UK Parliament suspended as end-game for Brexit looms: CNBC

UK Prime Minister Johnson vows not to delay Brexit: Reuters

N. Korea fires projectiles after offering more talks with US: Time

Germany’s 30yr bond yield briefly rises above 0%: Reuters

States are ramping up investigations into Google and Facebook: Wired

US consumer borrowing in July posted the biggest gain since 2017: CNBC

US debt appears a lot higher than generally recognized: CNBC

US recession risk appears low, but contraction may be near anyway: MW

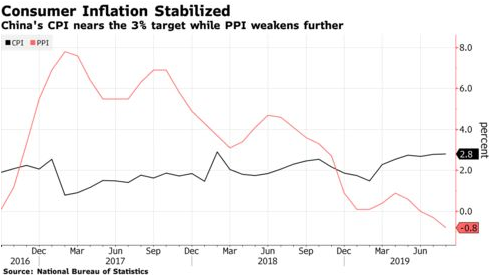

Factory deflation in China signals accelerating slowdown: Bloomberg

Emerging Markets Equities Topped Asset Class Returns Last Week

Stock markets in emerging markets continued to rebound last week, posting the strongest gain for the major asset classes, based on a set of exchange-traded funds. No mean feat, considering that nearly every slice of global markets rallied during the trading week through Friday, Sep. 6.

Macro Briefing | 9 September 2019

Typhoon strikes Japan, leaving nearly 1 million households without power: CNN

Nearly 1,500 deaths in France attributed to summer heat: BBC

US job growth was weaker than expected in August: CNBC

UK economy grew faster than expected in July: Reuters

Is China’s economic slowdown worse than official data suggest? WSJ

China’s gold reserves rose a strong 5% in August: FXStreet

Will a manufacturing recession prevent Trump’s re-election? Bloomberg

The ‘Volfefe index’ tracks influence of Trump’s tweets on bond market: CNBC

VIX Index, the US stock market “fear gauge,” fell to lowest print since July on Friday:

Book Bits | 7 September 2019

● The Economists’ Hour: False Prophets, Free Markets, and the Fracture of Society

By Binyamin Appelbaum

Review via Reuters

What is it about “free markets”? The phrase creates a frisson of excitement among a certain group of people. In “The Economists’ Hour: False Prophets, Free Markets, and the Fracture of Society”, Binyamin Appelbaum describes what happened when these intellectual fanatics were given the power to act on their ideas. It is not a happy tale.

Like most foolish notions about human society, the basic belief in free markets is simple, appealing and deeply wrong. It’s simple to think that all will be well if governments just leave competitive markets alone. It’s also appealing: There’s no need to plan or judge if price signals provided by the self-regulating market do all the economic work. And it’s wrong: Neither human nature nor the modern economy works the way these economists assume. Appelbaum’s narrative provides ample evidence of that.

Continue reading

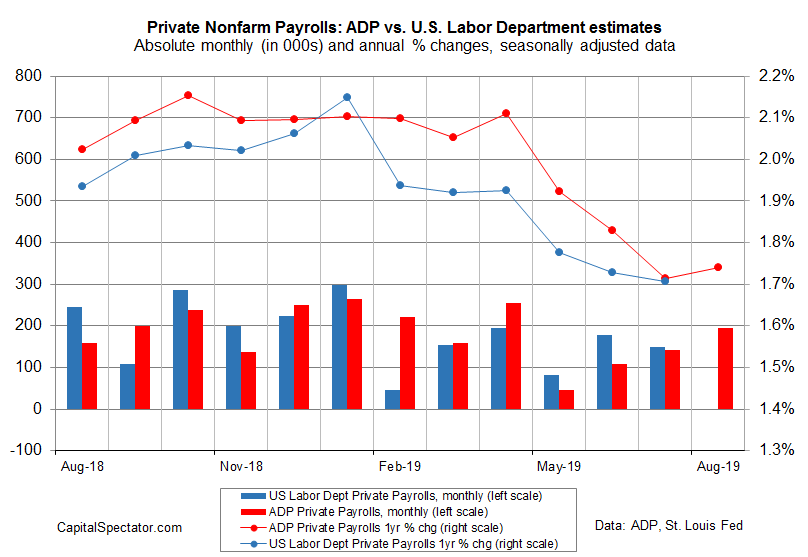

US Companies Hired Fewer-Than-Expected Workers In August

Private payrolls rose 96,000 in August, moderately below expectations, according to this morning’s update from the Labor Dept. The soft gain fans worries anew that the recent slowdown in the economy will bring a recession at some point in the near future. The one-year trend still ranks as healthy growth, but the downside bias looks is starting to look worrisome.

Low Vol And Momentum Top US Equity Factor Returns In 2019

US stocks have been whipsawed this year, but looking through the recent noise shows that all the major equity factors continue to post solid gains, based on a set of exchange-traded funds. The leading performers, however, are enjoying outsized gains that are far ahead of the relative laggards.

Macro Briefing | 6 September 2019

Hurricane Dorian is pounding North Carolina: CNN

China and US set to meet in October for trade negotiations: CNBC

Slower US job growth expected in today’s update from Labor Dept: Reuters

Global growth slowed in August, near 3-year low: IHS Markit

German industrial output continued to fall in July: Bloomberg

US factory orders rose for second month in July: MW

ISM Non-Mfg Index accelerated to moderately strong pace in August: Bloomberg

US Services PMI slowed to a crawl in August: CNBC

US private payrolls rose 195k in August, best pace in 4 months: ADP

The Fed’s Between The Rock And The Hard Place

Yesterday’s release of the Beige Book survey from the Federal Reserve paints an upbeat profile, advising that the “the economy expanded at a modest pace through the end of August.” But gathering storm clouds suggest that the rest of the year could bring rougher seas, raising doubts about how the central bank will navigate a slowing economy.

Macro Briefing | 5 September 2019

Hurricane Dorian threatens the Carolinas: CNN

US and China schedule trade talks for early October: WSJ

A new recession warning for Germany: factor orders fell in July: Bloomberg

UK Parliament blocks no-deal Brexit: Vox

Is Hong Kong leader’s concession enough to end protests? Vox

Fed’s Beige Book report offers upbeat profile of US economy: MW

US trade deficit narrowed slightly in July: Reuters

GDPNow model trims US GDP growth for Q3 to sluggish +1.5%: Atlanta Fed

Today’s ADP estimate of US payrolls for Aug expected to post 1.7% annual gain:

Risk Premia Forecasts: Major Asset Classes | 4 September 2019

The Global Market Index’s risk premium dipped to an annualized 4.6% in today’s revised outlook, based on data through August. The projection markets a modest decline from last month’s analysis. GMI is an unmanaged market-value-weighted portfolio that holds all the major asset classes (except cash). The forecast for this passive benchmark represents the ex ante premium over the expected “risk-free” rate for the long term.