Trump says Europe is unfairly boosting its economy: NY Times

Asian markets rise on Wed in anticipation of US-China trade deal: MW

Blackstone’s Schwarzman: Trump-Xi meeting unlikely to lead to trade deal: CNBC

Fed considers the case for a rate cut for today’s policy announcement: WSJ

The Fed is becoming politicized: Bloomberg

Firms may leave Hong Kong due to political uncertainty: CNBC

US housing starts fell 4.7% in May for year-over-year comparison:

Best Practices For Consuming Business Cycle Analysis

Recession chatter is heating up again, largely for obvious reasons: several key economic indicators are flashing warning signs. The wobbly numbers have convinced some analysts that economic contraction in the near term is fate. We’ve been here before in recent years, only to discover that the recession warnings were wrong. Is it different this time? Will the economy finally succumb? No one really knows, which leaves us with only one question: How can we make an informed, probability-based estimate of recession risk?

Macro Briefing: 18 June 2019

US plans to send more troops to Middle East: Reuters

Trump: ‘millions of illegal aliens’ to be removed starting next week: CBS

China’s US Treasury holdings fell to 2-year low in April: Bloomberg

Hong Kong leader apologizes but refuses to step down: Reuters

German economic expectations plunge in June: FT

Euro falls sharply after ECB chief lays groundwork for more stimulus: CNBC

Facebook leads consortium to launch new digital currency: CNBC

Is prolonging the US economic expansion counterproductive? MW

NY Fed Mfg Index in June falls to lowest level since late-2016: MW

US home builder sentiment eased in June but still points to growth: CNBC

US REITs Led Gains For Major Asset Classes Last Week

Securitized real estate shares in the US led a partial rally in global markets last week. Real estate investment trusts (REITs) posted a fractionally higher return over the second-best performer: bonds in emerging markets. Overall, returns for the trading week ended Friday, June 14, were mixed for the major asset classes, based on a set of exchange-traded funds.

Macro Briefing: 17 June 2019

Hong Kong protests continued on Sunday: CNN

Newly freed activist calls for Hong Kong leader to quit: Reuters

Iran says it will breach terms of nuclear deal in 10 days: WSJ

Trump ready to impose more tariffs on China without a trade deal: CNBC

Fed expected to keep rates unchanged this week: Reuters

Will the Fed consider if it made a mistake? NY Times

Chinese tech giant Huawei: US ban will cost it $30 billion in lost sales: CNN

Consumer sentiment in US eased in June: Bloomberg

US industrial output rebounded in May: WSJ

Business inventories for US rose in April, creating headwinds for growth: CNBC

US retail spending’s 1yr trend slipped to middling +3.2% in May:

Book Bits | 15 June 2019

● Equity Smart Beta and Factor Investing for Practitioners

By Khalid Ghayur, et al.

Summary via publisher (Wiley)

Equity Smart Beta and Factor Investing for Practitioners offers a hands-on guide to the popular investment opportunities of smart beta, which is one of the fastest growing areas within the global equity asset class. This well-balanced book is written in accessible and understandable terms and contains an in-depth manual filled with analytical information and new ideas. The authors—noted experts in the field—include a definition of smart beta investing and detail its history. They also explore the distinguishing characteristics of smart beta strategies, offer an overview of factor investing, and reveal the implementation of smart beta approaches. Comprehensive in scope, the book contains helpful examples of applications, real-life illustrative case studies, and contributions from leading and respected practitioners that explain how they approach smart beta investing.

Continue reading

Simulating Survey-Based Consensus Forecasts With Econometrics

Surveying economists for their projections on a variety of economic and financial indicators and aggregating the results has wide appeal, and for good reason. The wisdom of the crowd, such as it is, tends to be more reliable through time compared with any one forecaster. But there are challenges with standard consensus forecasts—challenges that can minimized if not solved with econometric-based applications.

Macro Briefing: 14 June 2019

US Secretary of State blames Iran for attacks on tankers: CNN

Iran says it’s not responsible for tanker attacks: Reuters

IEA predicts global oil demand will fall to lowest level in years: CNBC

Trump and Warren: a pair of economic populists: Bloomberg

China’s mfg growth rate slowed to 17-year low in May: Reuters

Gold rises to 14-month high: WSJ

US mfg job growth accelerated in first 2 yrs of Trump admin: EIG

Import prices for US fell in May–biggest decline in five months: Reuters

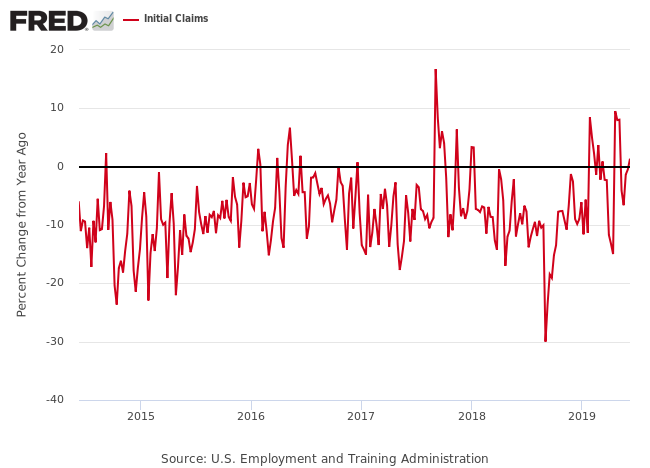

US jobless claims rose 1.4% last week vs. year-ago level:

Treasury Market’s Inflation Outlook Tumbles

The Treasury market continues to downgrade US inflation expectations, which suggests that the case is strengthening for a rate cut by the Federal Reserve.

Macro Briefing: 13 June 2019

Beijing will likely prevail in Hong Kong despite protests: NY Times

Smaller protests continue in Hong Kong on Thursday: Reuters

Trump: US will deploy 1,000 troops to Poland: BBC

Oil prices rise after tanker attack in Gulf of Oman: Bloomberg

Europe’s industrial output fell again in April: Reuters

Business inflation expectations hold at 2.0% in 6th Fed district: Atlanta Fed

US core consumer inflation ticks down to 2.0% annual pace in May: