that was otherwise skewed to the downside.

Continue reading

Macro Briefing | 2 December 2019

UN chief: ‘War against nature must stop’: Reuters

China suspends US Navy visits to Hong Kong, sanctions US groups: Reuters

China’s mfg sector expanded by more than expected in Nov: CNBC

US mfg data in focus in today’s releases: CNBC

Euro area’s mfg sector continues to contract in November: IHS Markit

UK mfg contracts as Brexit uncertainty weighs on sector: IHS Markit

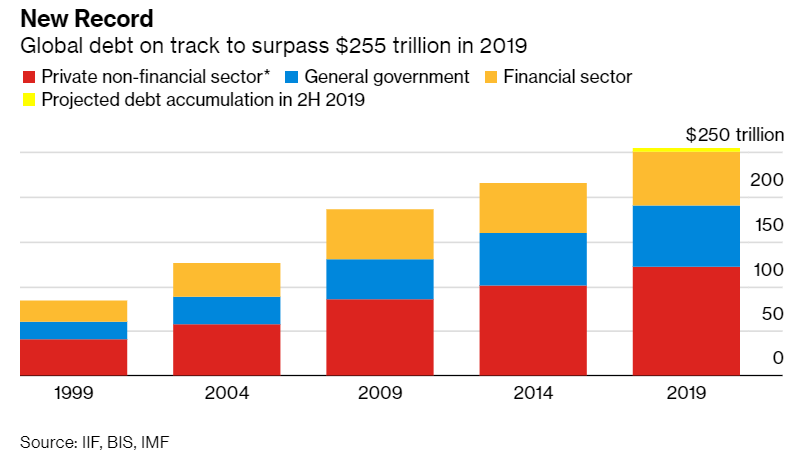

Global debt on track to rise to a record $255 trillion-plus in 2019: Bloomberg