● Paper Dragons: China and the Next Crash

By Walden Bello

Summary via publisher (ZED Books)

Emerging relatively unscathed from the banking crisis of 2008, China has been viewed as a model of both rampant success and fiscal stability. But beneath the surface lies a network of fissures that look likely to erupt into the next big financial crash. A bloated real-estate sector, roller-coaster stock market, and rapidly growing shadow-banking sector have all coalesced to create a perfect storm: one that is in danger of taking the rest of the world’s economy with it. Walden Bello traces our recent history of financial crises – from the bursting of Japan’s ‘bubble economy’ in 1990 to Wall Street in 2008 – taking in their political and human ramifications such as rising inequality and environmental degradation. He not only predicts that China might be the site of the next crash, but that under neoliberalism this will simply keep happening.

Continue reading

Research Review | 20 September 2019 | Factor Investing

Momentum with Volatility Timing

Yulia Malitskaia (VKY Analytics)

July 9, 2019

The growing adoption of factor investing simultaneously prompted the active topic of factor timing approaches for the dynamic allocation of multi-factor portfolios. The trend represents a natural development of filling the gap between passive and active management. The paper addresses this direction by introducing the volatility-timed winners approach that applies past volatilities as a timing predictor to mitigate momentum factor underperformance for time intervals spanning the market downturn and post-crisis period. The proposed approach was confirmed with Spearman rank correlation and demonstrated in relation to different strategies including momentum volatility scaling, risk-based asset allocation, time series momentum and MSCI momentum indexes. The corresponding analysis generalized existing volatility scaling strategies and brought together the two branches of the smart-beta domain, factor investing and risk-based asset allocation.

Continue reading

Macro Briefing | 20 September 2019

Iran threatens “all-out-war” if US attacks in reponse to Saudi attacks: WaPo

Oil on track for 7% gain this week in the wake of Saudi attacks: Reuters

FedEx pilot arrested in China, raising tension with US: CNN

US is temporarily exempting hundreds of Chinese products from tariffs: CNBC

World growth is “fragile,” says incoming ECB President Christine Lagarde: MW

US Leading Economic Index steady in August after strong gain in July: CB

US jobless claims continue to point to healthy labor market: CNBC

Philly Fed’s mfg index: moderately strong growth rate in Sep: Philly Fed

US existing home sales rose to highest level in over a year in Aug: Bloomberg

US Business Cycle Risk Report | 19 September 2019

Slow growth continues to dominate the US economic profile, and the trend could weaken further in the months ahead. But the downshift has yet to trigger a credible recession warning. Although some indicators suggest otherwise – including the inverted Treasury yield curve – a broad reading of economic and financial data still points to a modest expansion in the recent past—and for the immediate future.

Macro Briefing | 19 September 2019

Fed cuts rates by 1/4 point, drawing criticism from Trump: Politico

Fed lost control of key interest rate early this week: CNBC

OECD: global growth expected to ease to slowest pace in a decade: WSJ

US discussing with Gulf allies possible responses to Saudi attacks: Reuters

UK Supreme Court’s hearing of case against prime minister ends today: Reuters

Former Fed official: trade-war uncertainty, not tariffs, weighing on economy: CNBC

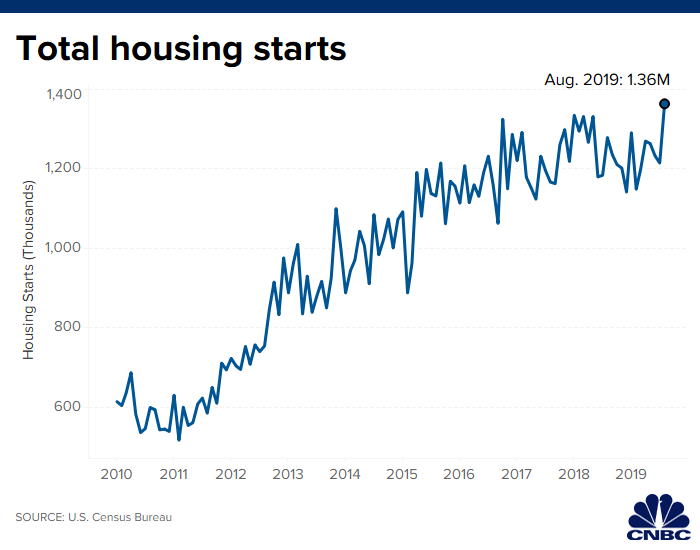

US housing starts rose to 12-year high in August: CNBC

Beware The Wild West Of Recession Analytics

The casual consumer of economic news may be tempted to lump the recent surge in recession warnings as one of a kind. But the quality and reliability in this corner of macro analytics varies widely and so it’s essential to recognize the basics for how and why business cycle profiles diverge.

Macro Briefing | 18 September 2019

Fed expected to cut rates today, for second time this year: WSJ

Saudi Arabia set to show evidence of Iran link in oil facility attacks: Reuters

Oil exports will continue as normal, Saudi Arabia says: Bloomberg

Israel election, second in 5 months, results in deadlock: BBC

An economic crisis for Latin America is lurking: NY Times

Eurozone inflation stable in Aug, at lowest pace in nearly 3 years: Reuters

UK inflation slips to slowest pace since 2016: Bloomberg

US manufacturing activity rebounded in August, Federal Reserve reports: CNBC

US homebuilders remain bullish in September on housing outlook: NAHB

Will The Recent Rally In Value Stocks Last?

September has been kind to undervalued shares, offering investors a reason to wonder if this long-suffering slice of the US equity market is finally due to lead over its growth counterparts. A few weeks is hardly a reliable gauge, but hope springs eternal… again.

Macro Briefing | 17 September 2019

Oil shock creates new uncertainty for global economy: CNN

Oil market weighs the impact from attacks on Saudi production: NY Times

Oil prices pull back after Monday’s surge: Reuters

US gasoline prices set to rise after spike in oil prices: Bloomberg

Iran ‘will never talk to America,’ supreme leader says: CNBC

The Fed is divided but expected to cut interest rates this week: Reuters

Israelis go to polls today for the 2nd time in 5 months: Politico

German economic sentiment rebounds in Sep after sharp slide: Investing.com

NY Fed Mfg Index reflects sluggish growth in September: NY Fed

Oil spiked on Monday after weekend attacks on Saudi Arabia: CNBC

Foreign Stocks Topped Last Week’s Market Gains

Equities ex-US posted the strongest increases last week for the major asset classes, based on a set of exchange traded funds. But on Monday morning that rally suddenly looks like ancient history after the attacks on oil-production facilities in Saudi Arabia over the weekend.